- United States

- /

- Biotech

- /

- NasdaqGS:YMAB

Benign Growth For Y-mAbs Therapeutics, Inc. (NASDAQ:YMAB) Underpins Stock's 26% Plummet

To the annoyance of some shareholders, Y-mAbs Therapeutics, Inc. (NASDAQ:YMAB) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 23% in that time.

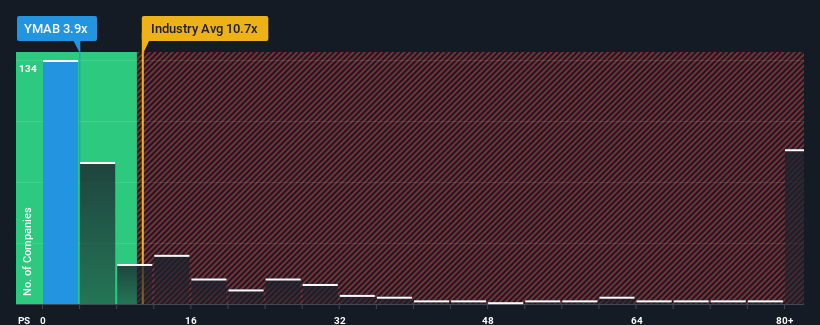

Following the heavy fall in price, Y-mAbs Therapeutics' price-to-sales (or "P/S") ratio of 3.9x might make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 10.7x and even P/S above 65x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Y-mAbs Therapeutics

What Does Y-mAbs Therapeutics' Recent Performance Look Like?

Y-mAbs Therapeutics hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Y-mAbs Therapeutics.How Is Y-mAbs Therapeutics' Revenue Growth Trending?

In order to justify its P/S ratio, Y-mAbs Therapeutics would need to produce anemic growth that's substantially trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 9.0%. Even so, admirably revenue has lifted 84% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 14% per year as estimated by the eleven analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 116% per year, which is noticeably more attractive.

With this in consideration, its clear as to why Y-mAbs Therapeutics' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Y-mAbs Therapeutics' P/S looks about as weak as its stock price lately. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, our analysis of Y-mAbs Therapeutics' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for Y-mAbs Therapeutics (1 is potentially serious!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:YMAB

Y-mAbs Therapeutics

A commercial-stage biopharmaceutical company, focuses on the development and commercialization of radioimmunotherapy and antibody based therapeutic products for the treatment of cancer.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives