- United States

- /

- Pharma

- /

- NasdaqGM:WVE

A Look at Wave Life Sciences’s (WVE) Valuation Following Excitement Over PRISM Platform Progress and RNA Pipeline Momentum

Reviewed by Kshitija Bhandaru

Wave Life Sciences (WVE) saw its shares climb in the latest session as excitement grows around new developments for its PRISM platform. Investors are watching upcoming clinical trial data that could shape the company’s revenue potential.

See our latest analysis for Wave Life Sciences.

Momentum in Wave Life Sciences’ RNA pipeline has caught investors’ attention, fueling a 9% share price gain over the past month. Despite this bump, the stock’s year-to-date share price return sits at -43%. However, its three-year total shareholder return of 46% highlights the potential upside investors see if upcoming clinical milestones translate to revenue growth.

If you’re interested in discovering what other fast-moving opportunities are out there, now’s a great time to broaden your horizons and explore fast growing stocks with high insider ownership

With shares still trading at a notable discount to analyst targets despite strong pipeline momentum, the key question is whether Wave Life Sciences is undervalued at current levels or if the market has already factored in future growth potential.

Most Popular Narrative: 62.5% Undervalued

With the latest close at $7.60 and the narrative's fair value at $20.27, optimism is running high around Wave Life Sciences' future prospects. Attention is turning to whether current pipeline events will be enough to lift its share price closer to that ambitious valuation.

The upcoming clinical data readouts for key programs (AATD with WVE-006 and obesity with WVE-007) in late 2025 and early 2026 represent potential inflection points. These are supported by strong early efficacy and favorable safety. If positive, they could significantly expand revenue opportunities in large, underserved markets driven by an aging population and rising chronic disease prevalence.

Curious what explosive assumptions are propping up that sky-high target? There is a storyline of relentless revenue growth, margin transformation, and premium multiples hidden in the numbers. You may be surprised by the kind of financial leap this narrative is projecting. Don’t miss the full logic.

Result: Fair Value of $20.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still real risks. Declining collaboration revenue and rising operating costs could pose headwinds if clinical or commercial milestones are delayed or missed.

Find out about the key risks to this Wave Life Sciences narrative.

Another View: Market Multiples Tell a Different Story

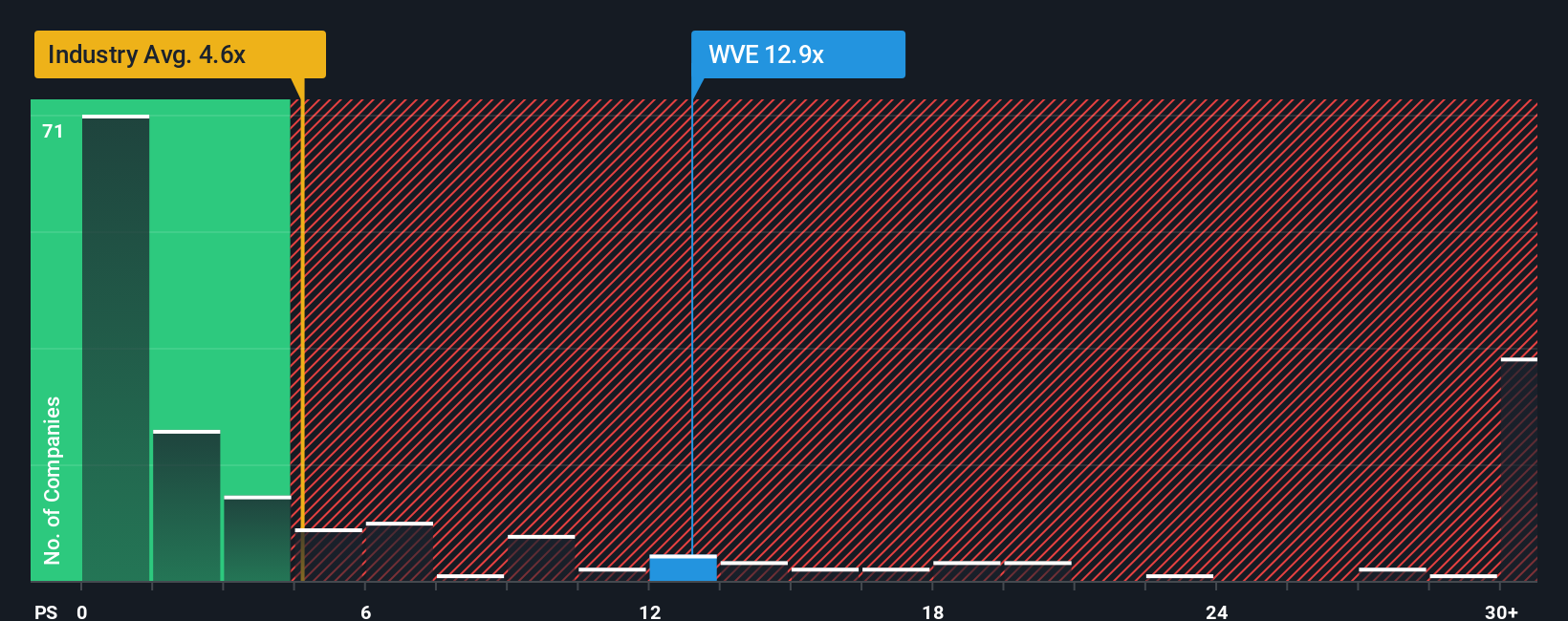

Looking from a market comparison angle, Wave Life Sciences trades at a price-to-sales ratio of 12.9x, which is sharply higher than both industry peers at 4.9x and the broader US pharma sector at 4.6x. The fair ratio is estimated at just 1.4x, suggesting the stock could be pricing in a lot of future good news. Does this leave investors with more risk than upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wave Life Sciences Narrative

If you see things differently or want to dig into the numbers yourself, you can shape your own take on Wave Life Sciences in just a few minutes with Do it your way.

A great starting point for your Wave Life Sciences research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let the next big opportunity slip past you. Leverage these tailored screeners to uncover stocks that fit your investment goals and broaden your portfolio’s potential.

- Boost your returns by tapping into growth stories behind these 24 AI penny stocks. Artificial intelligence is transforming industries and driving innovation.

- Lock in solid income opportunities by evaluating these 19 dividend stocks with yields > 3%. This screener spotlights companies rewarding shareholders with high and stable dividend yields.

- Seize the edge in digital finance by analyzing these 79 cryptocurrency and blockchain stocks. This connects you with businesses advancing blockchain technology and cryptocurrency innovations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wave Life Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WVE

Wave Life Sciences

A clinical-stage biotechnology company, designs, develops, and commercializes ribonucleic acid (RNA) medicines through PRISM, a discovery and drug development platform.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives