- United States

- /

- Pharma

- /

- NYSE:JNJ

Johnson & Johnson (JNJ) Margins Jump to 27.3% on One-Off Gain, Testing Bullish Narratives

Reviewed by Simply Wall St

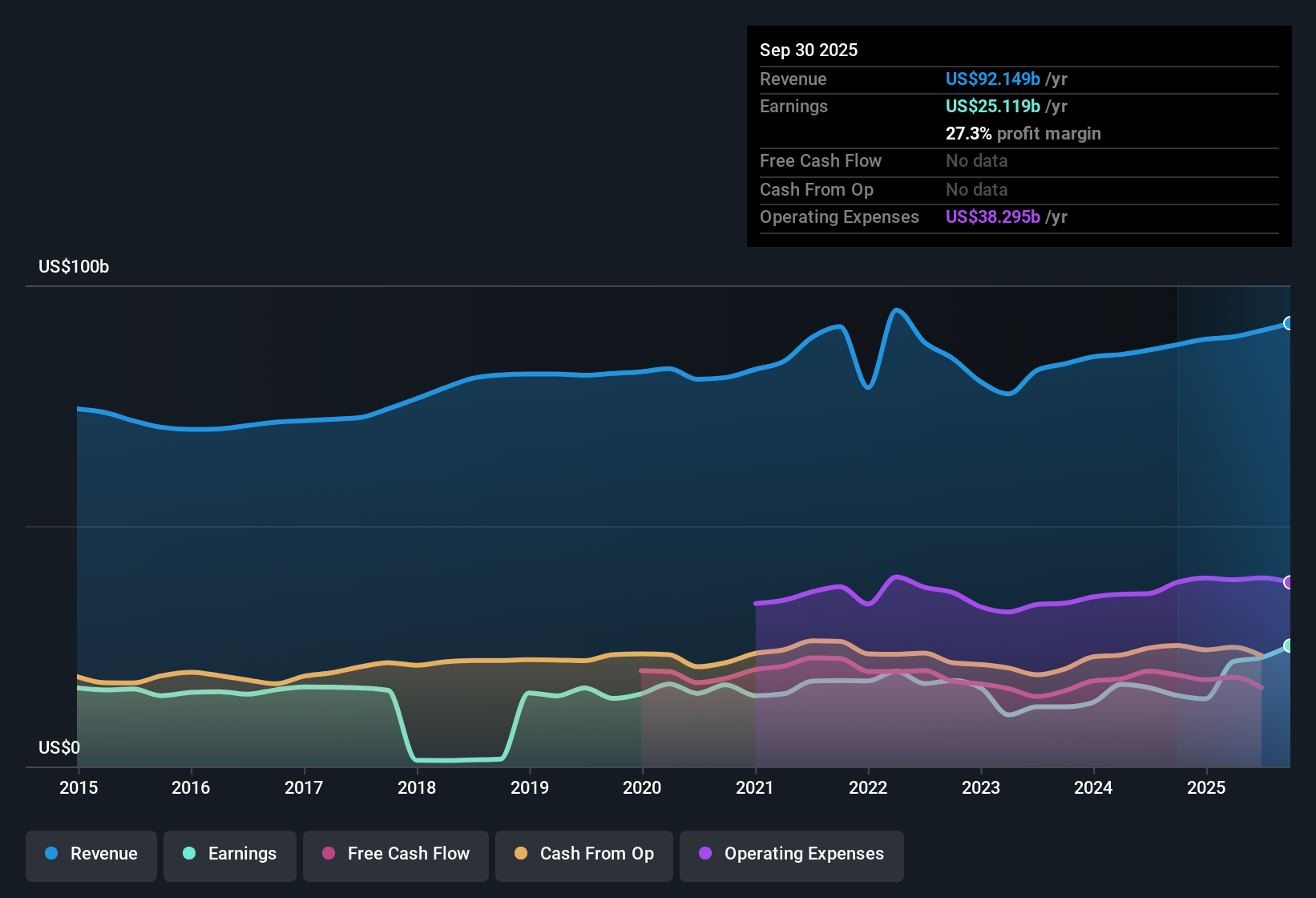

Johnson & Johnson (JNJ) posted robust earnings numbers in its latest report, with net profit margins rising to 27.3% compared to 16.8% a year ago and EPS boosted by a substantial 70.2% jump over the past year. These headline gains were driven in part by a one-off $5.9 billion gain, which brings a note of caution when comparing year-over-year performance. With expectations for annual revenue growth of 4.8% trailing broader market forecasts, investors are likely weighing JNJ’s impressive margins and continuing dividend against the near-term outlook for profit growth in light of non-recurring factors.

See our full analysis for Johnson & Johnson.Now, let’s see how these earnings results stack up against the prevailing stories investors are talking about. The next section will weigh the hard data against the main narratives shaping the outlook for Johnson & Johnson.

See what the community is saying about Johnson & Johnson

Profit Margins Hold Steady Despite Non-Recurring Gains

- Net profit margins remain elevated at 27.3%, well above last year, but this boost is heavily affected by a one-off $5.9 billion gain in the past twelve months, which makes it trickier to use this figure as a baseline for future performance.

- Analysts' consensus view points out that, while JNJ expects to maintain strong profitability, forward guidance sees profit margins dropping from 25.0% today to 22.0% in three years, mainly as the benefit of non-recurring items fades.

- This connects to management’s comment in the consensus that next-generation therapies, especially in immunology and oncology, should help support margins over the long term.

- Still, loss of exclusivity for major drugs, tariffs, and litigation have analysts watching margins closely for any slippage beyond the guided trend.

Consensus view readers are watching whether robust current margins will persist or fall faster than predicted, especially with one-off gains set to disappear. 📊 Read the full Johnson & Johnson Consensus Narrative.

Revenue Growth Trails Industry, but Pipeline and Acquisitions in Focus

- Revenue is forecast to grow at a 4.8% annual clip over the next three years, which is less than half the broader US market rate of 10% per year and highlights a more measured top-line outlook for JNJ compared to many peers.

- Analysts' consensus view highlights that the bullish case leans on future revenue drivers: over $55 billion in U.S. investment, expansion in MedTech, and acquisitions like Intra-Cellular Therapies are seen as key to offsetting the expected drag from lost exclusivity on drugs such as STELARA.

- The consensus notes that new products like CAPLYTA could add over $5 billion in peak sales and MedTech units like Abiomed and Shockwave have outperformed expectations in recent quarters.

- On the flip side, some bearish analysts worry US tariffs and competitive pressures, particularly in orthopedics and surgical units, could undercut the positive impact from these strategic bets.

Valuation Undercuts Peers, But Margin of Safety Is Slim

- At a current share price of $191.17 and a Price-to-Earnings Ratio of 18.3x, lower than the peer average of 24.3x but just above the industry average of 18.1x, JNJ appears to trade at a modest discount to many direct peers.

- Analysts' consensus view shows the company’s analyst price target stands at 195.29, just 2.2% above the latest share price, suggesting most analysts see limited near-term upside, even with projected long-term earnings growth.

- Consensus also emphasizes that JNJ's discounted cash flow fair value of 433.58 is much higher than both its current share price and analyst targets, which bullish investors might interpret as a long-term opportunity while skeptics view it as an optimistic outlier.

- The close gap between share price and consensus target reflects that the market already prices in both the risks and the potential upside from ongoing investments and upcoming products.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Johnson & Johnson on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Share your viewpoint in just a few minutes and add your story to the discussion. Do it your way

A great starting point for your Johnson & Johnson research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Johnson & Johnson’s revenue growth and profit outlook are constrained by the loss of exclusivity for major drugs and a limited pipeline to offset this slowdown.

Looking for companies with more consistent momentum? Check out stable growth stocks screener (2097 results) to discover businesses delivering reliable revenue and earnings expansion year in, year out.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JNJ

Johnson & Johnson

Engages in the research and development, manufacture, and sale of various products in the healthcare field worldwide.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives