- United States

- /

- Biotech

- /

- NasdaqGM:ZLAB

Assessing Zai Lab Shares After Recent FDA Nod and Shifting Market Momentum

Reviewed by Bailey Pemberton

If you own shares of Zai Lab or are just putting it on your “watch list,” you’re probably wondering what to make of this company’s next moves. After a sharp rise earlier in the year, Zai Lab’s stock has cooled off, down 12.8% in the past week and 7.9% over the last 30 days. Even so, it’s up 18.5% year to date and 12.3% higher from this time last year, showing some underlying investor optimism, especially after difficult years in the past. For context, the stock is still down 65.5% over five years, underscoring just how volatile its journey has been.

Some of this renewed energy is tied to positive shifts in larger market trends impacting innovative biotechs. Zai Lab has been emerging from a period of risk-off sentiment, with recent updates about its pipeline and regulatory environment breathing some hope back into the share price. Investors are clearly divided: are we seeing the start of a lasting recovery, or is this just another short-term swing?

If you’re trying to decide whether Zai Lab is undervalued or still risky, its valuation score might help. Zai Lab is undervalued on 4 out of 6 key checks, so it earns a valuation score of 4. But what does that actually mean for an investor’s next decision? Let’s dig deeper into how analysts arrive at this score, including the nitty gritty of multiple valuation approaches, and by the end, I’ll share a more insightful way to assess Zai Lab’s true worth.

Approach 1: Zai Lab Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is really worth by projecting its expected future cash flows and then discounting those projections back to today’s value. This approach gives investors a sense of the long-term earning potential and whether the current price reflects those future gains.

For Zai Lab, the DCF model relies on two stages: actual analyst estimates for the first five years and Simply Wall St’s extrapolations beyond that. Right now, Zai Lab’s latest twelve months of free cash flow comes in at a net loss of $207.6 million. Analysts expect this to improve dramatically, projecting positive free cash flow by 2027 and reaching $774.3 million in 2035. The projections see steady growth each year, with 2029 alone forecast at $365.2 million. This suggests renewed operational optimism for the company’s pipeline and business model.

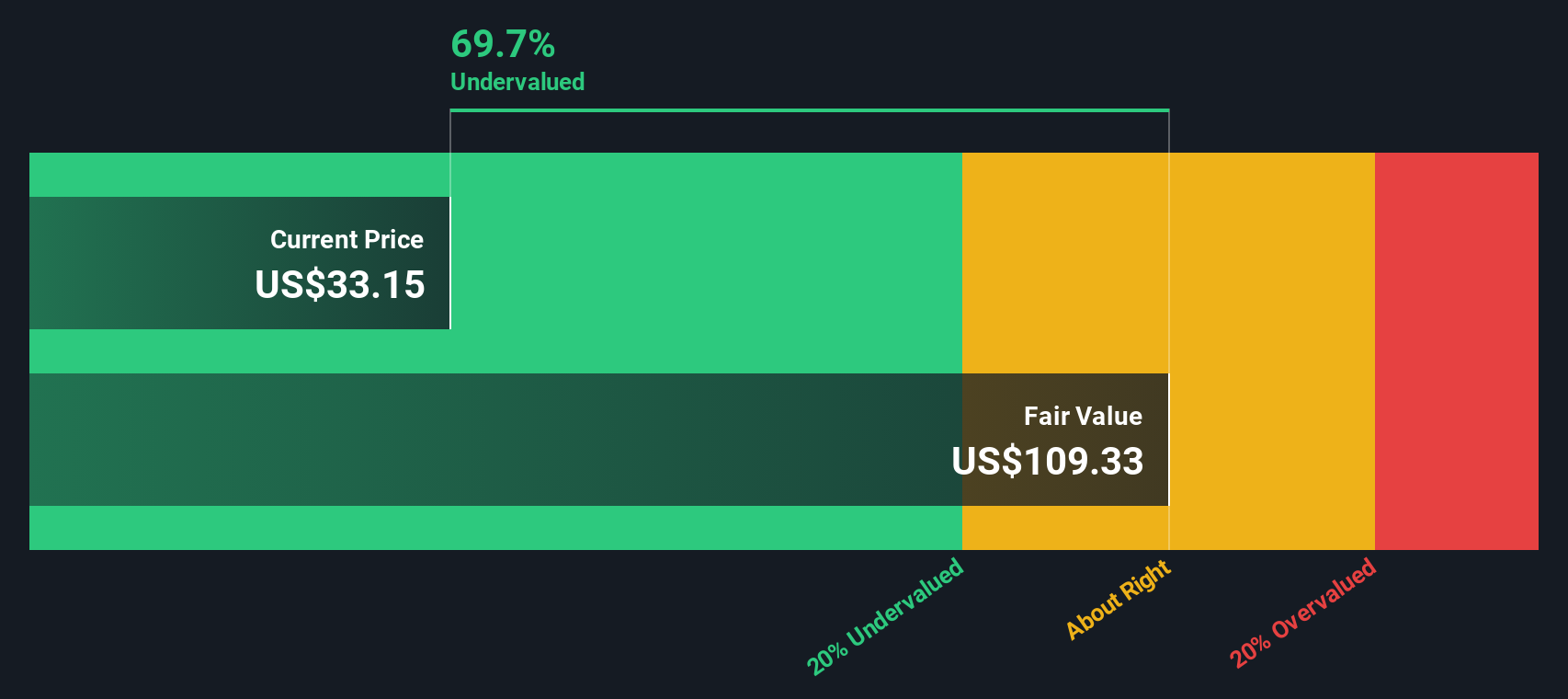

After crunching the numbers, the DCF model estimates Zai Lab’s fair value at $106 per share. With the stock currently trading at a 72.3% discount to this intrinsic value, the model indicates that Zai Lab is undervalued at today’s price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Zai Lab is undervalued by 72.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Zai Lab Price vs Sales

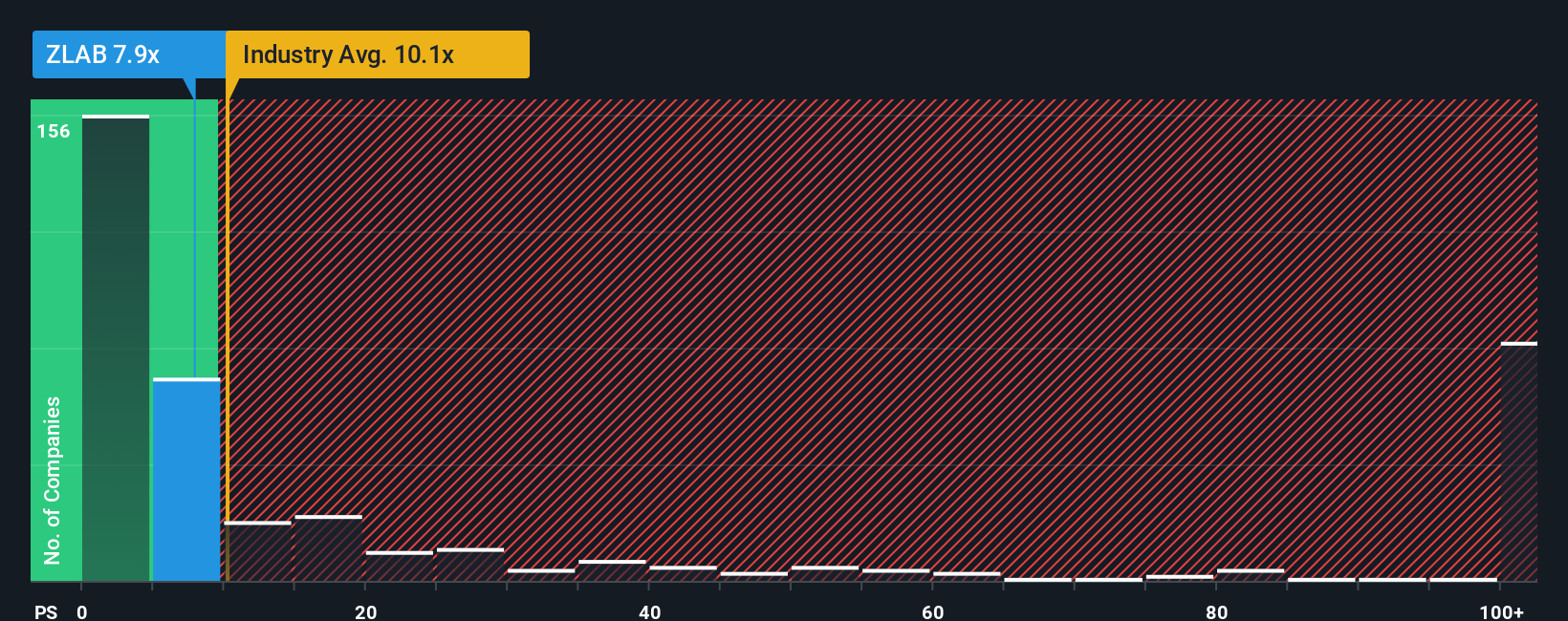

For companies like Zai Lab, which are not yet consistently profitable, the Price-to-Sales (P/S) ratio is a practical way to gauge valuation. This metric measures how much investors are willing to pay per dollar of revenue. It is especially helpful for biotechs with strong sales potential but fluctuating earnings. Growth expectations and perceived risk both play a major role in what constitutes a “normal” P/S ratio. Rapidly expanding companies or those in high-potential sectors tend to justify higher multiples, while companies facing uncertainty or competitive pressures usually trade at lower ratios.

Currently, Zai Lab trades at a P/S multiple of 7.64x. For comparison, the average for its biotech industry peers is 10.46x, and the selected peer group comes in even higher at 15.13x. While this suggests Zai Lab is trading below both the industry and peers, these standard benchmarks can overlook company-specific factors.

This is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio, calculated at 4.43x for Zai Lab, uses a proprietary formula that combines Zai Lab’s growth prospects, risk profile, profit margin, industry context, and market cap. This method provides a more complete and tailored picture than simply comparing to industry or peers alone.

Comparing Zai Lab’s current P/S of 7.64x with the Fair Ratio of 4.43x, the stock appears to be somewhat overvalued on this basis, though it is not as expensive as some competitors.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Zai Lab Narrative

Earlier, we mentioned there is an even better way to understand a company's value, and that is through Narratives. A Narrative is simply your story or perspective about a company that connects facts, forecasts, and the fair value you think is reasonable based on your expectations for its future revenue, margins, and earnings.

Unlike traditional ratios or price targets, Narratives bridge the gap between a company's big-picture outlook and what those numbers might actually look like. This helps you form a conviction about whether it's time to buy or sell. Narratives are easily created and tracked on Simply Wall St’s Community page, where millions of investors outline their assumptions and see their fair values compared to the latest market price.

What makes Narratives especially powerful is that they update automatically whenever new earnings or important news emerges, so your story and financial view stay relevant in real-time.

For example, when looking at Zai Lab, some investors’ Narratives expect explosive growth and assign a fair value as high as $75 per share. Others take a more cautious outlook and see only $39 per share as justified, illustrating how personal perspectives drive very different investment decisions.

Do you think there's more to the story for Zai Lab? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zai Lab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ZLAB

Zai Lab

A biopharmaceutical company, focuses on discovering, developing, and commercializing products that address medical conditions in the areas of oncology, immunology, neuroscience, and infectious diseases.

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)