- United States

- /

- Pharma

- /

- NYSE:BMY

Bristol Myers Squibb (BMY) Is Up 5.1% After Expanded Breyanzi MZL Approval Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- In early December 2025, Bristol Myers Squibb received U.S. FDA approval for Breyanzi (lisocabtagene maraleucel), a one-time CD19-directed CAR T cell therapy, to treat adults with relapsed or refractory marginal zone lymphoma after at least two prior systemic therapies.

- This indication meaningfully broadens Breyanzi’s eligible U.S. patient pool and reinforces BMS’s position in commercial cell therapy despite the therapy’s complex safety profile.

- We’ll now examine how this expanded Breyanzi indication, and its implications for BMS’s cell therapy franchise, may influence the existing investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Bristol-Myers Squibb Investment Narrative Recap

To own Bristol Myers Squibb, you need to believe its newer therapies can offset looming patent cliffs on blockbusters like Eliquis and Opdivo, while maintaining solid cash generation and dividends. The new U.S. Breyanzi approval in marginal zone lymphoma supports that replacement story by broadening the cell therapy franchise, but it does not change the fact that near term execution on key launches and trial readouts, particularly Cobenfy in Alzheimer’s psychosis, still looks like the most important catalyst and the largest source of downside risk if results disappoint.

Among recent announcements, the European Commission’s expanded approval of Breyanzi in mantle cell lymphoma ties in most directly with the latest U.S. label expansion, together reinforcing Bristol Myers Squibb’s push to scale its commercial cell therapy footprint. These back to back approvals matter for the broader thesis that newer oncology assets, including CAR T therapies, can help offset future revenue pressure from patent expiries, even as pricing reform and intensifying competition remain persistent headwinds.

Yet even as Breyanzi expands, investors should be aware that Bristol Myers Squibb still faces concentrated exposure to a small group of...

Read the full narrative on Bristol-Myers Squibb (it's free!)

Bristol-Myers Squibb's narrative projects $41.3 billion revenue and $9.2 billion earnings by 2028. This requires a 4.7% yearly revenue decline and about a $4.2 billion earnings increase from $5.0 billion today.

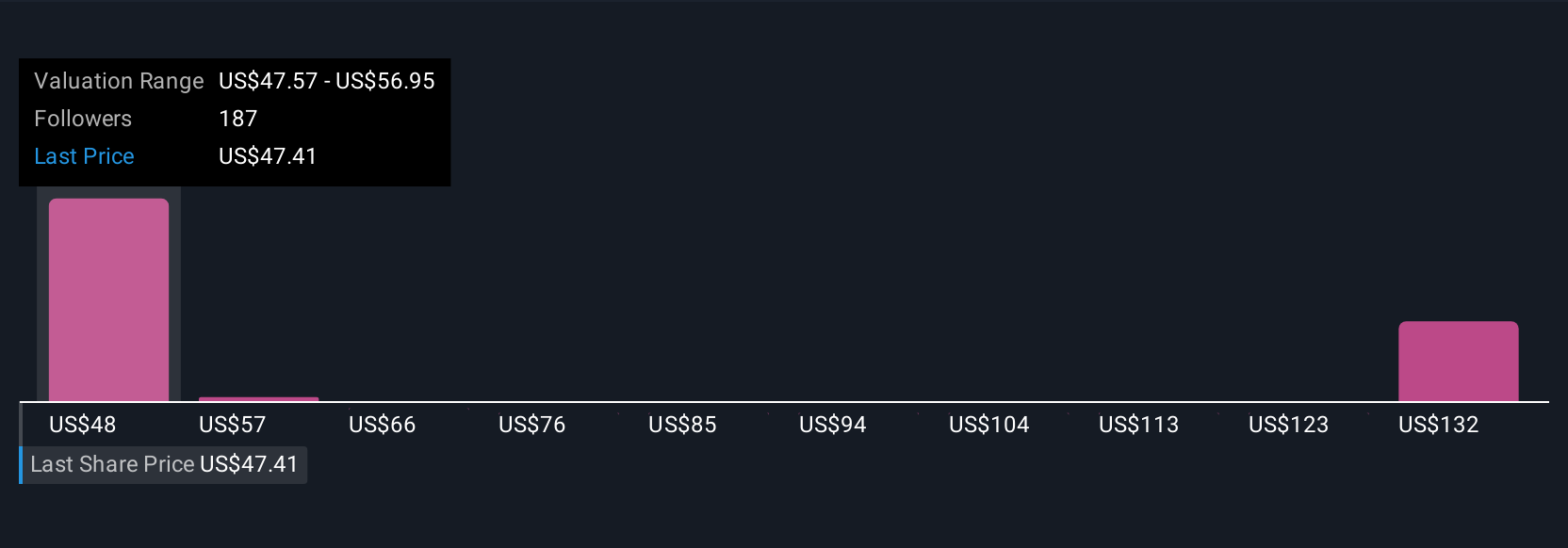

Uncover how Bristol-Myers Squibb's forecasts yield a $53.00 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Eleven fair value estimates from the Simply Wall St Community span roughly US$50 to US$118 per share, underlining just how far apart individual views can be. Against that backdrop, the belief that newer launches such as Breyanzi, Cobenfy and Camzyos can meaningfully offset major patent cliffs on Eliquis and Opdivo will likely be central to how you interpret these very different valuation anchors and what they could mean for Bristol Myers Squibb’s future earnings power.

Explore 11 other fair value estimates on Bristol-Myers Squibb - why the stock might be worth over 2x more than the current price!

Build Your Own Bristol-Myers Squibb Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bristol-Myers Squibb research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bristol-Myers Squibb research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bristol-Myers Squibb's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bristol-Myers Squibb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BMY

Bristol-Myers Squibb

Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, markets, distributes, and sells biopharmaceutical products worldwide.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)