- United States

- /

- Biotech

- /

- NYSE:ABBV

AbbVie (ABBV) Declares US$1.64 Quarterly Dividend for Shareholders

Reviewed by Simply Wall St

AbbVie (ABBV) recently affirmed a quarterly dividend of $1.64 per share, adding stability for shareholders amid a 12% quarterly price gain. Despite some company challenges, such as lower net income in Q2, the strong dividend outlook, positive trial results, and an increased revenue projection added momentum to AbbVie's stock performance. Additionally, the U.S. labor market's struggles have fueled expectations for Federal Reserve rate cuts, pushing Treasury yields lower. These market dynamics likely supported broad stock gains, within which AbbVie's movements aligned, further reinforced by its strong dividend and strategic product updates.

Find companies with promising cash flow potential yet trading below their fair value.

The recent developments at AbbVie, including the dividend affirmation and promising trial results, contribute to the company's robust performance narrative. These positive updates suggest steadiness in revenue growth, particularly as the company's strategic focus on immunology and neuroscience addresses the shifting landscape in global healthcare needs. As AbbVie navigates challenges like decreased net income in Q2, such strategic progress supports its growth trajectory amidst intense competition, regulatory changes, and evolving demand.

Over the past five years, AbbVie's shares have delivered remarkable total returns of 189.81%, indicating substantial long-term value for investors. However, when looking at the shorter-term horizon, the company underperformed the broader US market's 21.6% return over the past year. The company's performance exceeds the US Biotech industry's return of 2.9% decline, illustrating its competitive positioning amidst broader market fluctuations.

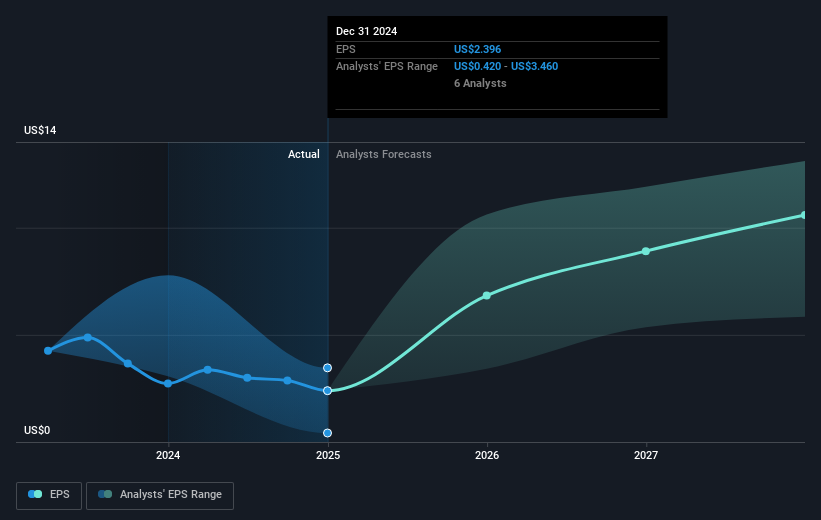

As for future expectations, analysts estimate that revenue and earnings will follow an upward trend, supported by anticipated increases in product demand within neuroscience and immunology. However, these forecasts remain sensitive to external factors such as patent expirations and pricing pressures. The current share price of $212.56 is closely aligned with the consensus price target of $216.48, reflecting a 2.1% discount. This suggests that analysts collectively see AbbVie's shares as fairly valued, with potential for modest price appreciation based on anticipated growth metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABBV

AbbVie

A research-based biopharmaceutical company, engages in the research and development, manufacture, commercialization, and sale of medicines and therapies worldwide.

Medium-low risk with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives