- United States

- /

- Pharma

- /

- NasdaqGS:AMRX

These 4 Measures Indicate That Amneal Pharmaceuticals (NYSE:AMRX) Is Using Debt Extensively

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Amneal Pharmaceuticals, Inc. (NYSE:AMRX) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Amneal Pharmaceuticals

What Is Amneal Pharmaceuticals's Debt?

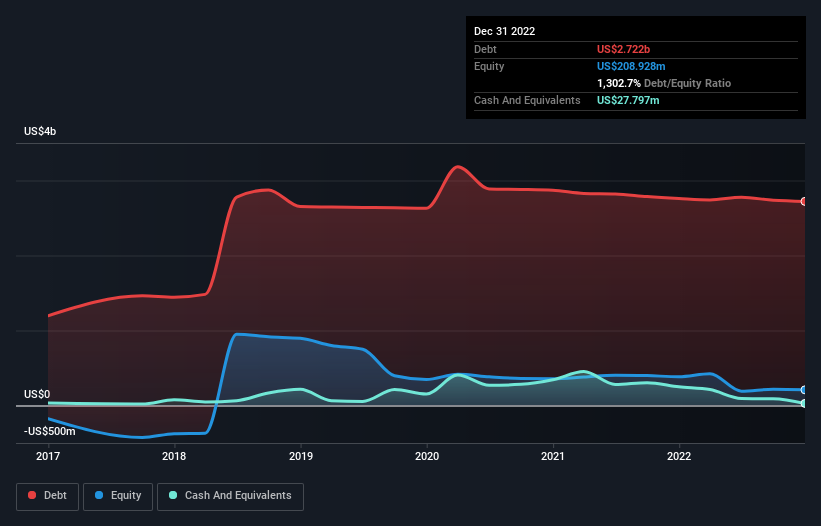

The chart below, which you can click on for greater detail, shows that Amneal Pharmaceuticals had US$2.72b in debt in December 2022; about the same as the year before. And it doesn't have much cash, so its net debt is about the same.

A Look At Amneal Pharmaceuticals' Liabilities

Zooming in on the latest balance sheet data, we can see that Amneal Pharmaceuticals had liabilities of US$752.8m due within 12 months and liabilities of US$2.84b due beyond that. Offsetting these obligations, it had cash of US$27.8m as well as receivables valued at US$796.9m due within 12 months. So its liabilities total US$2.77b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the US$459.8m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, Amneal Pharmaceuticals would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Amneal Pharmaceuticals shareholders face the double whammy of a high net debt to EBITDA ratio (6.1), and fairly weak interest coverage, since EBIT is just 1.3 times the interest expense. The debt burden here is substantial. More concerning, Amneal Pharmaceuticals saw its EBIT drop by 7.6% in the last twelve months. If that earnings trend continues the company will face an uphill battle to pay off its debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Amneal Pharmaceuticals can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Amneal Pharmaceuticals recorded free cash flow worth a fulsome 85% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Our View

On the face of it, Amneal Pharmaceuticals's interest cover left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Overall, it seems to us that Amneal Pharmaceuticals's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 2 warning signs with Amneal Pharmaceuticals (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AMRX

Amneal Pharmaceuticals

A global biopharmaceutical company, develops, manufactures, markets, and distributes generics, injectables, biosimilars, and specialty branded pharmaceutical products worldwide.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives