- United States

- /

- IT

- /

- NasdaqGS:VNET

High Growth Tech Stocks to Watch in January 2025

Reviewed by Simply Wall St

The United States market has remained flat over the last week but is up 23% over the past year, with earnings forecast to grow by 15% annually. In this context, identifying high growth tech stocks involves looking for companies that not only capitalize on current technological trends but also demonstrate strong potential for sustained revenue and earnings growth in a dynamic market environment.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.36% | 24.28% | ★★★★★★ |

| Ardelyx | 21.46% | 54.72% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| TG Therapeutics | 29.87% | 43.91% | ★★★★★★ |

| Bitdeer Technologies Group | 50.44% | 122.48% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.37% | 56.70% | ★★★★★★ |

| Blueprint Medicines | 23.25% | 55.27% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.13% | ★★★★★★ |

Click here to see the full list of 229 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Intuit (NasdaqGS:INTU)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Intuit Inc. is a company that offers financial management, compliance, and marketing products and services primarily in the United States, with a market capitalization of $167.38 billion.

Operations: Intuit generates revenue through four main segments: Pro-Tax ($596 million), Consumer ($4.43 billion), Credit Karma ($1.83 billion), and Global Business Solutions ($9.73 billion). The company focuses on financial management, compliance, and marketing services within these areas in the U.S.

Intuit, a major player in the financial software sector, continues to innovate and expand its market presence with strategic partnerships and product enhancements. Recently, Intuit's ProConnect Tax was integrated into SmartVault's suite, enhancing document management for tax professionals. This move follows a pattern of aggressive expansion and innovation aimed at consolidating its position in the competitive tax preparation market. Additionally, Intuit has introduced a groundbreaking fast refund service through TurboTax that promises federal tax refunds five days early—a significant development given that for many consumers, the annual tax refund is their largest paycheck of the year. These initiatives are part of Intuit's broader strategy to leverage technology to improve customer experience and retention rates significantly. With an 11.3% forecasted annual revenue growth rate and an impressive 17.3% expected earnings growth rate per annum, Intuit is strategically positioning itself as not just a software company but as an essential financial service provider in the digital age.

VNET Group (NasdaqGS:VNET)

Simply Wall St Growth Rating: ★★★★☆☆

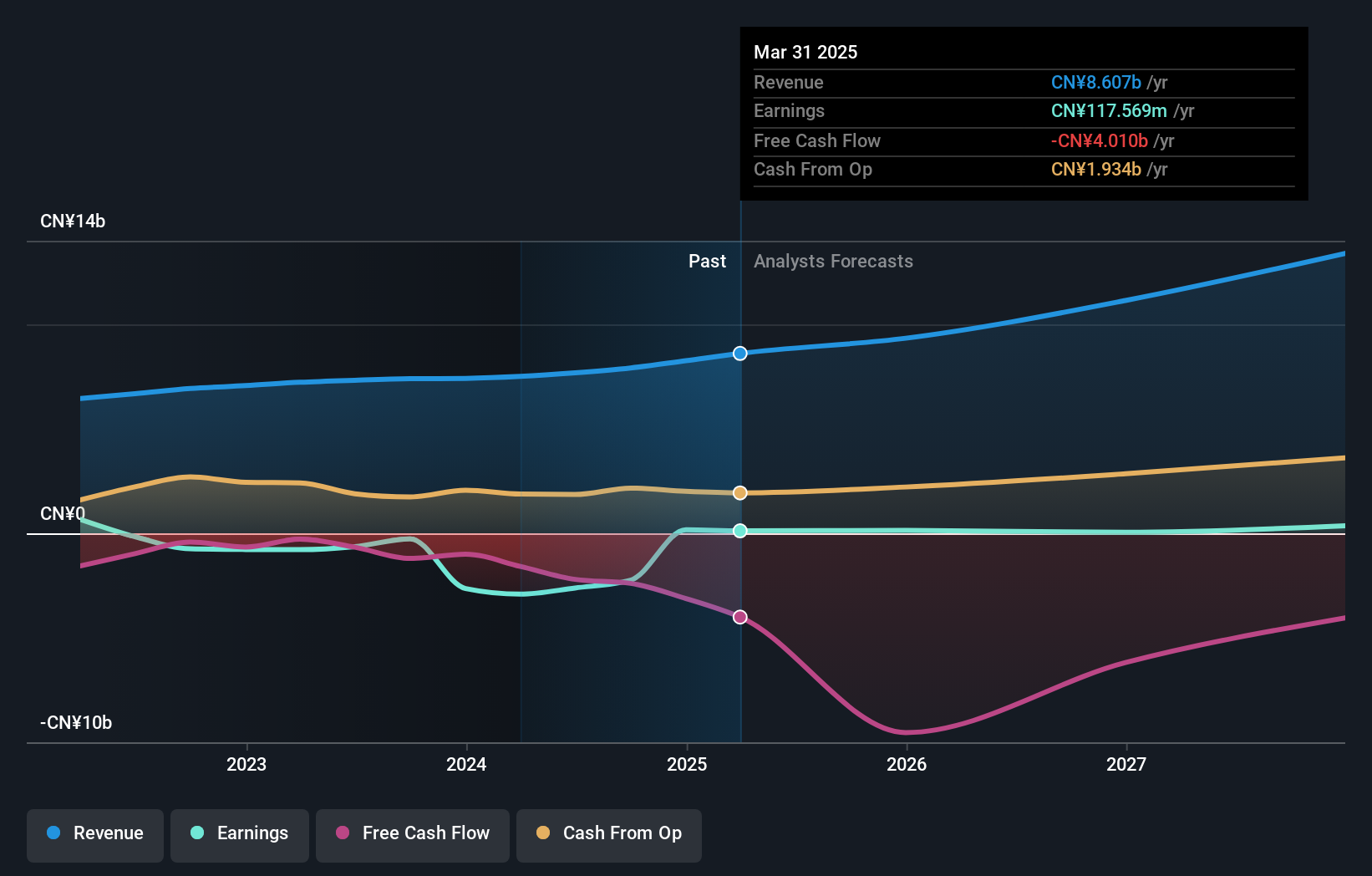

Overview: VNET Group, Inc. is an investment holding company that offers hosting and related services in China with a market capitalization of approximately $1.87 billion.

Operations: The company generates revenue primarily from hosting and related services, totaling CN¥7.91 billion.

VNET Group, amid a dynamic tech landscape, is steering towards profitability with strategic alliances like the recent joint venture to invest in hyperscale data centers in China. This move not only capitalizes on the growing infrastructure demands but also enhances VNET's service capabilities in a key market. The company's revenue growth at 9.7% annually outpaces the US market average, and its transition to profitability within three years underscores its potential resilience and growth trajectory in a competitive sector. Moreover, VNET's significant R&D commitment aligns with its expansion strategy, ensuring continuous innovation and improved offerings to meet evolving customer needs effectively.

- Click here to discover the nuances of VNET Group with our detailed analytical health report.

Evaluate VNET Group's historical performance by accessing our past performance report.

AbbVie (NYSE:ABBV)

Simply Wall St Growth Rating: ★★★★☆☆

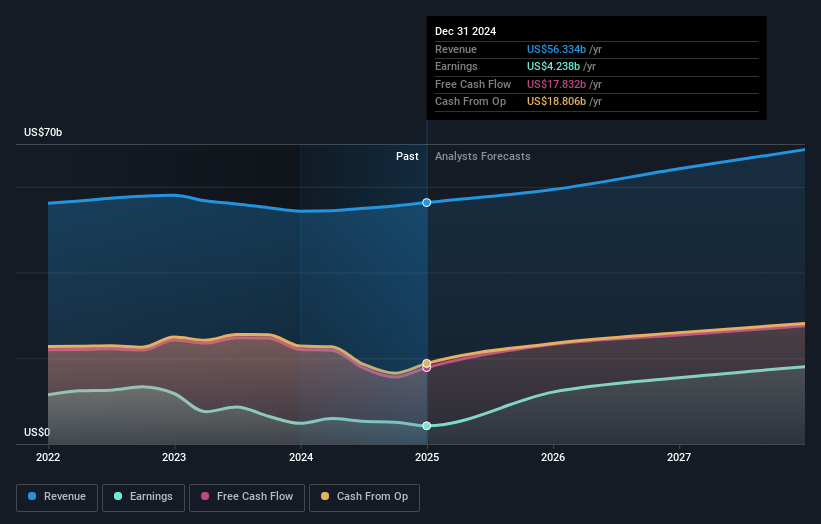

Overview: AbbVie Inc. is a global pharmaceutical company involved in the discovery, development, manufacturing, and sale of pharmaceuticals with a market capitalization of $300.94 billion.

Operations: AbbVie's primary revenue stream is from its Innovative Medicines and Therapies segment, generating $55.53 billion.

AbbVie, amidst evolving biotech landscapes, is enhancing its oncology portfolio through strategic alliances like the expanded collaboration with AbCellera for T-cell engager discovery. This partnership leverages AbbVie's robust R&D framework which has consistently allocated significant resources to innovation—evidenced by a recent R&D expense of $6.2 billion, representing 16.4% of its revenue. Additionally, the company's focus on high-stakes areas such as oncology and neuroscience is underscored by promising clinical advancements in treatments like ABBV-RGX-314 for retinal diseases and epcoritamab for lymphoma, positioning it well within competitive sectors despite a challenging growth rate projection (5.9% annually). These initiatives not only highlight AbbVie’s commitment to addressing complex medical needs but also strengthen its market position through scientific breakthroughs and strategic collaborations.

- Dive into the specifics of AbbVie here with our thorough health report.

Explore historical data to track AbbVie's performance over time in our Past section.

Seize The Opportunity

- Investigate our full lineup of 229 US High Growth Tech and AI Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VNET

VNET Group

An investment holding company, provides hosting and related services in China.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives