- United States

- /

- Pharma

- /

- NasdaqGM:WVE

Wave Life Sciences Ltd.'s (NASDAQ:WVE) 41% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

Unfortunately for some shareholders, the Wave Life Sciences Ltd. (NASDAQ:WVE) share price has dived 41% in the last thirty days, prolonging recent pain. Longer-term, the stock has been solid despite a difficult 30 days, gaining 14% in the last year.

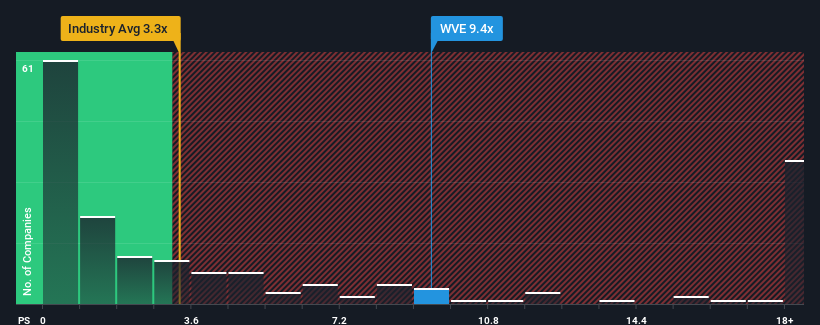

Although its price has dipped substantially, Wave Life Sciences' price-to-sales (or "P/S") ratio of 9.4x might still make it look like a strong sell right now compared to other companies in the Pharmaceuticals industry in the United States, where around half of the companies have P/S ratios below 3.3x and even P/S below 1x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Wave Life Sciences

What Does Wave Life Sciences' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Wave Life Sciences' revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Wave Life Sciences .What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Wave Life Sciences' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.4%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 164% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 20% per annum over the next three years. That's shaping up to be similar to the 20% per year growth forecast for the broader industry.

With this information, we find it interesting that Wave Life Sciences is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Final Word

A significant share price dive has done very little to deflate Wave Life Sciences' very lofty P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Analysts are forecasting Wave Life Sciences' revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. A positive change is needed in order to justify the current price-to-sales ratio.

You always need to take note of risks, for example - Wave Life Sciences has 2 warning signs we think you should be aware of.

If you're unsure about the strength of Wave Life Sciences' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Wave Life Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:WVE

Wave Life Sciences

A clinical-stage biotechnology company, designs, develops, and commercializes ribonucleic acid (RNA) medicines through PRISM, a discovery and drug development platform.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives