- United States

- /

- Pharma

- /

- NYSE:BHC

Investors Don't See Light At End Of Bausch Health Companies Inc.'s (NYSE:BHC) Tunnel And Push Stock Down 28%

The Bausch Health Companies Inc. (NYSE:BHC) share price has fared very poorly over the last month, falling by a substantial 28%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 41% share price drop.

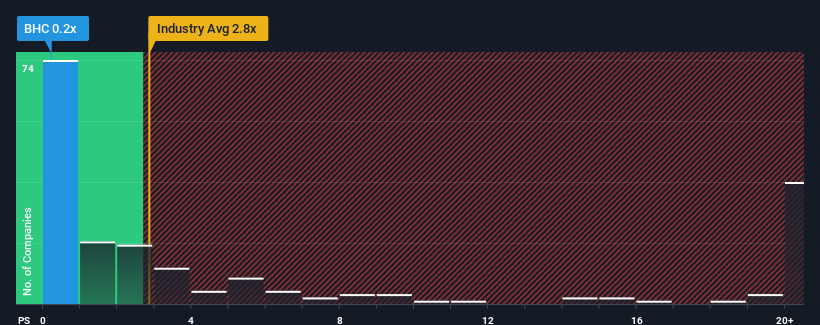

Following the heavy fall in price, Bausch Health Companies' price-to-sales (or "P/S") ratio of 0.2x might make it look like a strong buy right now compared to the wider Pharmaceuticals industry in the United States, where around half of the companies have P/S ratios above 2.8x and even P/S above 10x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Bausch Health Companies

How Bausch Health Companies Has Been Performing

Bausch Health Companies could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Bausch Health Companies will help you uncover what's on the horizon.How Is Bausch Health Companies' Revenue Growth Trending?

In order to justify its P/S ratio, Bausch Health Companies would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a decent 10% gain to the company's revenues. The latest three year period has also seen a 8.5% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 3.7% each year as estimated by the eight analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 19% per year, which is noticeably more attractive.

In light of this, it's understandable that Bausch Health Companies' P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Shares in Bausch Health Companies have plummeted and its P/S has followed suit. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Bausch Health Companies' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Bausch Health Companies, and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Bausch Health Companies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bausch Health Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHC

Bausch Health Companies

Operates as a diversified specialty pharmaceutical and medical device company, develops, manufactures, and markets a range of products primarily in gastroenterology, hepatology, neurology, dermatology, generic pharmaceuticals, over-the-counter (OTC) products, aesthetic medical devices, and eye health in the United States and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives