- United States

- /

- Biotech

- /

- NasdaqGM:ZLAB

Zai Lab (NasdaqGM:ZLAB): Assessing Valuation After Hong Kong’s TIVDAK Approval and Growth Prospects in Greater China

Reviewed by Simply Wall St

If you have been watching Zai Lab (NasdaqGM:ZLAB), the latest approval from the Hong Kong Department of Health is likely on your radar. This green light for TIVDAK, a treatment targeting recurrent or metastatic cervical cancer in adults, gives Zai Lab a bigger foothold in the region and spotlights its role as an exclusive license holder in Greater China. Regulatory review is also under way in mainland China, which hints at further market expansion and revenue potential ahead. For investors, this milestone sharpens the focus on how international product approvals might reshape the company's growth trajectory.

Looking at share price movements, Zai Lab’s stock jumped 2.5% yesterday despite some short-term pullbacks. It remains up 24% year to date and 54% over the past year. While its longer-term returns have been mixed, momentum has clearly picked up as the market digests not only this week’s TIVDAK approval but also a string of recent regulatory advances and industry conference appearances. Some observers note that investor optimism is returning, even as the company remains focused on scaling up commercial opportunities across its licensed products.

With shares rallying this year and potential future growth stories in play, the question for some investors is whether there is still value left for new buyers or if Zai Lab’s recent success is already reflected in the current price.

Most Popular Narrative: 45.4% Undervalued

The most widely followed valuation narrative positions Zai Lab as significantly undervalued, suggesting the current share price does not fully reflect its future growth potential and upcoming profitability.

Multiple high-potential product launches and label expansions over the next 12-18 months (including VYVGART, bemarituzumab, KarXT, TIVDAK, Tumor Treating Fields), combined with a deep pipeline in oncology and immunology, are expected to significantly increase Zai Lab's addressable market and diversify revenue streams. This supports both top-line growth and future earnings.

Curious what could fuel a dramatic price surge? There is a pivotal set of bold financial assumptions behind this value, which anticipates revenue, profits, and market presence rising far beyond today’s levels. Want to uncover which future catalysts and projections are powering this bullish scenario? The numbers behind this narrative might surprise you.

Result: Fair Value of $56.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, Zai Lab’s heavy reliance on external licensing and fierce local competition could quickly dim the outlook if there are changes in industry dynamics.

Find out about the key risks to this Zai Lab narrative.Another View: Discounted Cash Flow Perspective

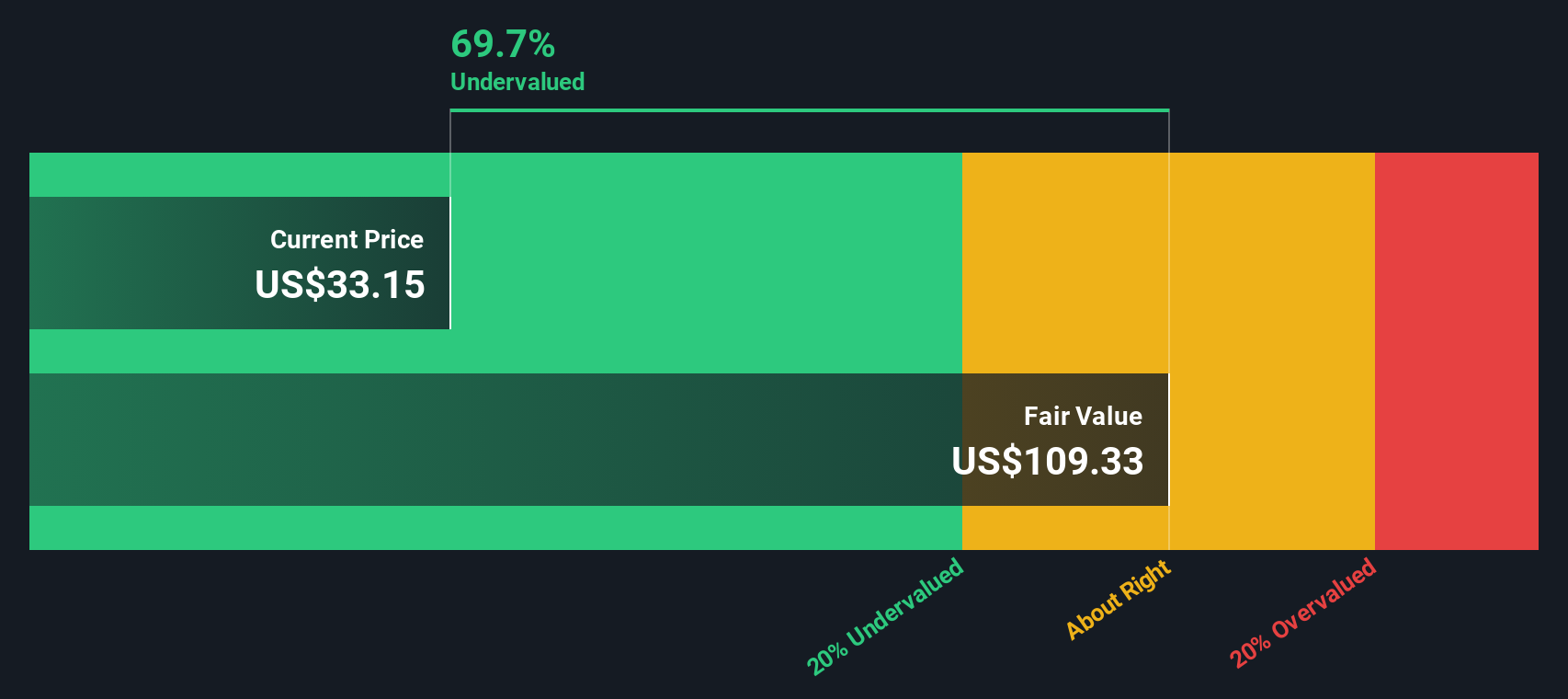

While some see Zai Lab as significantly undervalued based on its future growth, our DCF model also points to the shares trading well below fair value. This raises the question: could this model capture hidden strengths or overlook real risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Zai Lab for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Zai Lab Narrative

If you want to dig deeper or chart your own perspective, our tools make it easy to build an independent view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Zai Lab.

Looking for More Ways to Grow Your Portfolio?

There are standout companies beyond Zai Lab ready to capture tomorrow’s biggest opportunities. Make sure you’re not missing the next market mover and see what’s turning heads now.

- Uncover hidden gems with strong financials by checking out penny stocks with strong financials, which are shaping new frontiers in value and resilience.

- Power up your strategy with undervalued stocks based on cash flows, which spotlights stocks the market has overlooked and may give you a potential edge.

- Ride the next wave of medical innovation by exploring healthcare AI stocks, spotlighting pioneers who are fusing AI and healthcare breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zai Lab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGM:ZLAB

Zai Lab

A biopharmaceutical company, focuses on discovering, developing, and commercializing products that address medical conditions in the areas of oncology, immunology, neuroscience, and infectious diseases.

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)