- United States

- /

- Pharma

- /

- NYSE:PBH

Revenues Not Telling The Story For Prestige Consumer Healthcare Inc. (NYSE:PBH)

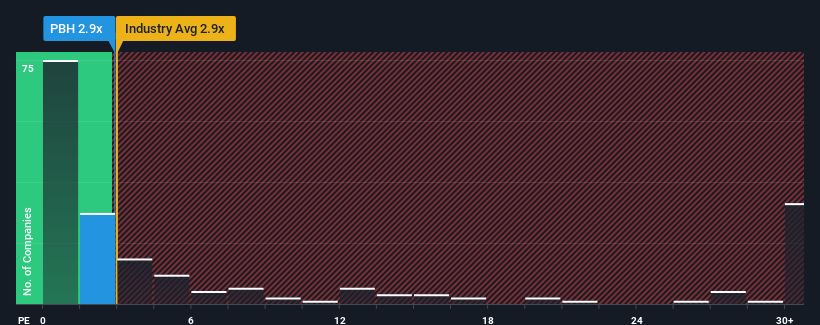

It's not a stretch to say that Prestige Consumer Healthcare Inc.'s (NYSE:PBH) price-to-sales (or "P/S") ratio of 2.9x seems quite "middle-of-the-road" for Pharmaceuticals companies in the United States, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Prestige Consumer Healthcare

What Does Prestige Consumer Healthcare's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Prestige Consumer Healthcare's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Prestige Consumer Healthcare's future stacks up against the industry? In that case, our free report is a great place to start.How Is Prestige Consumer Healthcare's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Prestige Consumer Healthcare's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Regardless, revenue has managed to lift by a handy 19% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 2.4% per annum during the coming three years according to the seven analysts following the company. That's shaping up to be materially lower than the 17% each year growth forecast for the broader industry.

With this in mind, we find it intriguing that Prestige Consumer Healthcare's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Bottom Line On Prestige Consumer Healthcare's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

When you consider that Prestige Consumer Healthcare's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

Before you take the next step, you should know about the 1 warning sign for Prestige Consumer Healthcare that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Prestige Consumer Healthcare, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PBH

Prestige Consumer Healthcare

Develops, manufactures, markets, distributes, and sells over the counter (OTC) health and personal care products in North America, Australia, and internationally.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives