- United States

- /

- Pharma

- /

- NYSE:BMY

Does Bristol Myers Stock Offer Value as AI Data-Sharing Alliance Makes Headlines?

Reviewed by Bailey Pemberton

If you’re holding Bristol-Myers Squibb or eyeing it as a potential buy, you’re not alone in wondering what move makes sense right now. The stock has tested even the most patient of investors lately, closing recently at $43.61 and sliding by 2.1% over the past week. Over the last month, that drop deepened to 5.9%, and the year-to-date return is a notable -23.2%. The one-year and multi-year performances haven’t offered much relief, with returns at -14.2% over the last year and down 30.0% over the past three. Even the five-year picture, which is typically where blue chip pharma stocks get the benefit of the doubt, shows Bristol-Myers Squibb in the red at -11.7%.

Some of this price pressure traces to industry-wide uncertainty and a swirl of headlines, like the government’s latest push, under both parties, to tackle rising drug prices and shake up how pharmaceuticals are bought. Ongoing updates about possible tariffs on imported drugs and the company’s involvement in big data-sharing alliances for AI-powered drug discovery have kept Bristol-Myers in the news, though not always in a way that moves sentiment decisively upward or downward. In short, risk perceptions are shifting, and it’s showing up in the stock price.

The silver lining? When we run Bristol-Myers Squibb through a battery of valuation checks, it comes away with a value score of 4 out of 6. So while the headlines might read as a caution flag, the valuation could be telling a different story, one that’s worth a closer look. Let’s walk through those valuation approaches first, and then I’ll share what I think is the best way to cut through the noise and gauge what the stock is really worth.

Why Bristol-Myers Squibb is lagging behind its peers

Approach 1: Bristol-Myers Squibb Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by projecting a company’s future free cash flows and then discounting them back to today’s value. This allows investors to estimate what the company is really worth based on the cash it is expected to generate over the long term, rather than just current profits or revenues.

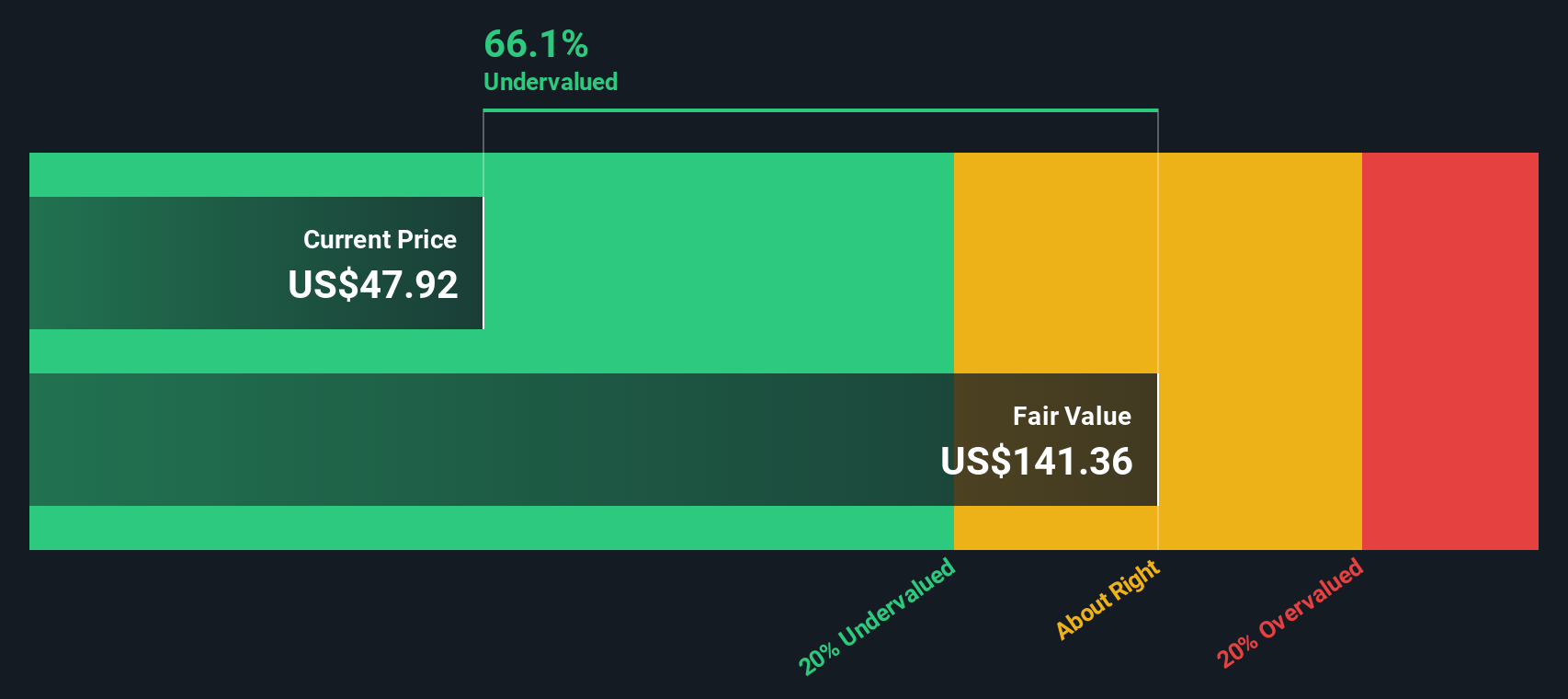

For Bristol-Myers Squibb, the current Free Cash Flow stands at $14.6 billion. Analysts provide explicit cash flow estimates for the next five years, with projections gradually trending down to $11.8 billion by 2029. After this period, future values are extrapolated using growth estimates. Simply Wall St uses a "2 Stage Free Cash Flow to Equity" model for these calculations, taking into account both analyst forecasts and longer-term trends.

Based on this model, the estimated intrinsic value of Bristol-Myers Squibb is $132.72 per share. Given that the recent share price is $43.61, the DCF model suggests the stock is trading at a substantial 67.1% discount to its intrinsic value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bristol-Myers Squibb is undervalued by 67.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Bristol-Myers Squibb Price vs Earnings

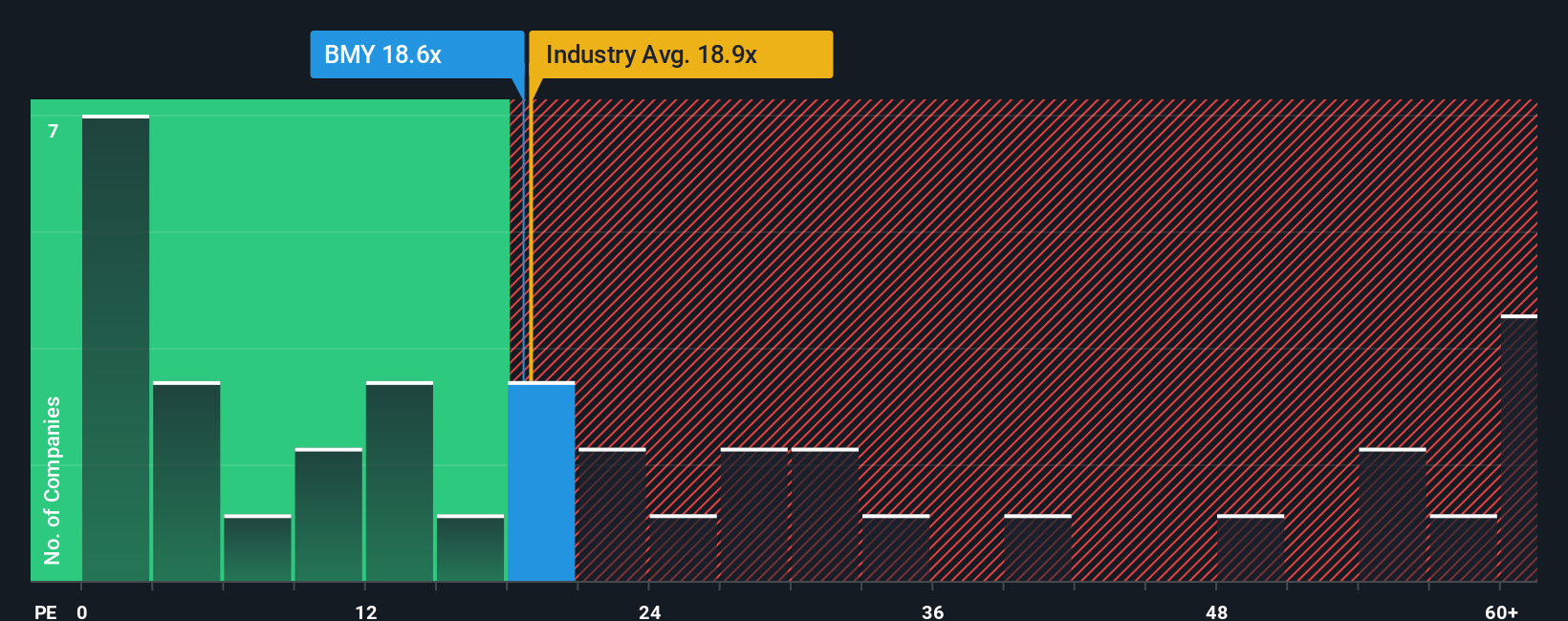

For profitable companies like Bristol-Myers Squibb, the Price-to-Earnings (PE) ratio is a widely accepted way of assessing value because it boils a company’s stock price down to the earnings each share generates. It works especially well when comparing stable, mature firms where profits are the main focus, as is the case with large pharmaceutical companies.

It’s important to remember that a "normal" or "fair" PE ratio varies based on expectations for growth and perceived risk. Companies with stronger growth prospects typically justify higher PE ratios, while elevated risks such as patent cliffs or regulatory challenges might warrant a discount.

Currently, Bristol-Myers Squibb trades at a PE ratio of 17.58x. This is just below the pharmaceutical industry average of 18.33x and roughly in line with the average of its closest peers at 16.29x. What really stands out, however, is the Simply Wall St Fair Ratio, calculated at 22.82x. This proprietary measure goes beyond simple comparisons by weighing the company’s earnings growth outlook, profit margins, market capitalization, risk profile, and industry positioning to arrive at a truly tailored benchmark.

The Fair Ratio is more robust than industry or peer comparisons alone because it accounts for the specific mix of risk and reward that Bristol-Myers Squibb brings to the table. By layering in these factors, it gives investors a more nuanced, big-picture sense of what the multiple should be for this particular company, not just the average competitor.

With Bristol-Myers Squibb’s actual PE at 17.58x and its Fair Ratio at 22.82x, the stock screens as undervalued on this basis, suggesting investors may be getting more earnings for their money than the broader market expects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bristol-Myers Squibb Narrative

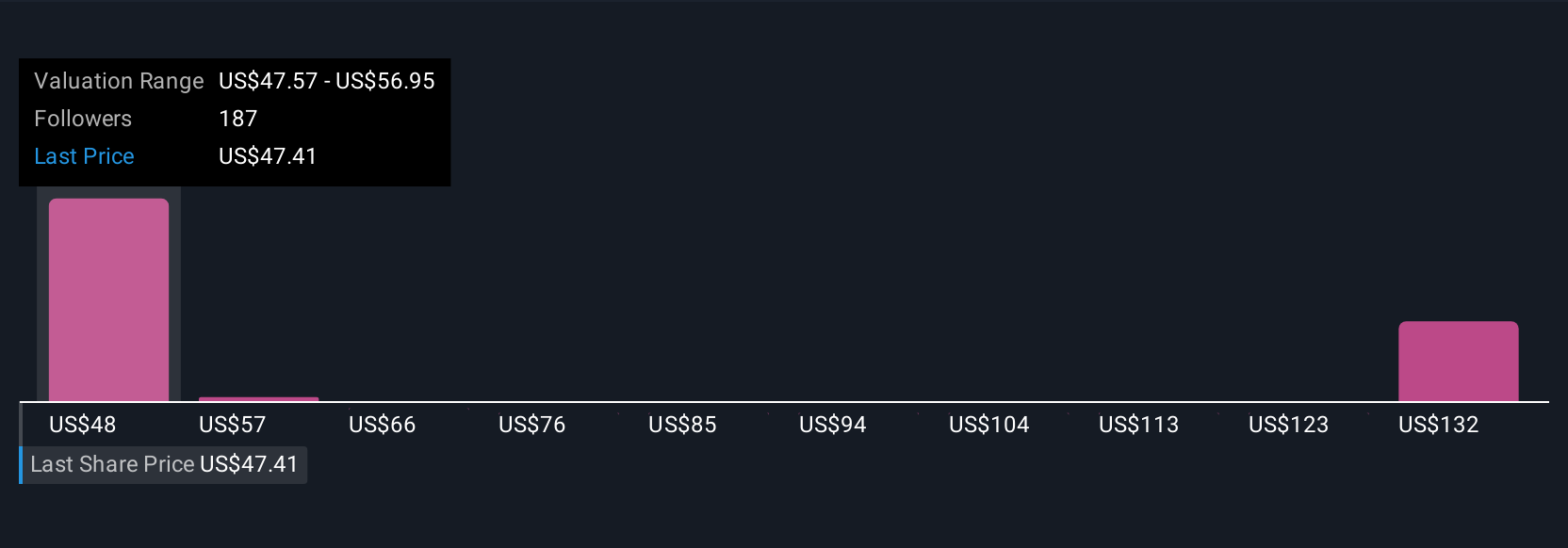

Earlier we mentioned that there’s an even better way to understand a stock’s true value: Narratives. Narratives connect the dots between a company’s story, your unique perspective on its prospects, and the numbers that drive financial forecasts and fair value estimates. Instead of treating investing as just a numbers game, Narratives let you take what you believe about Bristol-Myers Squibb's product pipeline, management, industry trends, and growth potential, and translate those beliefs into a concrete, share-price view.

Narratives are quick, intuitive, and accessible tools built into the Simply Wall St platform’s Community page, trusted by millions of investors worldwide. They help you put your specifics, like future revenue, earnings, or margin assumptions, into a model and instantly see what fair value you think the stock deserves. When new information, such as news or earnings, becomes available, Narratives update automatically, helping you reassess whether BMY’s current share price offers opportunity or risk. For example, one investor, optimistic about cost-cutting and new products, might set a fair value at $68 per share, while a more cautious peer concerned about patent cliffs and slowing growth might see just $34 as justified. Narratives make your decision-making dynamic, personal, and based on what matters most to you.

Do you think there's more to the story for Bristol-Myers Squibb? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bristol-Myers Squibb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BMY

Bristol-Myers Squibb

Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, markets, distributes, and sells biopharmaceutical products worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives