- United States

- /

- Biotech

- /

- NasdaqGM:XENE

Is Xenon Pharmaceuticals a Smart Investment After Its New Clinical Trial Partnership?

Reviewed by Bailey Pemberton

Wondering whether it’s time to buy, hold, or watch Xenon Pharmaceuticals? You aren’t alone. The stock has kept investors guessing, with performance that’s quietly outpaced most people’s radar. While the past week has been almost flat at 0.3%, Xenon’s shares have gained 2.8% over the past month. More impressively, the five-year return sits at a staggering 251.4%. Compare that to the modest year-to-date dip of -2.3% and near-breakeven performance over the last year, and it’s easy to see why the company’s trajectory turns heads.

Much of this long-term growth has come as the biotech sector draws renewed interest from both institutional and retail investors, especially companies advancing promising treatments. News of fresh clinical trial partnerships in the industry, alongside increased M&A activity among pharmaceutical firms, has helped put Xenon back on watchlists. This supports the view that growth opportunities remain, even if short-term moves have flickered between cautious optimism and brief pullbacks.

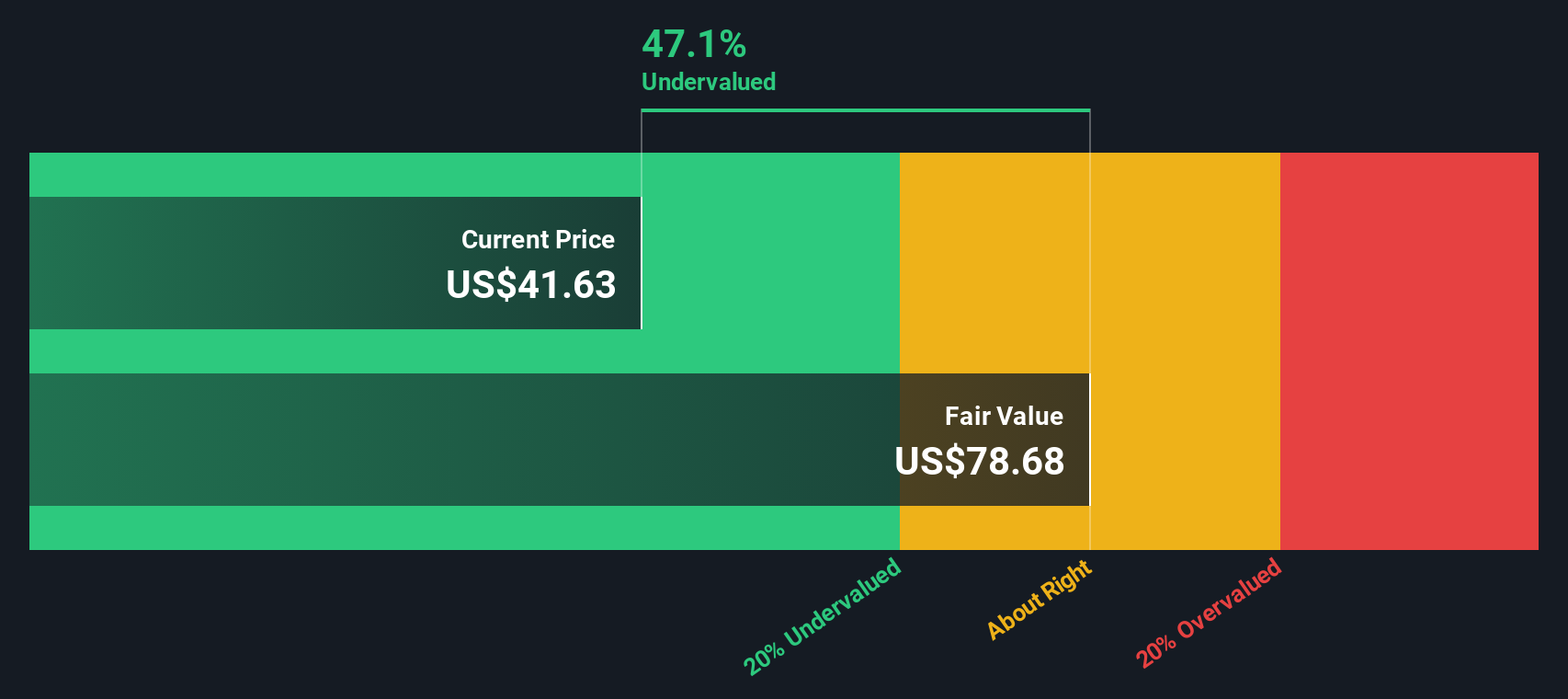

Now, onto what really counts: valuation. Based on a standard set of six valuation checks, Xenon Pharmaceuticals earns a score of 3, meaning it’s considered undervalued by half of the major methodologies we use. But numbers only tell part of the story. Next, we’ll dive into those different approaches to valuation, and stick around, because we’ll also explore a powerful perspective for understanding what Xenon might actually be worth.

Approach 1: Xenon Pharmaceuticals Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them to today’s value. This approach helps estimate what Xenon Pharmaceuticals is worth based on its ability to generate cash in the years ahead.

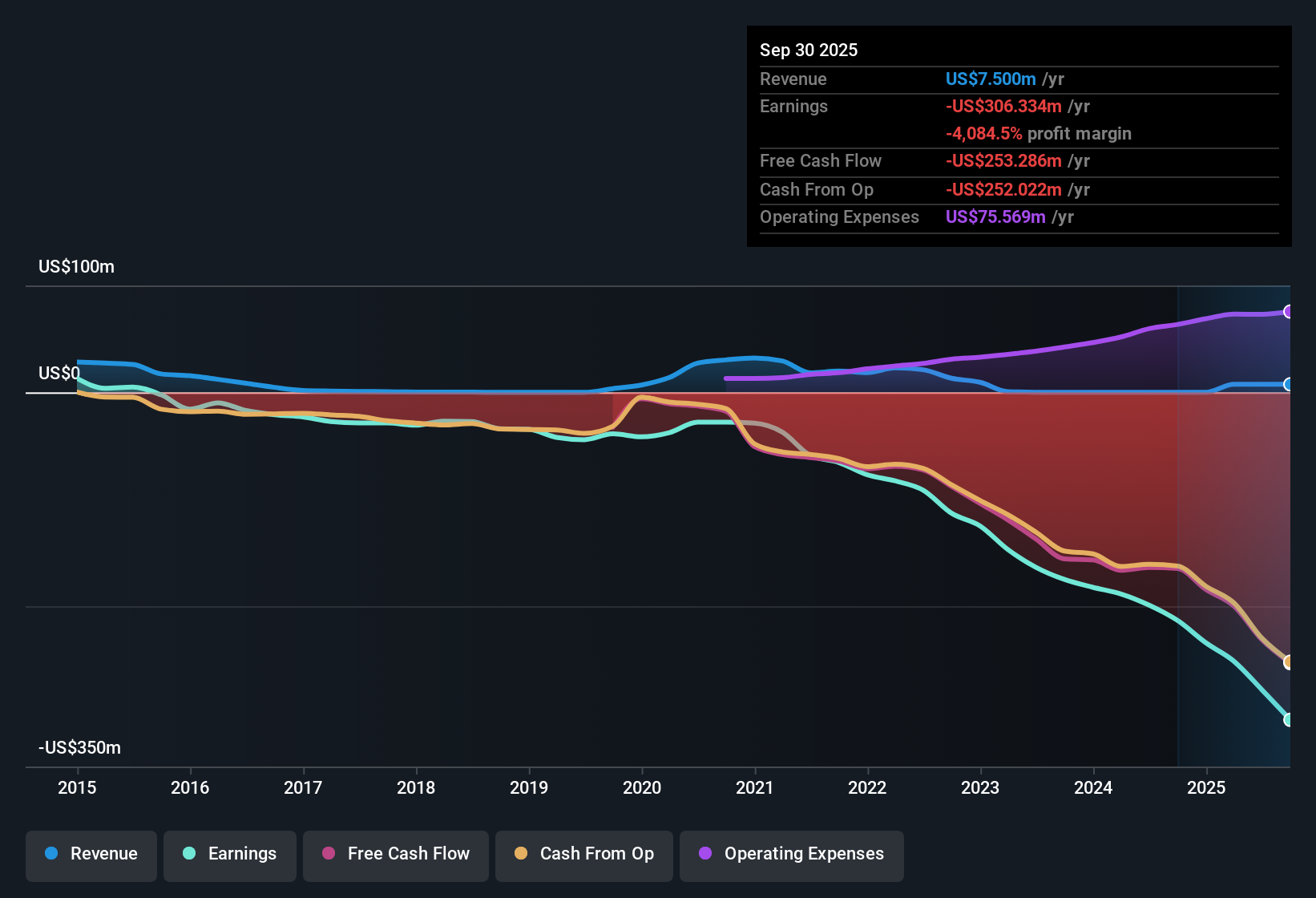

Currently, Xenon’s most recent Free Cash Flow stands at about -$240.8 million. According to analyst forecasts, cash flows are expected to remain negative for several years, reaching -$347.5 million in 2026 and only turning positive in 2029 at $96.7 million. Looking ten years into the future, projections suggest Xenon could generate approximately $358.7 million in Free Cash Flow by 2035, based on extrapolations by Simply Wall St.

With these figures, the DCF model produces an estimated intrinsic value for Xenon Pharmaceuticals at $79.95 per share. Compared to the current share price, this suggests the stock is 50.9% undervalued according to this detailed cash flow projection.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Xenon Pharmaceuticals is undervalued by 50.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Xenon Pharmaceuticals Price vs Book

The Price-to-Book (P/B) ratio is a useful metric for valuing pharmaceutical and biotech companies, especially when those companies are not yet profitable. Since Xenon Pharmaceuticals is still generating negative earnings, using the P/B ratio allows investors to compare the market value of the company to its actual net assets, helping to ground valuations in more tangible terms.

Typically, growth expectations and risk play a large role in what’s considered a fair P/B ratio. Companies that are delivering rapid advancements or breaking new ground in treatments may warrant a premium, while those facing uncertainty or slower-than-average growth might trade at lower multiples. The biotech industry as a whole trades at an average Price-to-Book of 2.5x. Xenon's current P/B ratio stands at 4.8x, slightly above the peer average of 4.4x, which suggests investors are already pricing in some optimism for future breakthroughs.

Simply Wall St’s "Fair Ratio" provides a custom benchmark by incorporating factors like Xenon’s growth outlook, profitability potential, risk profile, industry norms, and company size. Unlike a simple comparison against the sector or peer group, the Fair Ratio adjusts specifically for Xenon’s unique circumstances and offers a more tailored, accurate gauge of value.

Comparing Xenon’s current P/B ratio of 4.8x with its Fair Ratio shows that the stock is priced about where you would expect, taking its growth trajectory, risks, and sector characteristics into account.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Xenon Pharmaceuticals Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is essentially the story behind a company’s numbers, your perspective on its future, including what you think it is really worth and how you see its growth unfolding in areas like revenue, earnings, and profit margins. Narratives connect this story directly to financial forecasts and help you translate them into an actionable fair value estimate.

On Simply Wall St’s Community page, millions of investors use Narratives because it is an easy tool to express your personal outlook, see what others are thinking, and compare fair value projections to the current share price. Narratives update in real time whenever new information, such as breaking news or earnings results, becomes available, keeping your investment decisions relevant and up to date.

This approach helps you decide when a stock might be a buy or a sell, depending on whether your fair value sits above or below the current market price. For example, one investor’s Narrative might value Xenon Pharmaceuticals at more than double its current price, while another takes a more cautious view and sees it as modestly overvalued, illustrating just how dynamic and adaptable Narratives can be.

Do you think there's more to the story for Xenon Pharmaceuticals? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:XENE

Xenon Pharmaceuticals

A neuroscience-focused biopharmaceutical company, engages in the discovery, development, and delivery of therapeutics to treat patients with neurological and psychiatric disorders in Canada.

Flawless balance sheet and fair value.

Market Insights

Community Narratives