- United States

- /

- Life Sciences

- /

- NYSE:AVTR

Is Avantor's (AVTR) Board Appointment of Gregory Lucier Shaping a New Growth Trajectory?

Reviewed by Sasha Jovanovic

- Avantor, Inc. recently appointed Gregory T. Lucier to its Board of Directors, effective October 3, 2025, bringing with him decades of leadership across major healthcare and life sciences firms including Corza Medical, NuVasive, and Life Technologies.

- Lucier's extensive mergers and acquisitions experience and success in scaling global operations may signal new growth and transformation potential for Avantor.

- We'll explore how Lucier's addition to the Board could influence Avantor's future direction and long-term earnings outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Avantor Investment Narrative Recap

Avantor’s investment story centers on benefiting from global biopharmaceutical demand, ongoing cost transformation, and digital innovation, while managing ongoing revenue and margin pressures from competitive dynamics and soft industry funding. The recent appointment of Gregory T. Lucier adds depth to the board’s experience but does not materially alter the most immediate catalysts, such as bioprocessing recovery and revenue guidance, or near-term risks like margin compression from contract pricing and rebates.

Among recent announcements, the July 2025 CEO transition stands out, as the direction set by new management may have more direct impact on executing growth initiatives and offsetting pressures in core business lines. Lucier’s expertise could, over the longer term, complement these leadership changes as Avantor works to stabilize earnings and reclaim momentum in challenging end markets.

In contrast, investors should also be aware of the ongoing margin pressures tied to aggressive pricing and rebate strategies...

Read the full narrative on Avantor (it's free!)

Avantor's narrative projects $7.2 billion in revenue and $461.3 million in earnings by 2028. This requires 2.5% yearly revenue growth and a $226.1 million decrease in earnings from $687.4 million today.

Uncover how Avantor's forecasts yield a $14.12 fair value, a 5% upside to its current price.

Exploring Other Perspectives

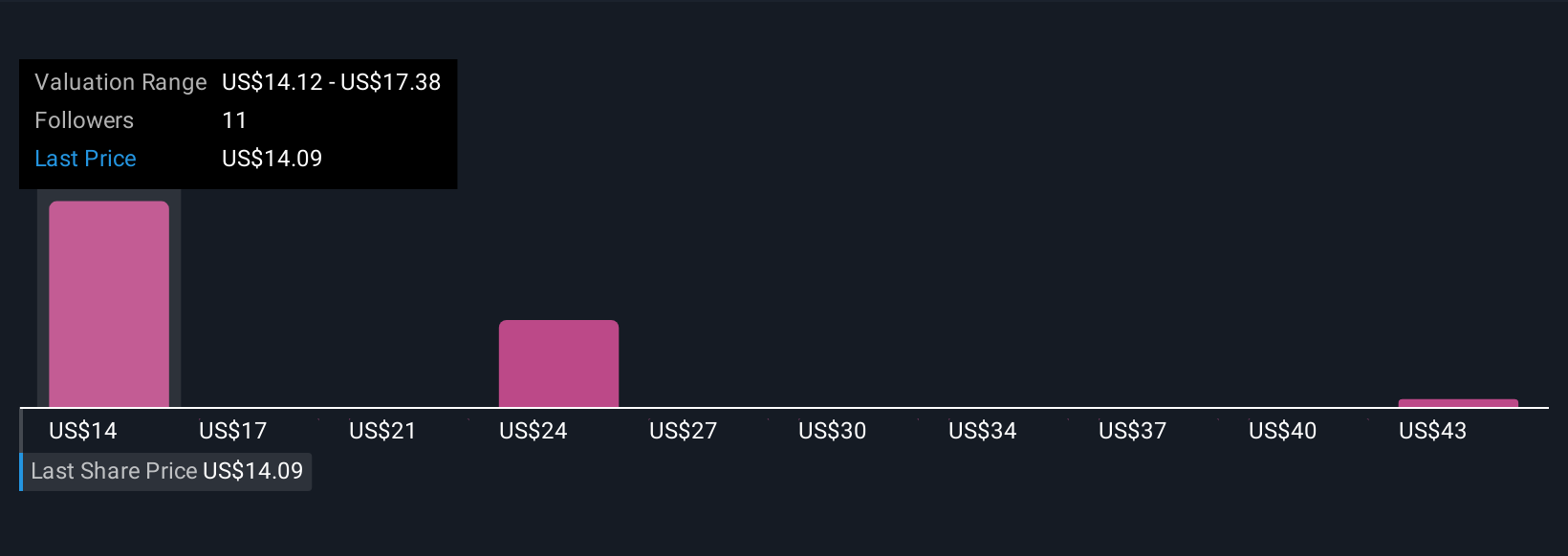

Three community members estimate Avantor’s fair value between US$14.12 and US$46.76, reflecting wide-ranging outlooks within the Simply Wall St Community. While opinions vary sharply, persistent margin challenges may be top of mind as you consider these diverse analyses.

Explore 3 other fair value estimates on Avantor - why the stock might be worth over 3x more than the current price!

Build Your Own Avantor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avantor research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Avantor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avantor's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AVTR

Avantor

Engages in the provision of mission-critical products and services to customers in the biopharma, healthcare, education and government, advanced technologies, and applied materials industries in the Americas, Europe, Asia, the Middle East, and Africa.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives