- United States

- /

- Pharma

- /

- NYSE:MRK

Merck (NYSE:MRK) Showcases Broad Cancer Research Portfolio At ASCO Annual Meeting

Reviewed by Simply Wall St

Merck (NYSE:MRK) is set to showcase significant research advancements, including updates on its KEYTRUDA indications at the upcoming ASCO Annual Meeting, which could enhance its oncology footprint. However, the company experienced a 3% decline in its share price last week, during a period when broader market indices, led by tech gains, posted positive returns. Despite this decline, Merck's ongoing initiatives in cancer treatment and digital health technologies signal sustained efforts against industry headwinds and regulatory challenges. The market's rally, driven by positive economic developments, provided some broader context for Merck's price movement, though it diverged from the overall upward trend.

We've identified 1 possible red flag for Merck that you should be aware of.

The recent news surrounding Merck's showcase of research advancements, particularly updates on KEYTRUDA at the ASCO Annual Meeting, might provide a boost to the company's oncology segment. Such updates could positively affect revenue and enhance earnings forecasts, despite the immediate past week's share price decline of 3%. Analysts project a consistent revenue growth rate of 4.4% annually over the next three years, emphasizing Merck's commitment to expanding its product pipeline and addressing current challenges such as declining GARDASIL sales and competitive market pressures.

Over a longer five-year period, Merck's total shareholder return, which includes both share price appreciation and dividends, stood at 20.82%. This growth indicates the company's capacity to provide long-term value to its investors. However, this performance contrasts with the more recent one-year timeframe where Merck underperformed the US Pharmaceuticals industry, which experienced a 10% decline. The divergence highlights the importance of considering different time frames when assessing performance.

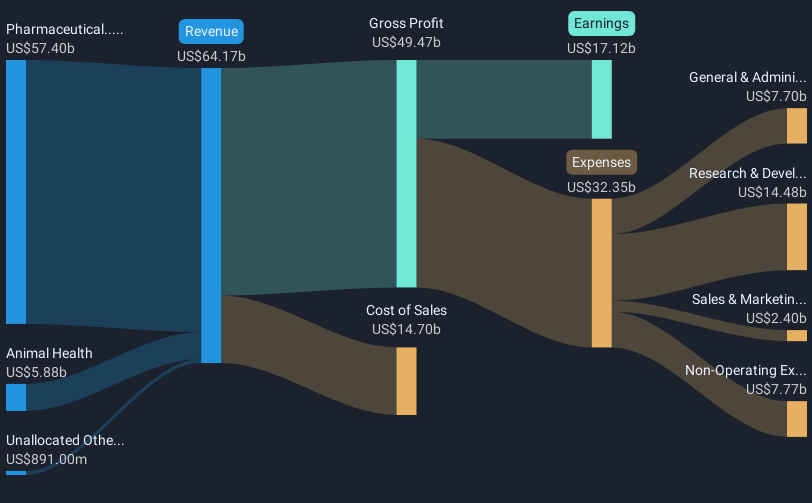

Regarding prices, Merck's current share price of US$79.04 represents a 24.7% discount to the consensus price target of approximately US$105. This suggests potential room for upward movement if future earnings, driven by new product launches and strategic investments, align with analyst expectations. Current forecasts estimate earnings to grow from US$17.43 billion to US$24.6 billion by May 2028, with ongoing investments in R&D and manufacturing expected to support this trajectory. Such developments, coupled with robust oncology initiatives, may position Merck well against industry headwinds and regulatory challenges.

Examine Merck's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MRK

Very undervalued with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives