- United States

- /

- Pharma

- /

- NYSE:BHC

Bausch Health Companies (NYSE:BHC): Valuation Insights After Paulson Capital's Premium Block Buy and Restructuring Moves

Reviewed by Kshitija Bhandaru

If you have been watching Bausch Health Companies (NYSE:BHC), the recent shakeup involving Paulson Capital snapping up Icahn Group’s massive share block at nearly 20% above the market price probably caught your eye. This move, coming at a tense moment for Bausch due to its heavy debt and looming patent cliffs, hints at high-stakes changes behind the scenes. Investors are now weighing what asset sales or restructuring efforts might mean for both the company’s balance sheet and future prospects.

These moves follow a rocky performance for BHC’s shares over the past year, with returns dropping roughly 16% in that time and contributing to a broader five-year slide. Still, the past three months have delivered a rare 9% gain, showing momentum may be shifting as speculation mounts around possible strategies to cut debt, including the potential sale of the Bausch + Lomb stake. For investors, the story is suddenly less about past troubles and more about what could be unlocked going forward.

With this premium share deal and renewed focus on restructuring, investors may be considering whether Bausch Health is seriously undervalued or if markets are simply pricing in the chance of a turnaround.

Most Popular Narrative: 5% Undervalued

According to the most widely followed narrative, Bausch Health Companies is currently seen as about 5% undervalued, reflecting optimism tempered by the company's risks and catalysts.

Bausch's initiatives to expand in gastroenterology and hepatology, notably through the acquisition of DURECT and ongoing late-stage pipeline development (for example, SSD rifaximin Phase III), position the company to capitalize on rising chronic disease rates and aging populations. This could potentially drive future revenue growth. International diversification, with sustained double-digit growth in regions like EMEA and Canada and new product launches in Latin America and Poland, enables Bausch to benefit from expanding healthcare access in emerging markets. This supports long-term topline growth and reduces geographic concentration risk.

What exactly is fueling this bullish view? The fair value calculation relies on bold growth projections, margin improvements, and a forward-looking profit multiple drawn from industry comparisons. Which of these moving parts has the greatest impact on Bausch’s valuation? Find out what is really driving that price target and see the numbers that could reshape your outlook on BHC.

Result: Fair Value of $7.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, looming drug price reforms and heavy debt loads could quickly turn optimism into caution if earnings or product sales fall short of expectations.

Find out about the key risks to this Bausch Health Companies narrative.Another View: Multiples Paint a Cautious Picture

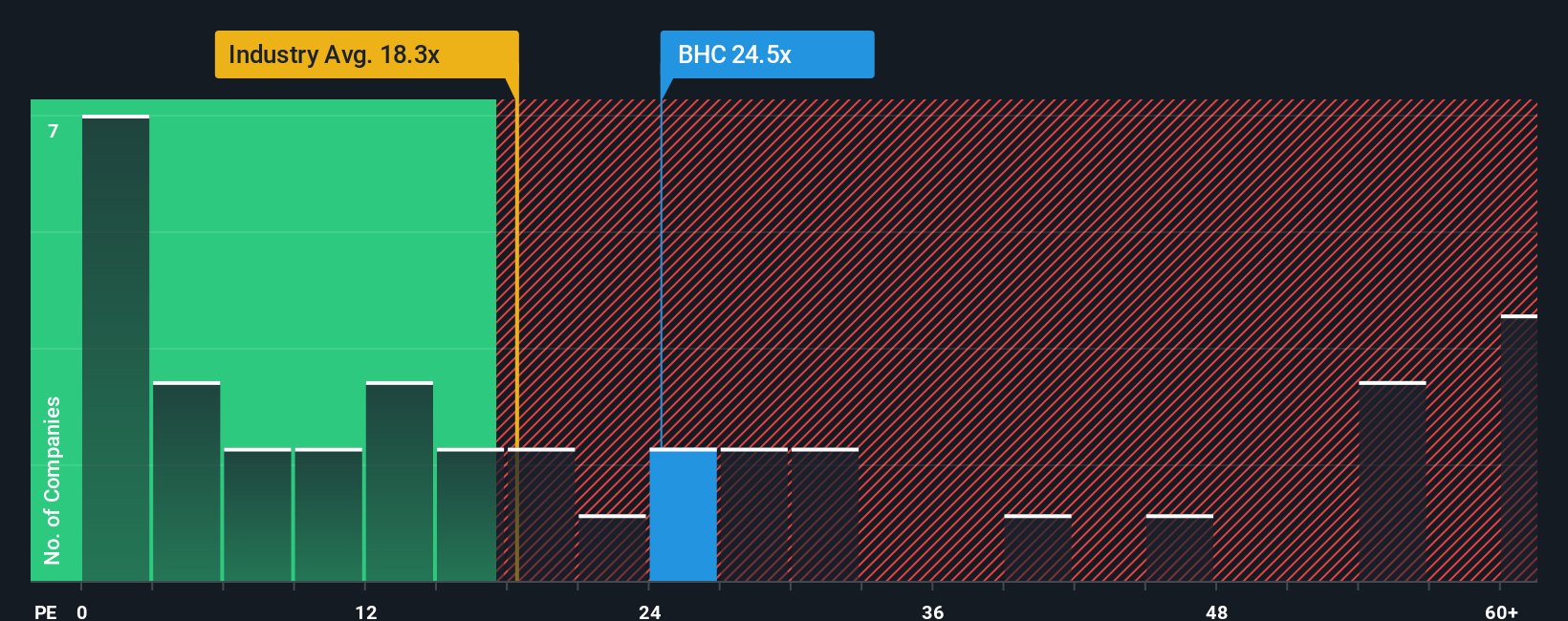

While analysts find Bausch Health comparatively undervalued based on future outlook, a different approach, using the standard price-to-earnings measure, suggests the stock is actually trading at a premium versus industry norms. Is the market pricing in risks, or expecting a rebound that fundamental numbers do not yet show?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Bausch Health Companies to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Bausch Health Companies Narrative

If you see things differently or want to dig deeper into the numbers, you can craft your own perspective quickly and easily. Do it your way.

A great starting point for your Bausch Health Companies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Tap into fresh market insights with powerful tools designed to pinpoint tomorrow’s winners before the crowd.

- Pounce on hidden opportunities by tracking undervalued stocks based on cash flows that stand out as prime value picks with strong cash flow fundamentals.

- Unleash your portfolio’s growth potential by targeting AI penny stocks making waves in artificial intelligence and shaping whole sectors.

- Power up your passive income strategy with dividend stocks with yields > 3% offering reliable yields above 3% to strengthen your earnings stream.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bausch Health Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHC

Bausch Health Companies

Operates as a diversified specialty pharmaceutical and medical device company, develops, manufactures, and markets a range of products primarily in gastroenterology, hepatology, neurology, dermatology, generic pharmaceuticals, over-the-counter (OTC) products, aesthetic medical devices, and eye health in the United States and internationally.

Fair value with limited growth.

Similar Companies

Market Insights

Community Narratives