- United States

- /

- Pharma

- /

- NasdaqGM:WVE

Could Investor Optimism Around Wave Life Sciences’ PRISM Platform Reveal a Turning Point for WVE?

Reviewed by Sasha Jovanovic

- In the past week, Wave Life Sciences attracted significant attention following notable investor optimism around its expanding portfolio of RNA-based therapeutics targeting diseases such as obesity, alpha-1 antitrypsin deficiency, Duchenne muscular dystrophy, and Huntington’s disease.

- An interesting aspect of this development is the spotlight on the proprietary PRISM platform, which is driving advancements across multiple RNA modalities and fueling positive market sentiment despite no single major news release.

- We’ll examine how recent momentum behind Wave's RNA therapeutics pipeline could potentially influence its investment outlook and underlying assumptions.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Wave Life Sciences Investment Narrative Recap

To invest in Wave Life Sciences, you need to believe in the long-term promise of its RNA-based therapeutics, backed by the proprietary PRISM platform and multiple clinical catalysts ahead. While the recent share price jump signals growing confidence in the company’s pipeline, the most important short-term catalyst remains upcoming clinical trial data readouts, especially for its key programs; however, the latest surge is not directly linked to any material development that would immediately change the biggest risk, continued high operating losses and a need for future funding if product milestones do not arrive soon.

Of the recent announcements, the positive data from the Phase 1b/2a RestorAATion-2 study for WVE-006 in alpha-1 antitrypsin deficiency stands out. These results reinforce progress in Wave’s pipeline and may set the stage for future milestone payments from partners like GSK, which are crucial catalysts given ongoing revenue challenges and the timing of upcoming clinical milestones.

However, investors should also be mindful that, in stark contrast, the company’s growing R&D spend and cash runway limitations could force funding decisions sooner than some expect...

Read the full narrative on Wave Life Sciences (it's free!)

Wave Life Sciences' narrative projects $177.5 million in revenue and $41.2 million in earnings by 2028. This requires 23.6% yearly revenue growth and a $171.1 million increase in earnings from the current $-129.9 million.

Uncover how Wave Life Sciences' forecasts yield a $20.27 fair value, a 167% upside to its current price.

Exploring Other Perspectives

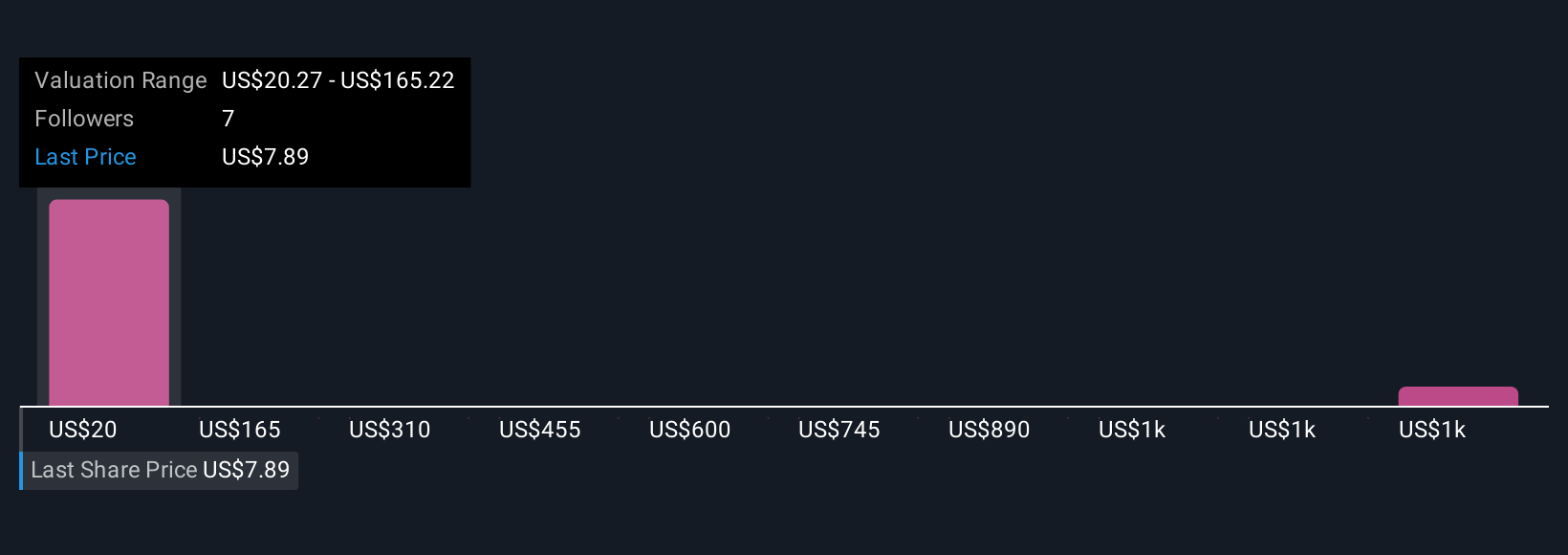

Simply Wall St Community members provided two fair value estimates for Wave Life Sciences, ranging from US$20.27 up to US$1,469.79 per share. As you consider these widely different valuations, remember upcoming clinical trial readouts remain pivotal for Wave’s future direction and funding flexibility, explore several perspectives before forming your own view.

Explore 2 other fair value estimates on Wave Life Sciences - why the stock might be a potential multi-bagger!

Build Your Own Wave Life Sciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wave Life Sciences research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Wave Life Sciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wave Life Sciences' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wave Life Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WVE

Wave Life Sciences

A clinical-stage biotechnology company, designs, develops, and commercializes ribonucleic acid (RNA) medicines through PRISM, a discovery and drug development platform.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives