- United States

- /

- Pharma

- /

- NYSE:PBH

Prestige Consumer Healthcare (PBH): Evaluating Valuation Following Strategic Eye Care Supplier Acquisition

Reviewed by Kshitija Bhandaru

Prestige Consumer Healthcare (PBH) recently faced headwinds in its eye care business because of supply chain disruptions. In response, the company acquired its eye care supplier for $100 million to address these issues directly.

See our latest analysis for Prestige Consumer Healthcare.

Prestige Consumer Healthcare’s decisive move to acquire its eye care supplier comes after a challenging stretch, with the share price down 20% year-to-date. Despite a tough recent run, long-term total shareholder returns remain strong. Returns have risen over 77% in five years and 18% over three years, hinting at underlying resilience and potential for renewed momentum as supply chain issues get resolved.

If you’re inspired by how Prestige is tackling challenges head-on, consider broadening your search and discover fast growing stocks with high insider ownership

With Prestige now trading at a notable discount to analysts’ targets, yet facing lingering uncertainties, investors must ask whether this is a window to buy into future growth or if the current market price is already fair.

Most Popular Narrative: 25.3% Undervalued

Prestige Consumer Healthcare's most popular valuation narrative calculates a fair value of $82.80 per share, significantly above the recent closing price of $61.84. This gap reflects optimism around operational recovery and bold growth assumptions despite recent setbacks.

Prestige's supply chain investments, specifically the acquisition of Pillar5 and onboarding new suppliers for Clear Eyes, are set to resolve current supply constraints. This is expected to support normalization and eventual growth of revenues, especially in the high-demand eye care segment, starting from the second half of fiscal '26 and into fiscal '27.

Curious where this bullish target comes from? The narrative bets big on a rebound in margins and a future profit multiple matched by only the industry’s elite. Which surprising projections could justify this optimism? Only one way to find out.

Result: Fair Value of $82.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing supply chain delays or faltering core brand relevance could undermine the optimistic outlook and slow Prestige’s expected recovery and growth.

Find out about the key risks to this Prestige Consumer Healthcare narrative.

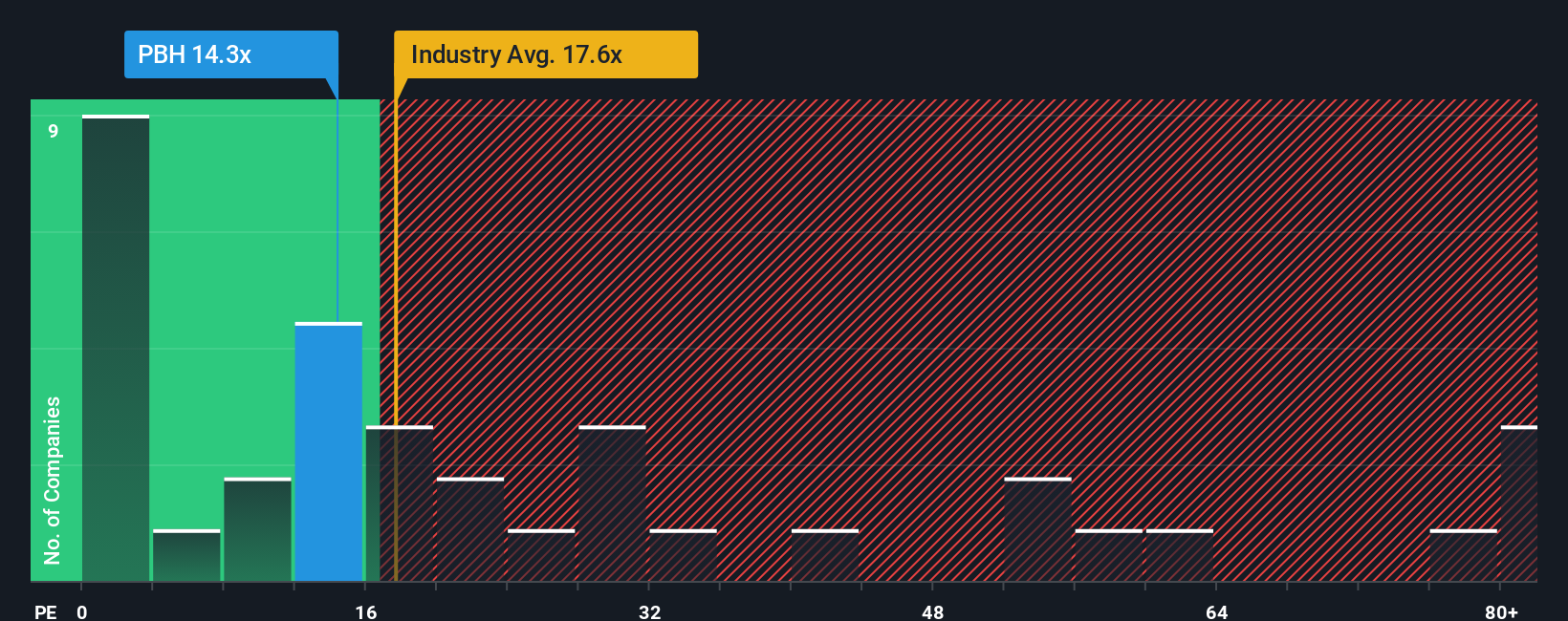

Another View: Sizing Up Price Multiples

Looking at valuation through another lens, Prestige Consumer Healthcare trades at a price-to-earnings ratio of 14.3x. This figure is nearly half the peer average of 31.2x in its sector and is also below the US industry average of 19.9x. However, its ratio closely mirrors the calculated fair ratio of 14.2x, suggesting the market could be reasonably pricing the shares based on this benchmark. Does this mean investors are already capturing most of the downside protection, or is there hidden opportunity that consensus forecasts have missed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Prestige Consumer Healthcare Narrative

If this perspective doesn't fully click for you, why not dive into the numbers yourself and craft a quick narrative in just a few minutes? Do it your way

A great starting point for your Prestige Consumer Healthcare research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Take charge of your investing journey by checking out more unique stock picks. The market never waits, so catch tomorrow's big winners before the crowd does.

- Spot fast-growing opportunities by tracking these 25 AI penny stocks as artificial intelligence transforms entire industries and unlocks new sources of value.

- Maximize your income potential by targeting these 18 dividend stocks with yields > 3% that offer reliable yields and steady growth far above the market average.

- Catalyze your portfolio with these 79 cryptocurrency and blockchain stocks riding the momentum of decentralized finance and blockchain adoption worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PBH

Prestige Consumer Healthcare

Develops, manufactures, markets, distributes, and sells over the counter (OTC) health and personal care products in North America, Australia, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives