- United States

- /

- Biotech

- /

- NasdaqGS:ZYME

How Might ZYME’s Shifting Leadership Shape Its Late-Stage Oncology Ambitions?

Reviewed by Sasha Jovanovic

- Zymeworks Inc. recently appointed Dr. Adam Schayowitz, Ph.D., MBA as Acting Chief Development Officer, following the discontinuation of its ZW171 program due to unfavorable Phase 1 trial results, while its lead asset zanidatamab has received regulatory approvals in the U.S., China, and Europe for the treatment of HER2-positive biliary tract cancer.

- This sequence of executive changes and clinical development updates is drawing attention to how Zymeworks is reshaping its leadership and asset portfolio during an important period for its pipeline progression and regulatory expansion.

- We'll assess how Dr. Schayowitz's appointment as Acting CDO could influence Zymeworks' ability to deliver on its late-stage oncology ambitions.

Find companies with promising cash flow potential yet trading below their fair value.

Zymeworks Investment Narrative Recap

To own shares of Zymeworks, investors need confidence that its partnerships and late-stage oncology pipeline can translate regulatory milestones, such as approvals for zanidatamab, into sustained revenue streams, despite setbacks like the ZW171 discontinuation. The appointment of Dr. Adam Schayowitz as Acting Chief Development Officer, while noteworthy for his expertise, is not expected to materially alter the immediate impact of regulatory or commercial catalysts, with the company’s near-term fortunes still tied heavily to partner and royalty outcomes.

Among recent announcements, the discontinuation of ZW171 due to clinical challenges stands out, highlighting the risk associated with early-stage pipeline assets. This development emphasizes the importance of existing partner programs such as zanidatamab and their ability to deliver milestones or royalties, which remain the most important short-term drivers for the stock.

However, it is critical that investors know less discussed risks, like the company’s dependence on irregular milestone payments and the financial consequences if...

Read the full narrative on Zymeworks (it's free!)

Zymeworks' outlook anticipates $150.9 million in revenue and $24.2 million in earnings by 2028. This implies a 7.1% annual revenue growth rate and a $97.9 million increase in earnings from current earnings of -$73.7 million.

Uncover how Zymeworks' forecasts yield a $21.45 fair value, a 19% upside to its current price.

Exploring Other Perspectives

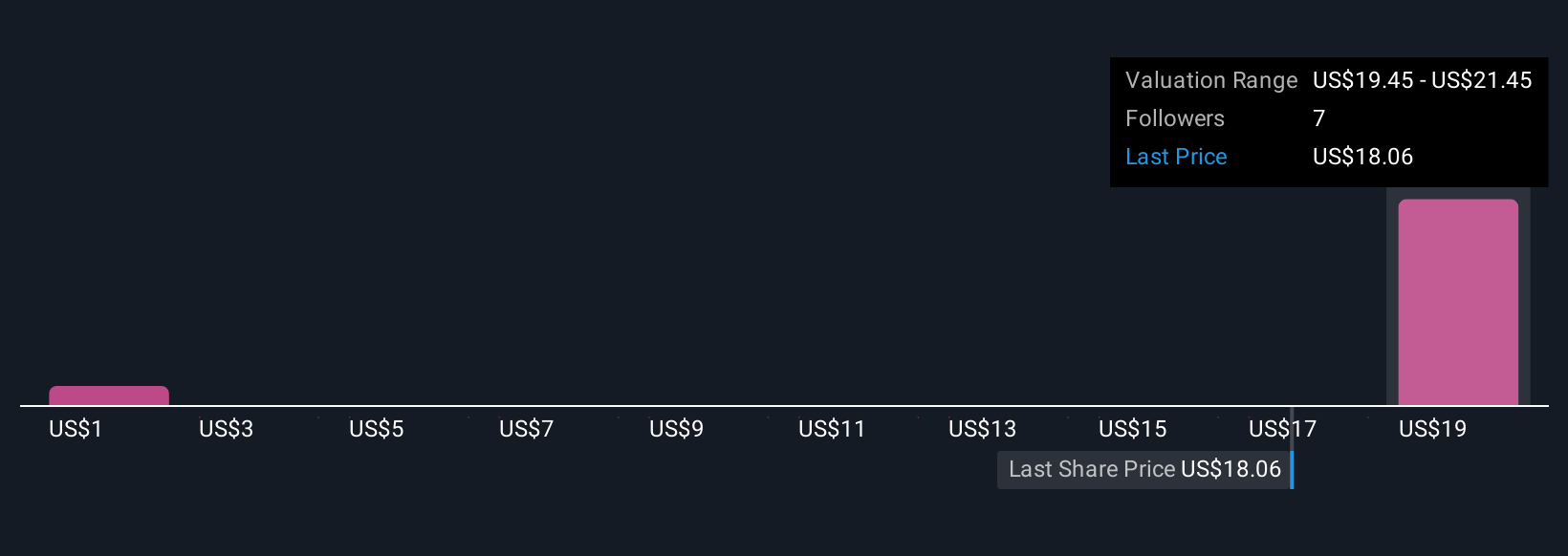

Fair value estimates from the Simply Wall St Community range widely, from US$1.43 to US$21.45 per share across two contributors. This diversity of opinion contrasts sharply with Zymeworks’ reliance on successful partner execution, reflecting a market where performance expectations, and potential outcomes, differ greatly among investors.

Explore 2 other fair value estimates on Zymeworks - why the stock might be worth less than half the current price!

Build Your Own Zymeworks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zymeworks research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Zymeworks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zymeworks' overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zymeworks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZYME

Zymeworks

A clinical-stage biotechnology company, discovers, develops, and commercializes biotherapeutics for the treatment of cancer, and autoimmune and inflammatory diseases (AIID).

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives