- United States

- /

- Pharma

- /

- NYSE:BMY

Bristol-Myers Squibb (NYSE:BMY) Gets EC Nod For Breyanzi In NHL Treatment

Reviewed by Simply Wall St

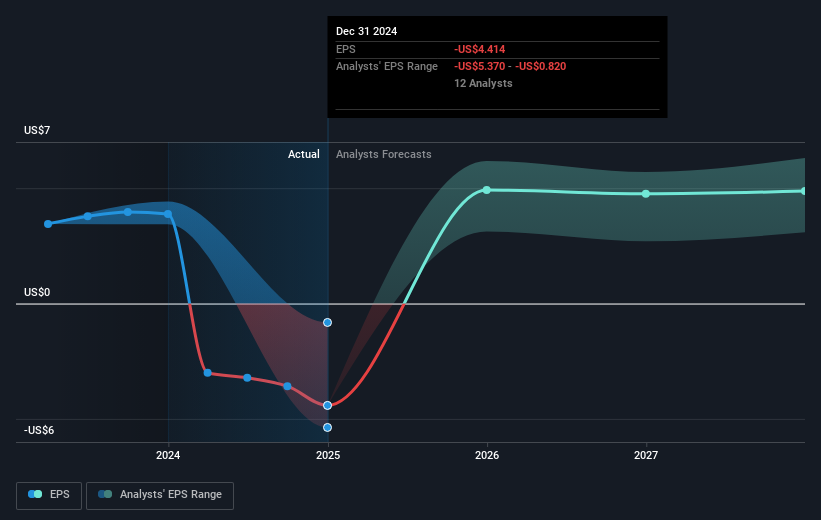

Bristol-Myers Squibb (NYSE:BMY) recently gained European Commission approval for Breyanzi, broadening treatment options for indolent non-Hodgkin lymphoma, which was a significant recent event. During the last quarter, the company's stock rose by 8%, amid a backdrop of several key events and broader market trends. Positive results from the Phase 3 POETYK PsA-2 trial for Sotyktu and a substantial share buyback program may have bolstered investor confidence. Additionally, a quarterly dividend declaration continued to assure income-oriented investors. On a broader scale, market activity demonstrated volatility; however, the technology sector experienced a rally, and the Dow Jones Industrial Average rebounded, signaling a partial market recovery following a correction phase. These factors contributed to Bristol-Myers Squibb's share performance, as the company navigated a challenging but promising landscape with strategic product approvals and shareholder-focused actions.

Over the past five years, Bristol-Myers Squibb experienced a total return of 47.98%, reflecting both share price appreciation and dividends. This period saw the company advance significantly in product innovation, notably with the approval of Opdivo combinations for multiple cancers, contributing to its market persistence. Key collaborations, such as with Intensity Therapeutics for oncology research, expanded its therapeutic pipeline. Despite challenges tied to unprofitability and increased debt, Bristol-Myers Squibb successfully navigated the pharmaceutical landscape, outperforming the US Pharmaceuticals industry, which saw a 0.8% decline over the last year.

Noteworthy financial maneuvers included a substantial increase in share buyback authorizations, reflecting a commitment to enhancing shareholder value. As Bristol-Myers Squibb adapted by reinforcing clinical trial successes and expanding its portfolio through partnerships, it demonstrated a focused approach in maximizing shareholder returns and remaining competitive, even amid broader industry shifts. This multifaceted approach has helped bolster investor confidence and maintain a strong market position in recent years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bristol-Myers Squibb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BMY

Bristol-Myers Squibb

Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, markets, distributes, and sells biopharmaceutical products worldwide.

Undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives