- United States

- /

- Pharma

- /

- NYSE:MRK

What Does Merck’s London Research Exit Mean for Its Current Stock Price?

Reviewed by Bailey Pemberton

If you are staring at Merck’s stock chart and wondering whether now is the moment to jump in, hold steady, or walk away, you are not alone. Merck’s recent price action has caught the eye of both long-term investors and those looking for a turnaround story. Over the last week, shares slid by 3.3%, reflecting a backdrop of pharmaceutical sector news and internal changes. Yet in the past month, there has actually been a modest gain of 2.3%, even as year-to-date performance sits at -14.6% and the stock is still down 21.2% from a year ago. The longer-term view shows some resilience, with a 32.9% return over the last five years. This reminds us that Merck has weathered plenty of market storms.

Headlines have not been kind lately, especially with news of Merck scrapping its billion-pound London research project and shifting resources stateside, which triggered both a staff reduction and waves of market speculation. Broader industry currents, such as hints of evolving US drug pricing policy and shifting global investment from competitors, have only added to the uncertainty. At the same time, these factors may also mean opportunities where others see risk.

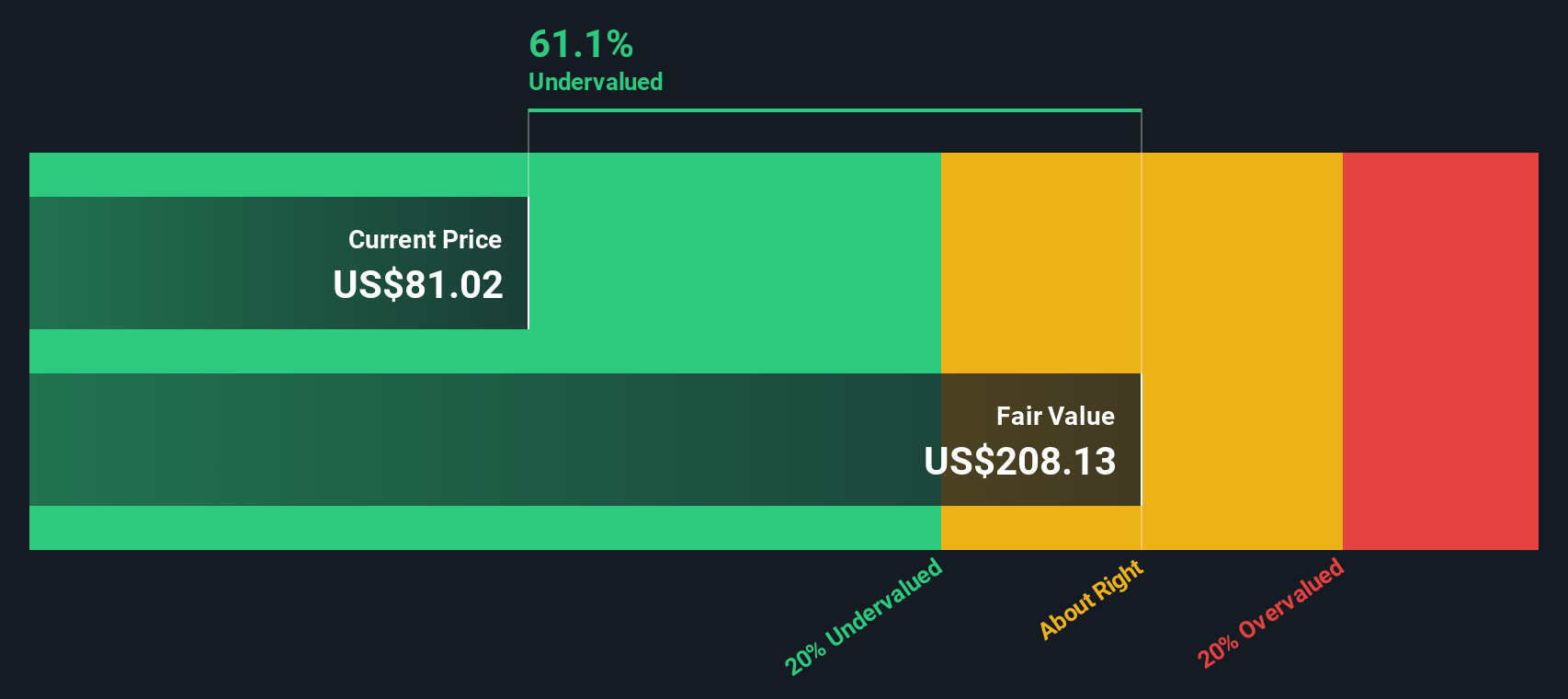

This brings us to the big question: is Merck undervalued, fairly priced, or still expensive despite the pullback? According to our valuation scorecard, Merck scores a perfect 6 out of 6. It is undervalued by every single metric we check.

In the next section, we will break down exactly which valuation approaches point to this rare "all-clear" signal and, more importantly, tease out a smarter way to judge value that most investors overlook.

Why Merck is lagging behind its peers

Approach 1: Merck Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the fair value of a stock by projecting its future cash flows, then discounting those back to today. This approach helps investors gauge what a company is truly worth based on expected business performance rather than market sentiment.

For Merck, the current Free Cash Flow stands at $14.53 billion. Analysts provide detailed projections for the next five years, and further estimates are extrapolated for the long term. By 2029, annual Free Cash Flow is expected to reach $23.19 billion according to these blended projections.

The two-stage Free Cash Flow to Equity model used here weighs both near-term analyst estimates and longer-term extrapolations. When the projected cash flows are discounted back to their present value, Merck’s intrinsic value comes out to $207.62 per share. This is a substantial 59.2% discount compared to the current market price, even factoring in uncertainties.

Simply put, the DCF analysis suggests Merck is deeply undervalued relative to its long-term cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Merck is undervalued by 59.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Merck Price vs Earnings

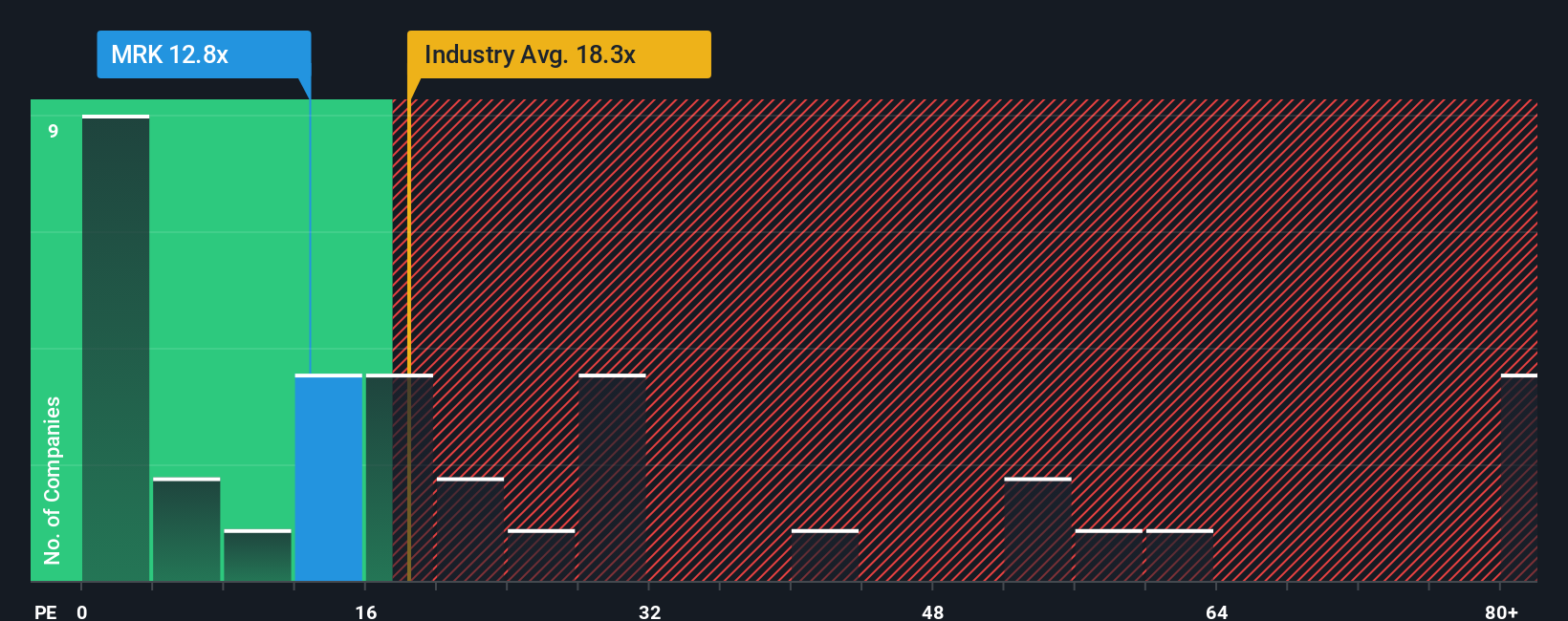

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies because it directly ties the price investors are willing to pay with the company’s actual earnings. For businesses like Merck that generate consistent profits, PE provides a clear sense of what the market expects for future growth and risk.

Generally, higher growth prospects or lower risk merit a higher “normal” or “fair” PE ratio. Low growth or elevated risk lead to a lower one. For context, Merck currently trades at a PE of 12.9x. This is well below the Pharmaceuticals industry average of 18.1x and the peer average of 18.3x, signaling the market may be pricing Merck more conservatively than many of its counterparts.

Simply Wall St’s proprietary Fair Ratio model analyzes Merck’s growth outlook, risk profile, profit margins, industry sector, and market capitalization. Unlike a simple peer or industry comparison, the Fair Ratio reflects a more holistic view tailored to what Merck specifically deserves based on its fundamentals. For Merck, this Fair Ratio is 26.2x, which is not only higher than current market levels but also substantially above the industry and peer benchmarks.

With Merck’s current PE ratio at 12.9x and a Fair Ratio of 26.2x, the stock appears meaningfully undervalued according to this method.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Merck Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a smarter, more dynamic approach to investing.

A Narrative is simply the story you believe about a company’s future, connecting your expectations for its business, like projected revenues and profit margins, to a fair value estimate you are comfortable with. These Narratives help you move beyond static numbers by letting you anchor your investment decisions in both the facts of today and your outlook for tomorrow.

On Simply Wall St’s Community page, millions of investors easily create Narratives, linking their views on Merck’s strategy, competitive strengths, and market challenges directly to customizable financial forecasts and fair value calculations. As real-world events and news roll in, each Narrative updates automatically, ensuring your analysis reflects the latest developments. This way, you are never working from stale information.

Narratives shine brightest when comparing Fair Value to current share price, providing clear signals on when you might want to act. For example, the highest Narrative fair value for Merck right now is $141.0, reflecting strong optimism around oncology and product launches. The lowest, at $82.0, comes from investors who anticipate weaker sales and margin pressures. This demonstrates how unique perspectives shape every valuation.

Do you think there's more to the story for Merck? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MRK

Very undervalued with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives