- United States

- /

- Pharma

- /

- NYSE:JNJ

Johnson & Johnson (JNJ): Is the Stock Fairly Valued After Its Recent Uptrend?

Reviewed by Kshitija Bhandaru

See our latest analysis for Johnson & Johnson.

Johnson & Johnson’s 8% rise over the past month is part of a bigger upswing, with a 21.6% 90-day share price return and 21.9% total shareholder return over the last year. Recent momentum suggests renewed optimism from investors about its long-term growth prospects, as steady performance combines with improving sentiment.

If healthcare momentum like J&J’s interests you, now is a great moment to discover the next set of opportunities with See the full list for free.

However, given the strong rally and robust returns, some investors may wonder if Johnson & Johnson’s stock is still attractively priced or if the recent gains already reflect all the company’s future growth potential.

Most Popular Narrative: Fairly Valued

Johnson & Johnson’s most closely watched narrative points to a fair value very close to the last close price. This suggests the stock currently trades in line with broad analyst expectations. This backdrop sets the stage for one pivotal business transformation in the company’s future strategy.

"The company's substantial investment of over $55 billion into manufacturing, R&D, and technology in the U.S. over the next four years is projected to expand capacity for advanced medicines and devices, potentially increasing operational efficiency and future earnings."

There is a bold earnings blueprint behind this fair value status, involving multibillion-dollar commitments and the potential for margin expansion. Want to uncover the high-stakes forecasts and learn what assumptions move Johnson & Johnson’s valuation needle? The full picture is just one click away.

Result: Fair Value of $185.13 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing litigation and potential pricing pressures remain. These factors could quickly alter the outlook if they escalate unexpectedly.

Find out about the key risks to this Johnson & Johnson narrative.

Another View: What Do Market Ratios Reveal?

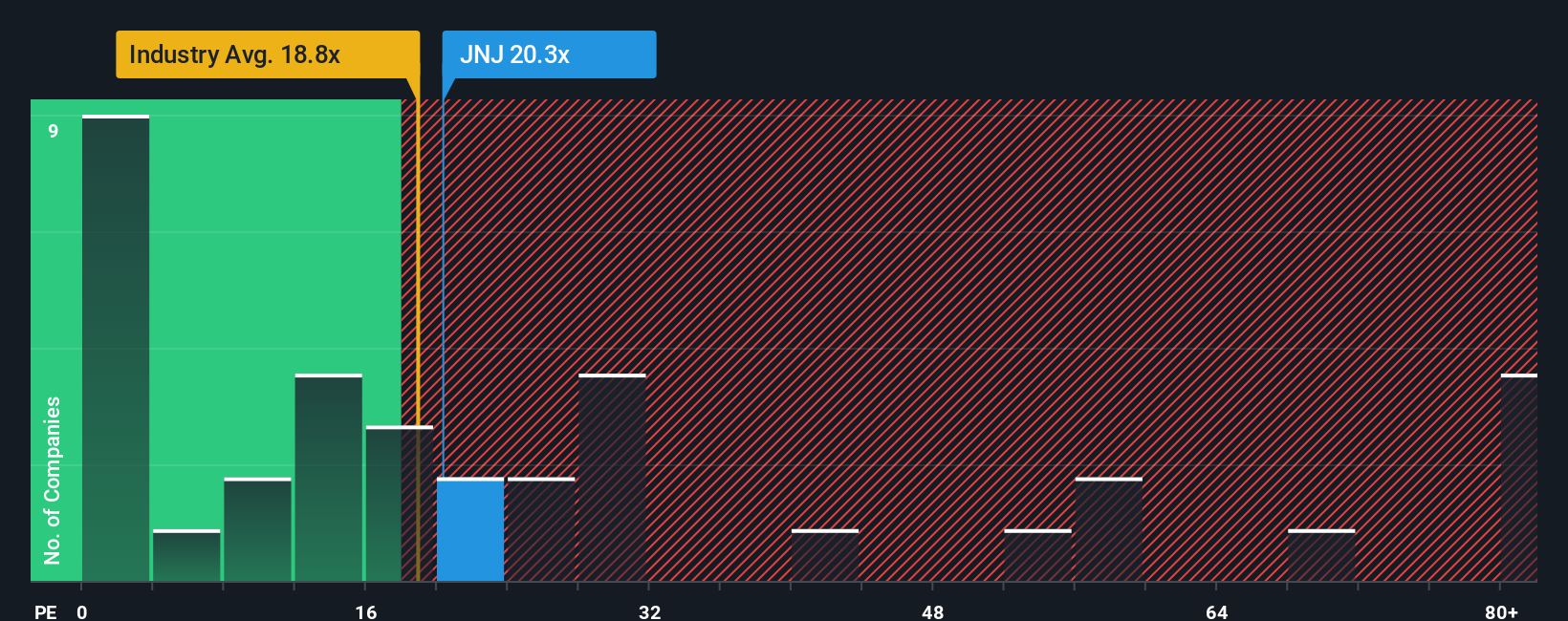

Looking through a different lens, Johnson & Johnson’s current price-to-earnings ratio is 20.3x, which is lower than the peer average of 24.5x and below its own fair ratio of 24x. However, it sits a bit higher than the industry average of 18.8x. This means investors benefit from a discount to peers and the company’s fair ratio, but compared to the wider sector, it could still be considered expensive. What will close this gap first: future earnings surprises or a valuation reset?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Johnson & Johnson Narrative

Whether you see things differently or prefer your own independent analysis, your unique perspective is just minutes away. You can Do it your way.

A great starting point for your Johnson & Johnson research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

If you want to stay ahead of the curve and capture new opportunities, try these proven strategies using Simply Wall Street’s powerful screener tools.

- Start building your growth portfolio by targeting steady earnings and above-average yields with these 19 dividend stocks with yields > 3%, delivering consistent income potential.

- Catalyze your watchlist with these 24 AI penny stocks, driving tech innovation and fueling the AI trends that power tomorrow’s biggest winners.

- Unlock hidden bargains by pinpointing these 898 undervalued stocks based on cash flows, offering strong fundamentals at attractive prices before the rest of the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JNJ

Johnson & Johnson

Engages in the research and development, manufacture, and sale of various products in the healthcare field worldwide.

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives