- United States

- /

- Pharma

- /

- NYSE:PBH

Supplier Acquisition Could Be a Game Changer for Prestige Consumer Healthcare (PBH)

Reviewed by Sasha Jovanovic

- Prestige Consumer Healthcare recently acquired its eye care supplier for US$100 million to resolve supply chain issues that had impacted its performance and led to missed earnings forecasts earlier in the year.

- This action follows decreased interest from major investors and declining quarterly revenue, as the company seeks to stabilize operations and restore growth in its eye care business.

- We'll explore how Prestige's decisive supplier acquisition aims to shore up supply chain reliability and what it means for its investment outlook.

These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Prestige Consumer Healthcare Investment Narrative Recap

To own Prestige Consumer Healthcare stock, you need to believe the company’s recovery from recent supply chain setbacks, especially in its key eye care category, can drive sustained profit and cash flow growth as operations normalize. The supplier acquisition directly targets the most critical short-term catalyst: restoring Clear Eyes product availability, but it also raises operational integration risks, which could impact earnings if execution falters.

Among recent updates, Prestige’s lowered revenue and EPS guidance for fiscal 2026 stands out, reflecting the immediate impact of earlier supply chain disruptions. The success of the supplier acquisition is closely tied to reversing these downward revisions and enabling management’s longer-term growth ambitions.

However, just as the acquisition offers some hope, investors should also be aware of the lingering risks if recovery in the Clear Eyes franchise fails to meet expectations...

Read the full narrative on Prestige Consumer Healthcare (it's free!)

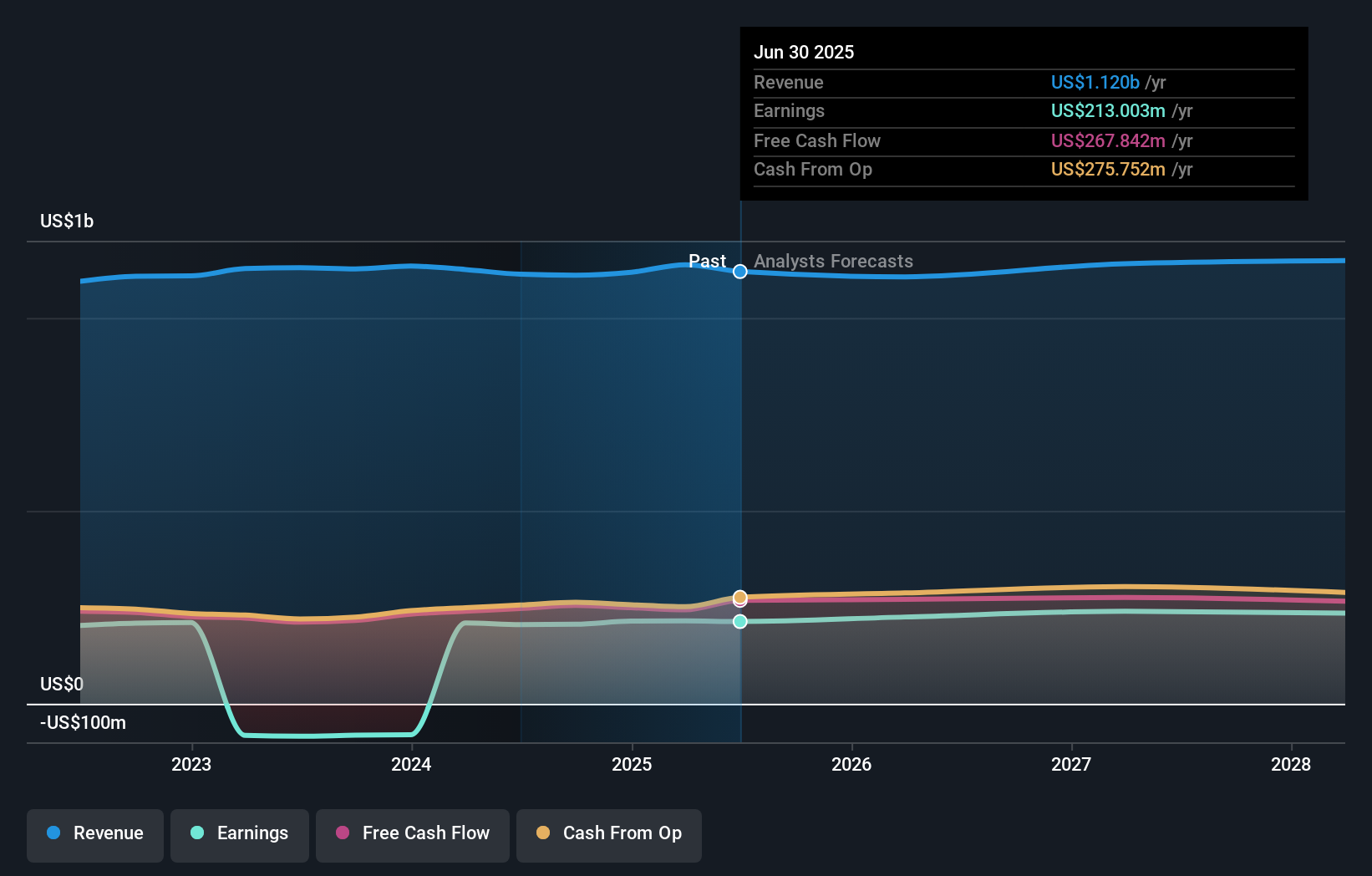

Prestige Consumer Healthcare's outlook anticipates $1.2 billion in revenue and $236.2 million in earnings by 2028. This is based on a projected annual revenue growth rate of 1.0% and an increase in earnings of $23.2 million from the current $213.0 million.

Uncover how Prestige Consumer Healthcare's forecasts yield a $82.80 fair value, a 36% upside to its current price.

Exploring Other Perspectives

Community fair value estimates for Prestige Consumer Healthcare all sit at US$82.80, based on 1 individual perspective from the Simply Wall St Community. While consensus expects supply chain moves to improve growth, your view on integration and market share recovery will shape your outlook.

Explore another fair value estimate on Prestige Consumer Healthcare - why the stock might be worth just $82.80!

Build Your Own Prestige Consumer Healthcare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Prestige Consumer Healthcare research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Prestige Consumer Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Prestige Consumer Healthcare's overall financial health at a glance.

No Opportunity In Prestige Consumer Healthcare?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PBH

Prestige Consumer Healthcare

Develops, manufactures, markets, distributes, and sells over the counter (OTC) health and personal care products in North America, Australia, and internationally.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives