- United States

- /

- Life Sciences

- /

- NYSE:A

Agilent Technologies (NYSE:A) Revises Full-Year Revenue Guidance, Reports Q2 Earnings and Growth

Reviewed by Simply Wall St

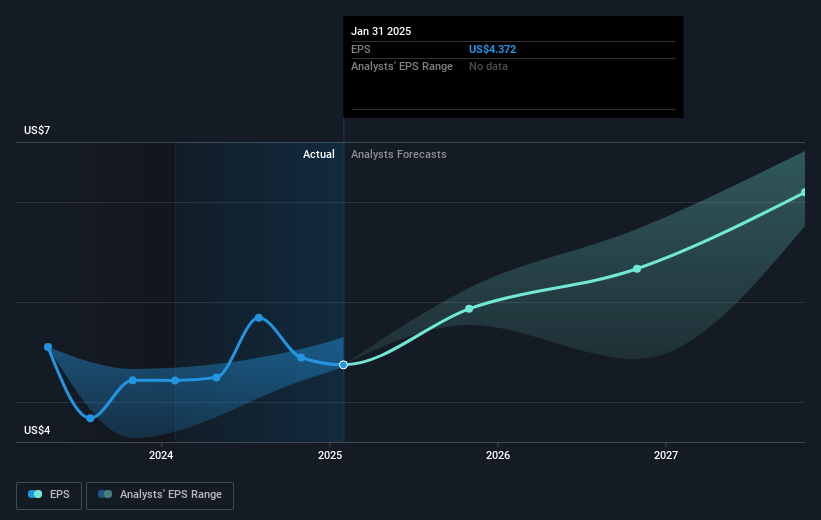

Agilent Technologies (NYSE:A) recently announced updates regarding its corporate guidance for Q3 2025 and raised its full-year earnings outlook, amidst reporting a 3.75% share price increase over the past month. Despite a decline in net income and earnings per share in Q2, the company's strong sales growth and revenue guidance adjustment likely provided support for investor sentiment. Concurrently, the broader market has been showing a mixed performance due to macroeconomic factors such as court rulings on tariffs and positive earnings reports from major tech firms like Nvidia. These mixed signals in the market may have been met with investor interest in Agilent's steady progress.

You should learn about the 1 warning sign we've spotted with Agilent Technologies.

The recent developments in Agilent Technologies provide a mixed outlook for potential investors. While the company's Q3 2025 corporate guidance updates and full-year earnings outlook revision reflect optimism, these announcements introduce volatility in revenue and earnings forecasts. The Ignite Transformation strategy, although positioned to enhance revenues and margins, faces potential currency and policy headwinds that analysts caution could affect future growth targets. The share price adjustment of 3.75% suggests investors are cautiously optimistic but aware of these underlying risks.

Over the past five years, Agilent's total shareholder return was 26.74%, showcasing modest growth compared to its one-year underperformance against the broader US market, which returned 11.5%. However, Agilent's earnings growth has outpaced the life sciences industry, which faced a substantial decline of 28.1% in the past year. This suggests resilience amidst sector challenges, particularly with advanced launches like the Infinity III series, which could bolster long-term prospects.

As of today, Agilent is trading at US$105.24, significantly below the consensus analyst target of US$140.6, indicating a 25.1% potential upside. This difference in valuation highlights investor hesitancy despite agreed-upon earnings and margin improvement expectations. Monitoring the execution of Agilent's strategic initiatives and external market influences will be crucial for assessing its path towards the price target.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:A

Agilent Technologies

Provides application focused solutions to the life sciences, diagnostics, and applied chemical markets worldwide.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives