- United States

- /

- Pharma

- /

- NYSE:BMY

Bristol-Myers Squibb (NYSE:BMY) Showcases Breakthrough Oncology Data at ASCO 2025 Meeting

Reviewed by Simply Wall St

Bristol-Myers Squibb (NYSE:BMY) is advancing in oncology, as evidenced by its upcoming presentations at the 2025 ASCO Annual Meeting, which highlight its strong focus on cancer treatments. This coincided with a 2.66% rise in its share price last week. The company's progress included new data from several studies on its oncology portfolio, which could attract investor interest despite broader market declines driven by global trade tensions and tech sector losses. While the market overall fell by 1.4%, BMY's modest gain suggests that its recent product developments may have provided a counterbalance to the prevailing market trends.

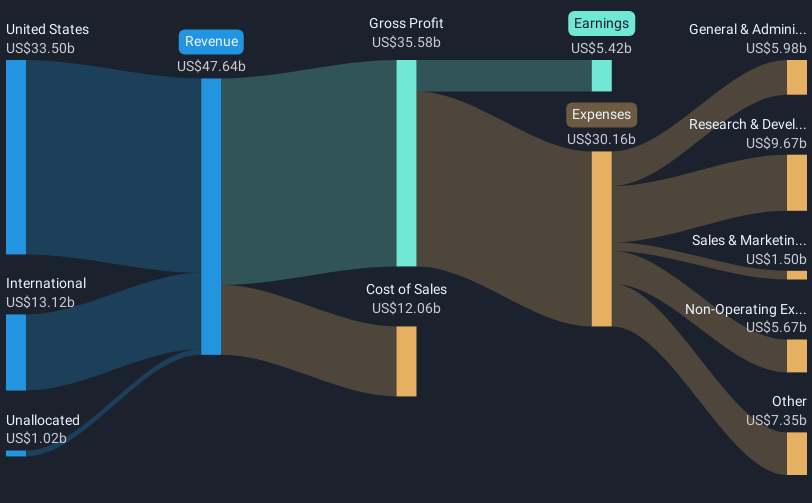

The recent developments from Bristol-Myers Squibb in oncology could significantly affect both the company's narrative and its future revenue and earnings forecasts. With ongoing presentations at the 2025 ASCO Annual Meeting, the focus on cancer treatment advancements suggests a solid foundation for potential growth. As R&D efforts intensify, revenue streams might benefit, especially with promising new indications like those for Cobenfy in Alzheimer's disease. However, operational efficiency efforts are imperative, given the mixed analyst expectations on revenue, which forecast a 4.2% annual decrease over the next three years.

Over the past year, Bristol-Myers Squibb's total shareholder return was 18.78%, indicating a positive performance trajectory within that timeframe. However, when viewed against the broader US Pharmaceuticals industry decline of 12.1% and the overall market's return of 10.5%, BMY's performance stands out. This underlines the market's recognition of its potential in overcoming broader economic challenges, particularly as the market experienced a 1.4% decline during the recent week.

Despite these gains, the current share price of US$47.57 lags behind the analyst consensus price target of US$57.2, representing a potential upside of 16.8%. Such a discrepancy could suggest an opportunity if the anticipated advancements materialize in revenue and earnings growth. Analysts project earnings to reach US$9.8 billion by 2028, necessitating a leverage of strategic growth initiatives to align with this forecast. Thus, current share movements should be viewed as part of longer-term strategic planning, with an eye on how ongoing R&D achievements can drive future valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bristol-Myers Squibb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BMY

Bristol-Myers Squibb

Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, markets, distributes, and sells biopharmaceutical products worldwide.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives