- United States

- /

- Pharma

- /

- NYSE:LLY

Why Eli Lilly and Company (NYSE:LLY) may be Cheap and has Growth Driven by Capital Investments

Eli Lilly and Company (NYSE:LLY), released their earnings report with mixed results. That is why we are going to overview the fundamental value drivers of the company, and see if Eli Lilly is in a good position for the future.

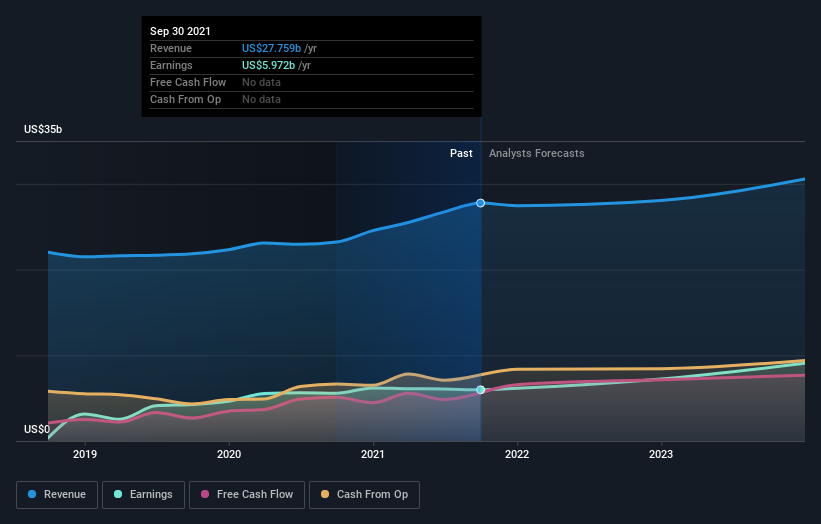

We will look at the most current results, as well as the future earning potential of the company. Starting with the last Q3 report, we see:

- Revenue: US$6.77b (up 18% from 3Q 2020).

- Net income: US$1.11b (down 8.1% from 3Q 2020).

- Profit margin: 16% (down from 21% in 3Q 2020). The decrease in margin was driven by higher expenses.

Over the last 3 years on average, earnings per share has increased by 37% per year whereas the company’s share price has increased by 32% per year.

It seems that the share price closely follows the earnings increase of the company. On a qualitative level, Eli Lilly has a wide product portfolio and is continuously investing in growth. In the year to date, Eli Lilly has invested some US$7b in growth assets, including: $US4.3b in R&D, US$1b in capital investments, US$1.7b in business development.

Capital investments allow companies to grow, and we can see how productive are their investments in the business by looking at the return measures.

Eli Lilly had a return of capital employed (ROCE) of 24.8%, which is higher than the 19.8% it had three years ago. This shows that the company has a very good return on capital, which has also been growing in the past years. A great return measure can be a leading indicator of future growth, because it shows that the company is allocating resources with higher efficiency.

Check out our latest analysis for Eli Lilly

Valuation

Great news for investors – Eli Lilly is still trading at a fairly cheap price. The Simply Wall St valuation model shows that the intrinsic value for the stock is $392.91, but it is currently trading at US$253 on the share market, meaning that there still might be an opportunity to dig deeper.

Remember, that our valuation model projects future cash flows, and investors might want to consider the factors that put those cash flows at risk, such as: patent expirations, competitor product overlap, emerging treatments that are possibly superior, loss of segment sales because of reduced demand (example: reduction of products related to COVID-19 treatment). Estimating the real risk factors is difficult, but a key feature before you make an investment decision.

Another thing to keep in mind is that Eli Lilly’s share price may be quite stable relative to the rest of the market, as indicated by its low beta. This means that if you believe the current share price should move towards its intrinsic value over time, a low beta could suggest it is not likely to reach that level anytime soon, and once it’s there, it may be hard to fall back down into an attractive buying range again.

Outlook

Eli Lilly's earnings over the next few years are expected to increase by 87%, indicating a highly optimistic future ahead. This should lead to more robust cash flows, feeding into a higher share value.

Key Takeaways

Even with the mixed results from the last quarter, Eli Lilly seems to produce increasing cash flows that can justify a higher valuation.

The company is continuously investing in growth assets and has a diversified product portfolio that can produce long-term income. Outlook is positive in the near future, and the company is estimated to increase both revenues and profits.

If you want to dive deeper into Eli Lilly, you'd also look into what risks it is currently facing. While conducting our analysis, we found that Eli Lilly has 1 warning sign and it would be unwise to ignore it.

If you are no longer interested in Eli Lilly, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

Valuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives