- United States

- /

- Pharma

- /

- NYSE:LLY

Is Eli Lilly a Bargain After $350B U.S. Manufacturing Investment Announcement?

Reviewed by Simply Wall St

If you own Eli Lilly stock or are thinking about jumping in, you are far from alone. With blockbuster drugs and market-shaking news around every corner, Eli Lilly is always in the spotlight. Recent headlines have fueled excitement about the company’s growth plans, from pledging major investments in new U.S. manufacturing to forging partnerships in China that expand their reach for obesity and diabetes medications. But what does this all mean for the shares in your portfolio?

Investors have seen a wild ride over the past year. The stock is up nearly 2% in the past week and over 9% in the past month, signaling a strong rebound. Step back a little further, though, and you’ll notice the year-to-date return is still down nearly 2%, while the 1-year performance sits at -15%. Contrast that with Eli Lilly’s astonishing 160% three-year return and a five-year gain topping 439%, and it is clear why the stock continues to capture attention, both for its soaring peaks and periodic stumbles.

Of course, the big question is always valuation. Is Eli Lilly an unstoppable innovator trading at a reasonable price, or has the market already factored in every ounce of good news? According to our composite valuation score, which gives 1 point for each of 6 key metrics where a company is undervalued, Eli Lilly gets a 2 out of 6. So while there may be growth ahead, the stock doesn’t scream ‘bargain’ by traditional measures.

Let’s break down the valuation approaches in more detail, and also look at a way to get a fuller picture of what Eli Lilly might really be worth, beyond the usual valuation checks.

Eli Lilly scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Eli Lilly Discounted Cash Flow (DCF) Analysis

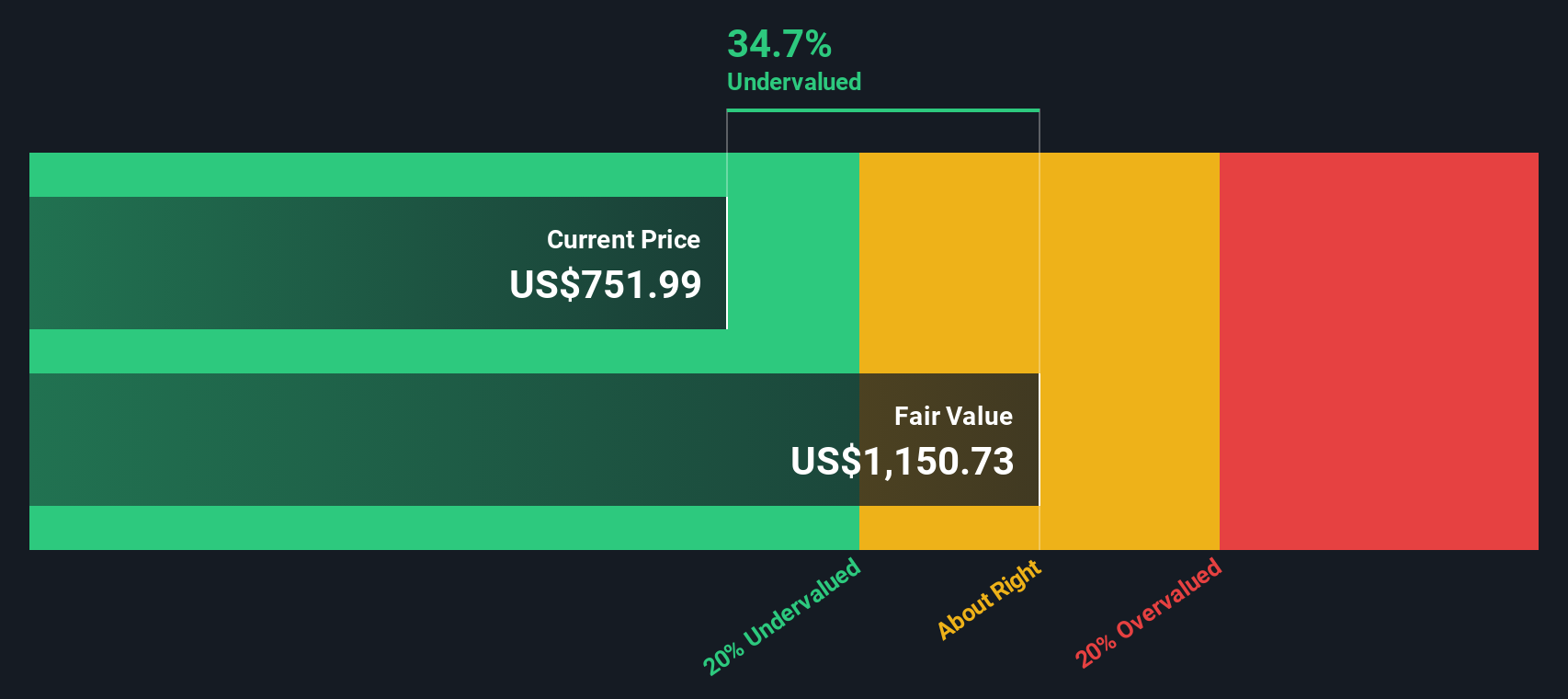

A Discounted Cash Flow (DCF) model estimates what a company is truly worth by projecting its future cash flows and discounting them back to today's dollars. This method provides investors with a long-term outlook and shows how much value Eli Lilly can generate over time.

For Eli Lilly, the latest twelve months' free cash flow stands at approximately $2.25 billion. Analysts project rapid growth, with cash flows expected to exceed $33.5 billion by 2029. The DCF model uses a "2 Stage Free Cash Flow to Equity" approach to extend these cash flows further out, combining analyst estimates for the next five years with responsibly extended projections through 2035 by Simply Wall St.

According to this forward-looking analysis, Eli Lilly’s estimated intrinsic value is $1,156.15 per share. This is about 33.9% higher than its recent trading price, suggesting the stock is undervalued according to this method. The model indicates that the potential for future growth and profitability may not yet be fully reflected in the current market price.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Eli Lilly.

Approach 2: Eli Lilly Price vs Earnings

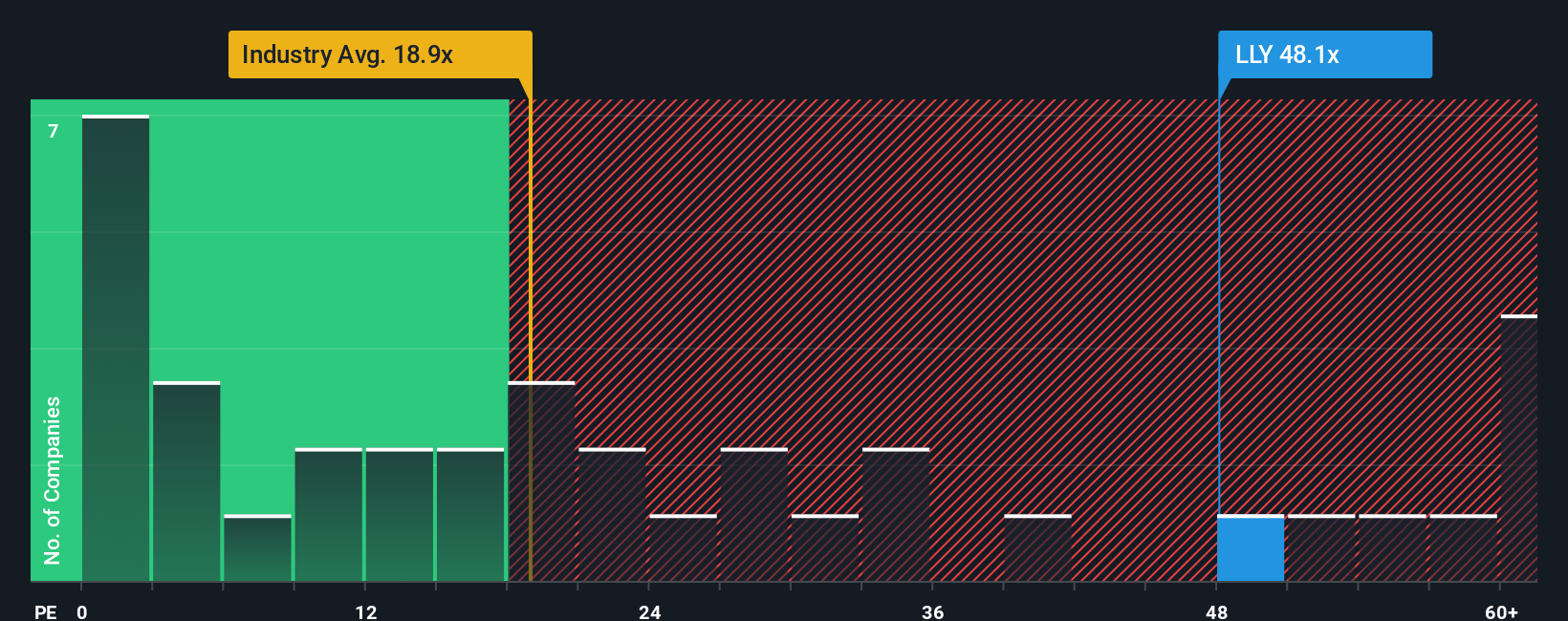

The Price-to-Earnings (PE) ratio is widely used to value profitable companies, especially in established sectors like pharmaceuticals, as it directly links a company’s share price to its underlying earnings power. It helps investors gauge how much they are paying for each dollar of earnings and is particularly meaningful when a company consistently generates healthy profits.

Determining whether a PE ratio is high or low depends on several factors. Higher growth expectations typically justify higher PE ratios, since investors are willing to pay up today for future earnings. On the other hand, greater risk or unpredictability can warrant a discount. That is why it is common to compare a company’s PE against industry benchmarks, which reflect prevailing growth prospects and risk levels.

Eli Lilly currently trades at a lofty PE of 49.7x, well above both its peers' average of 15.6x and the broader Pharmaceutical industry average of 18.7x. At first glance, this may imply the stock is priced for perfection. However, Simply Wall St’s "Fair Ratio" for Eli Lilly, calculated using a proprietary approach that considers earnings growth, profit margins, the company’s size, and unique risks, comes out to 42.8x. This custom benchmark goes beyond surface-level peer and sector comparisons by focusing on what is most relevant to Lilly’s situation. Putting it all together, while Lilly’s current PE is slightly above its Fair Ratio, the gap is modest.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Eli Lilly Narrative

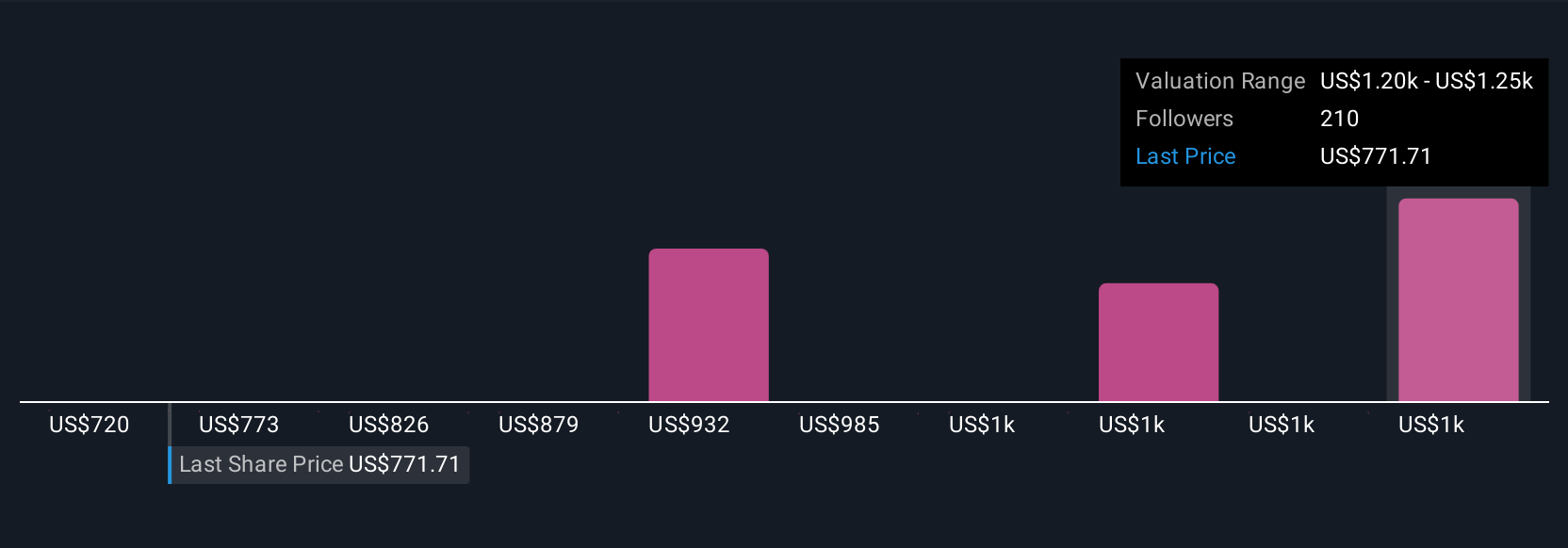

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a structured story behind the numbers. It is the perspective an investor takes based on their assumptions about a company’s future, including what they think fair value is and their expectations for revenue, earnings, and profit margins.

Unlike traditional valuation methods, Narratives connect the dots by linking Eli Lilly’s past, present, and future. You can combine the company’s unique story and catalysts with your own financial forecasts and see what that means for the share price right now.

Narratives are straightforward to use and available on Simply Wall St’s Community page, where millions of investors share their reasoning and check their ideas against others. This tool helps you decide when to buy or sell, by comparing your fair value (based on your assumptions) with the current market price. And because Narratives update automatically when there is important news or earnings updates, your view stays relevant and informed.

For example, one investor might see Eli Lilly’s global expansion and innovation as a reason to assign a fair value near $1,190 per share, while another may be cautious about regulatory risks and competitive threats, estimating fair value closer to $650. Narratives help you make sense of these differences, so you can invest with more confidence and clarity.

Do you think there's more to the story for Eli Lilly? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives