- United States

- /

- Pharma

- /

- NYSE:OGN

Is Organon a Hidden Bargain After Shares Drop Nearly 40% in 2024?

Reviewed by Bailey Pemberton

If you’re sizing up what to do with your Organon shares or considering taking the plunge, you’re not alone. Lately, the stock has been on quite the ride, leaving investors and would-be buyers curious about its real worth. There have been a few headwinds this year, with the share price sliding 29.1% since January. The 12-month drop sits at an even sharper 39.0%. Despite these declines, the past month brought a small sign of life: a 2.1% bump. The 7-day move was a modest -0.7%. With three-year performance at -47.3%, it is clear the market has been cautious, possibly reflecting renewed perceptions of risk.

Yet, when you dig into how Organon stacks up on valuation, things get interesting. If you use objective methods to check for undervalued opportunities, Organon checks 5 out of 6 boxes, giving it a strong value score of 5. That is a rare feat among peers and hints that there could be more than just bad news baked into the current price.

So, what does this all mean from a value perspective? Let’s start breaking down how Organon fares under a variety of valuation approaches, before circling back to what might just be an even smarter way to size up its investment potential.

Why Organon is lagging behind its peers

Approach 1: Organon Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's true value by forecasting future cash flows and then discounting them back to today, reflecting the present worth of those future earnings. This approach gives a forward-looking view based on expected performance, rather than just historical results.

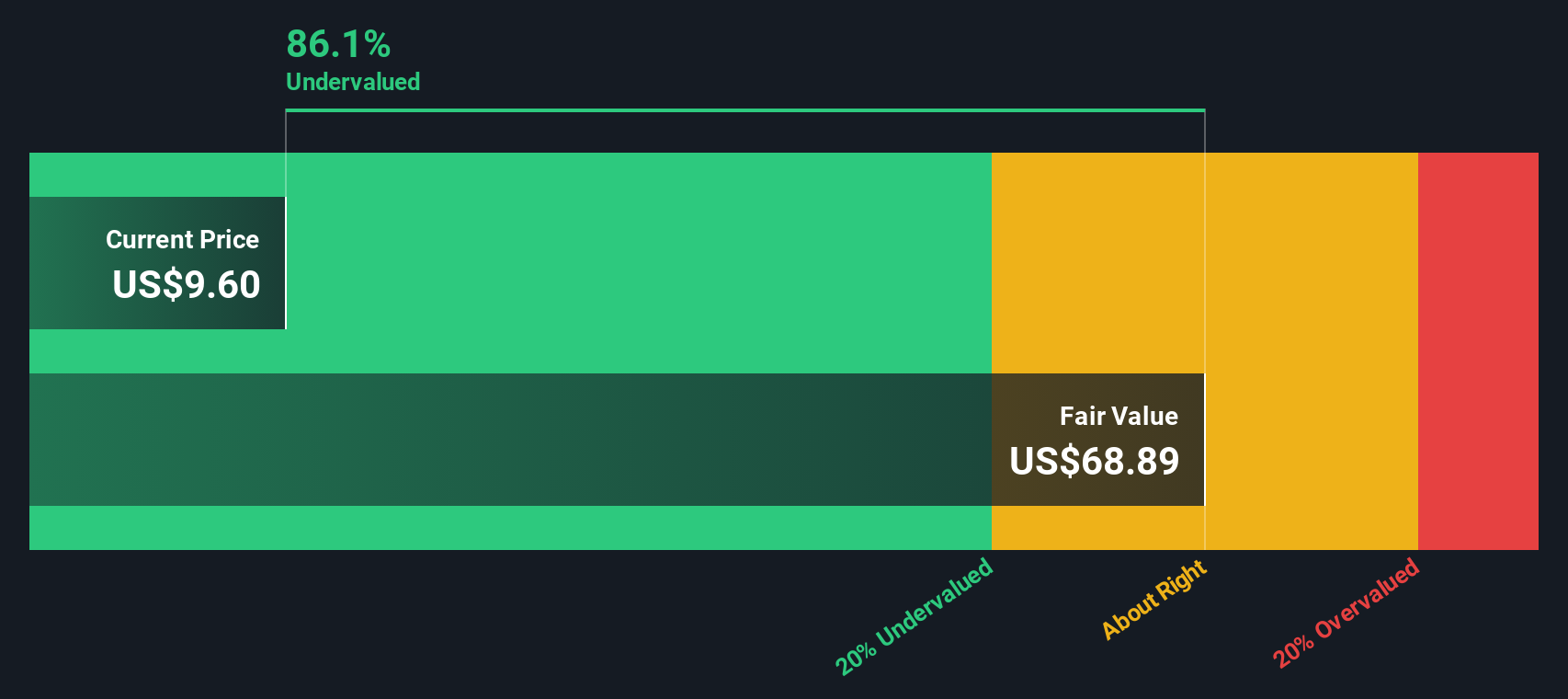

For Organon, the DCF model uses its current Free Cash Flow of $482 million as a starting point. Analysts estimate that cash flows will continue to grow in the coming years, reaching $1.28 billion by the end of 2029. The initial projections come from multiple analysts for the first five years, beyond which the figures are extrapolated using more general growth rates.

Based on these projections, the DCF model calculates Organon’s intrinsic value at $73.72 per share. This is considerably higher than the current share price, suggesting an intrinsic discount of 85.6%. In other words, the market price is far below Organon’s fundamental value according to this method.

In summary, the DCF analysis strongly suggests that Organon shares are deeply undervalued for those focused on long-term cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Organon is undervalued by 85.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Organon Price vs Earnings (PE Ratio)

The price-to-earnings (PE) ratio is a popular valuation metric for profitable companies, as it directly links a company’s share price to its underlying earnings. Investors often look to this ratio because it provides a quick snapshot of how much they are paying for each dollar of profit, which is especially relevant when a business is consistently generating positive earnings.

What counts as a “normal” or “fair” PE ratio is shaped by a company’s growth prospects and perceived risk. Stocks with higher expected earnings growth or lower risk typically command a higher PE. Those with muted outlooks or added risks tend to trade at a discount.

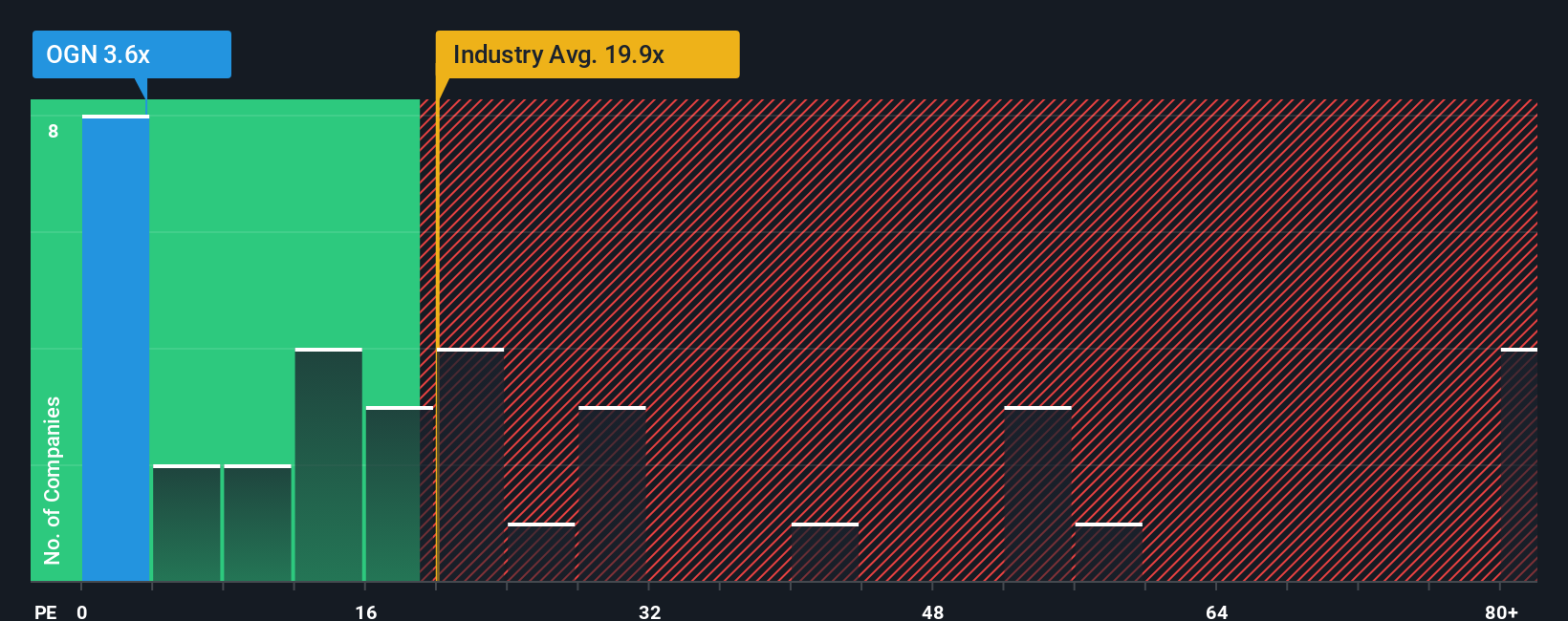

Organon currently trades at a PE ratio of just 3.9x. That is considerably lower than both the pharmaceutical industry average of 18.3x and the peer group average of 34.1x. At first glance, this deep discount may raise questions about whether the stock is truly undervalued, or if the market sees other concerns not captured by headline earnings.

To get a more nuanced picture, it is helpful to consider the “Fair Ratio,” a proprietary benchmark from Simply Wall St that sets the expected PE based on factors such as earnings growth, profit margins, market cap, industry norms, and company-specific risks. Unlike raw comparisons, the Fair Ratio offers a more tailored view of valuation by adjusting for nuances that broad averages may miss.

Organon’s Fair Ratio is 19.9x, far higher than its actual multiple of 3.9x. This wide gap suggests the stock is priced much lower than what would be expected for its financial profile, even once growth and risk are factored in.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Organon Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives, a smarter and more personal approach to making investment calls. A Narrative is your story behind the numbers: it blends your view on Organon’s future (things like fair value, revenue, earnings, and margins) with the facts and figures to create your own forecast and valuation. Narratives connect the dots between what’s happening in Organon’s business, what you think will play out next, and how that translates into how much the stock should be worth.

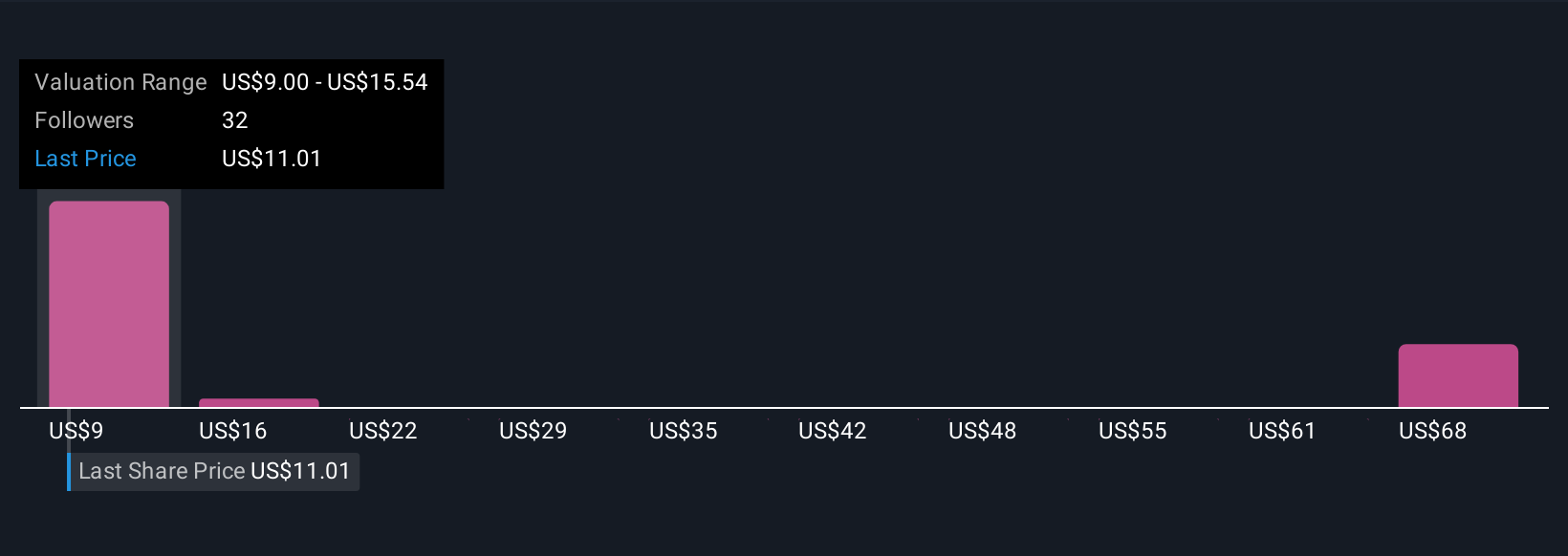

This powerful tool is now available for everyone on Simply Wall St’s Community page, helping millions of investors quickly compare their own perspective with those of others. Narratives let you see how your assumptions, such as future growth or risks, stack up against the consensus. They automatically update whenever new information or earnings are released. If you think new launches and biosimilars will spur strong international growth, your Narrative might point to a fair value near $18.00. If you are more cautious due to pipeline and pricing headwinds, you may land closer to $9.00, reflecting a different outlook. You can instantly see how these choices affect your “buy” or “wait” decision as Fair Value versus current Price updates in real time.

Do you think there's more to the story for Organon? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OGN

Organon

Develops and delivers health solutions through prescription therapies and medical devices in the United States, Europe, Canada, Japan, rest of the Asia Pacific, Latin America, the Middle East, Russia, Africa, and internationally.

Undervalued with limited growth.

Similar Companies

Market Insights

Community Narratives