- United States

- /

- Pharma

- /

- NasdaqGS:ZVRA

Could Zevra Therapeutics’ (ZVRA) Insider Buying Hint at Greater Management Confidence in Growth Ahead?

Reviewed by Sasha Jovanovic

- Zevra Therapeutics recently announced it has granted a total of 38,000 stock options to two new employees as inducement awards, with vesting over four years under its 2023 Employment Inducement Award Plan.

- This move follows a period of significant insider buying and strong revenue growth, both of which are often seen as signals of management confidence and business momentum.

- We'll now consider how this combination of insider buying and continued revenue expansion may influence the company's overall investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Zevra Therapeutics Investment Narrative Recap

To believe in the Zevra Therapeutics story, investors need confidence in the company’s ability to drive robust revenue growth from rare disease therapies, while managing the commercial risks tied to product concentration and the uncertain pace of European expansion. The recent stock option grants, although reflecting industry-standard retention efforts, are not likely to alter the key near-term catalysts or address the major revenue concentration risk Zevra currently faces.

Among recent developments, the July 28, 2025, submission of a Marketing Authorization Application for arimoclomol (MIPLYFFA) in Europe stands out. This move is highly relevant for Zevra’s immediate catalysts, as successful regulatory approval could unlock new geographic revenue streams and reduce short-term reliance on a single U.S. market asset.

Yet, despite promising growth signals, investors should be aware that slow adoption and competitive pressures in the urea cycle disorder market could become a more significant headwind than anticipated if...

Read the full narrative on Zevra Therapeutics (it's free!)

Zevra Therapeutics' narrative projects $296.5 million in revenue and $151.4 million in earnings by 2028. This requires 68.5% yearly revenue growth and an increase in earnings of $155.3 million from current earnings of -$3.9 million.

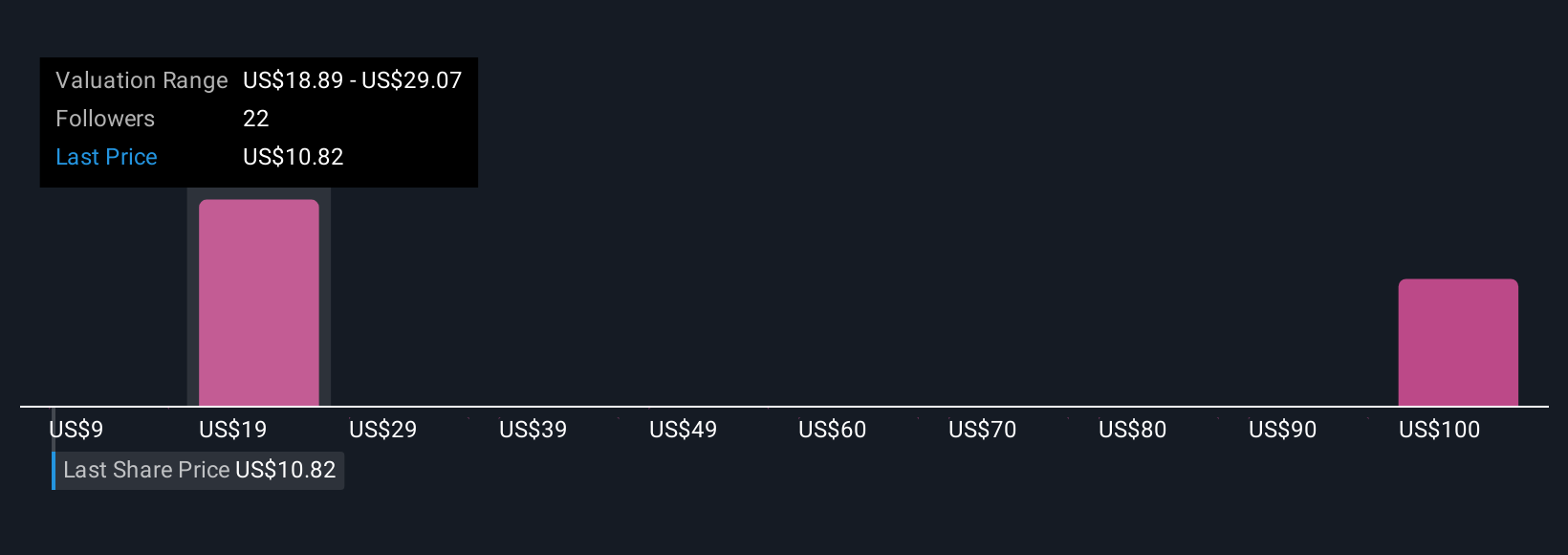

Uncover how Zevra Therapeutics' forecasts yield a $23.22 fair value, a 111% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community have shared fair value targets for Zevra, ranging from US$8.71 to US$110.52. While revenue is forecast to grow at 34.9 percent per year, differing views highlight why it’s important to consider a variety of perspectives before making any decisions.

Explore 7 other fair value estimates on Zevra Therapeutics - why the stock might be worth 21% less than the current price!

Build Your Own Zevra Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zevra Therapeutics research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Zevra Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zevra Therapeutics' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zevra Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZVRA

Zevra Therapeutics

A commercial-stage company, focuses on addressing unmet needs for the treatment of rare diseases in the United States.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives