- United States

- /

- Life Sciences

- /

- NYSE:A

Agilent Technologies (NYSE:A) Launches Eco-Friendly Infinity III Series With Green Lab Certification

Reviewed by Simply Wall St

Agilent Technologies (NYSE:A) witnessed a notable shift last month with a share price increase of 11%. This movement aligns with the broader market trends, as the introduction of Agilent’s Infinity III LC Series accentuates the company's commitment to sustainable innovation. The launch underscores enhanced laboratory efficiency, dovetailing with recent industry emphasis on eco-friendly practices. While the market generally rose due to easing tariff concerns, Agilent’s advancements in cancer research technologies and strong sustainability focus added weight to its upward trajectory. Despite fluctuations in the broader indexes, Agilent's strategic orientation towards advanced scientific solutions buoyed its performance.

Agilent Technologies’ recent unveiling of the Infinity III LC Series reflects a focus on sustainable solutions, potentially enhancing revenue streams through improved laboratory efficiency. This innovation aligns seamlessly with Agilent's broader Ignite Transformation strategy, which aims to boost growth via new pricing strategies, digital enhancements, and cost savings. Notably, the company has set a course for annual revenue increases of 5-7% and margin expansion, driven in part by collaboration with ABB Robotics on automated laboratory solutions and the successful uptake of advanced products like the Infinity LabAssist software.

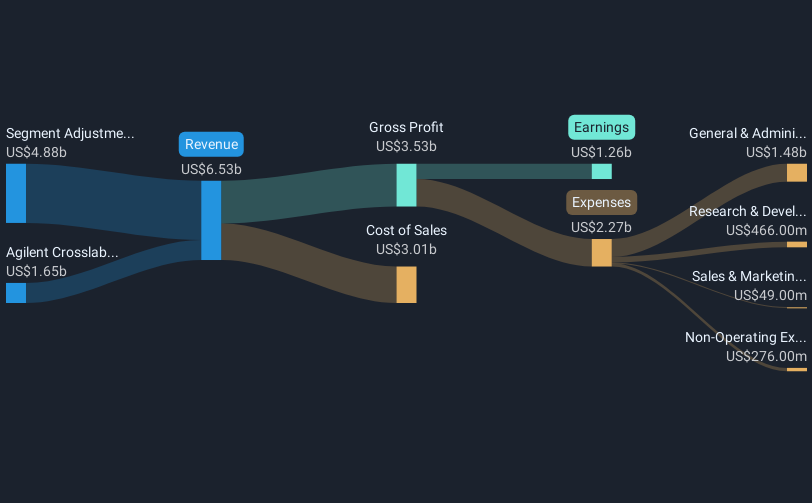

Over the past five years, Agilent's shareholders have seen a total return of 38.07%, contrasting with the company's more recent underperformance against the US Life Sciences industry over the last year, where Agilent exceeded a negative industry return of 29.5%. Analysts expect revenue and earnings to grow, with forecasts of earnings reaching US$1.7 billion by 2028, up from US$1.26 billion today. This forecast assumes a price-to-earnings ratio of 26.6x on 2028 earnings, which is lower than the current industry average.

Agilent’s shares are trading at US$105.24, which is below the consensus analyst price target of US$140.6, indicating an expected rise of about 25.1% if the forecast materializes. However, currency fluctuations, economic conditions, and governmental policy changes pose risks that could alter revenue projections. The successful execution of Agilent's transformative initiatives, combined with its leadership in fast-growing markets such as China, is critical as these elements are integral to achieving forecasted growth outcomes.

Understand Agilent Technologies' track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:A

Agilent Technologies

Provides application focused solutions to the life sciences, diagnostics, and applied chemical markets worldwide.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives