- United States

- /

- Pharma

- /

- NasdaqGS:VTYX

Spotlight On 3 Penny Stocks With Market Caps Under $500M

Reviewed by Simply Wall St

In the last week, the market has stayed flat, but it is up 11% over the past year, with earnings expected to grow by 14% per annum over the next few years. Though the term 'penny stock' might sound like a relic of past trading days, these smaller or newer companies can still offer significant opportunities when built on solid financials. We've selected three examples of penny stocks that combine balance sheet strength with potential for outsized gains, giving investors a chance to discover hidden value in quality companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| SideChannel (OTCPK:SDCH) | $0.0496 | $11.56M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (NYSE:TUYA) | $2.58 | $1.59B | ✅ 3 ⚠️ 3 View Analysis > |

| Perfect (NYSE:PERF) | $1.81 | $181.29M | ✅ 3 ⚠️ 0 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $4.48 | $53.75M | ✅ 1 ⚠️ 2 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $2.86 | $389.9M | ✅ 4 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.54 | $86.04M | ✅ 3 ⚠️ 2 View Analysis > |

| Table Trac (OTCPK:TBTC) | $4.7675 | $20.88M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.81 | $6.17M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.23 | $70.38M | ✅ 3 ⚠️ 2 View Analysis > |

| New Horizon Aircraft (NasdaqCM:HOVR) | $0.92 | $21.66M | ✅ 3 ⚠️ 6 View Analysis > |

Click here to see the full list of 719 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

4D Molecular Therapeutics (NasdaqGS:FDMT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: 4D Molecular Therapeutics, Inc. is a late-stage biotechnology company focused on developing adeno-associated virus vectors using its proprietary Therapeutic Vector Evolution platform, with operations in the Netherlands and the United States and a market cap of $176.03 million.

Operations: The company's revenue is primarily derived from its biotechnology segment, amounting to $0.023 million.

Market Cap: $176.03M

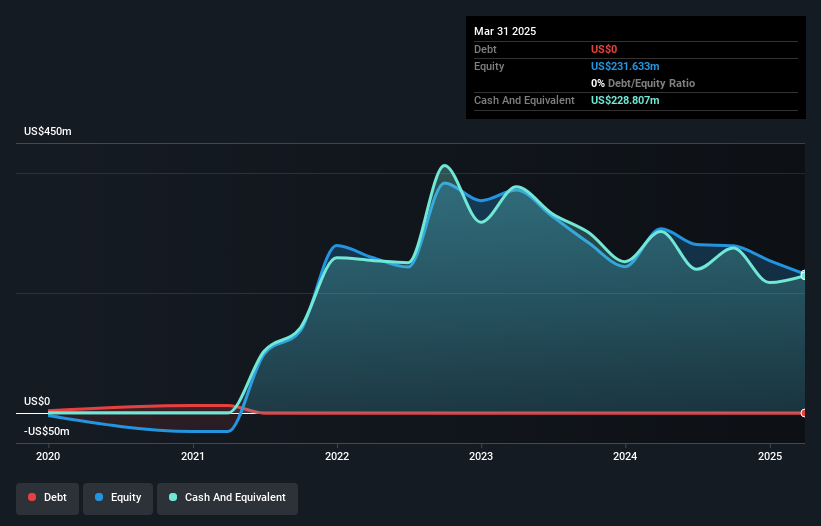

4D Molecular Therapeutics is a pre-revenue biotech firm with a focus on innovative therapies, recently receiving RMAT designation for 4D-150 in diabetic macular edema and wet AMD. Despite its promising pipeline, the company reported a net loss of US$47.97 million in Q1 2025, highlighting ongoing financial challenges. However, it maintains strong liquidity with short-term assets of US$332.6 million exceeding liabilities and remains debt-free. The management team is experienced, but profitability isn't expected soon as earnings are forecasted to decline over the next three years while revenue growth is anticipated at 65.73% annually.

- Click to explore a detailed breakdown of our findings in 4D Molecular Therapeutics' financial health report.

- Explore 4D Molecular Therapeutics' analyst forecasts in our growth report.

Myriad Genetics (NasdaqGS:MYGN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Myriad Genetics, Inc. is a molecular diagnostic testing and precision medicine company that develops and provides molecular tests both in the United States and internationally, with a market cap of approximately $408.35 million.

Operations: The company generates $831.3 million in revenue from its biotechnology segment.

Market Cap: $408.35M

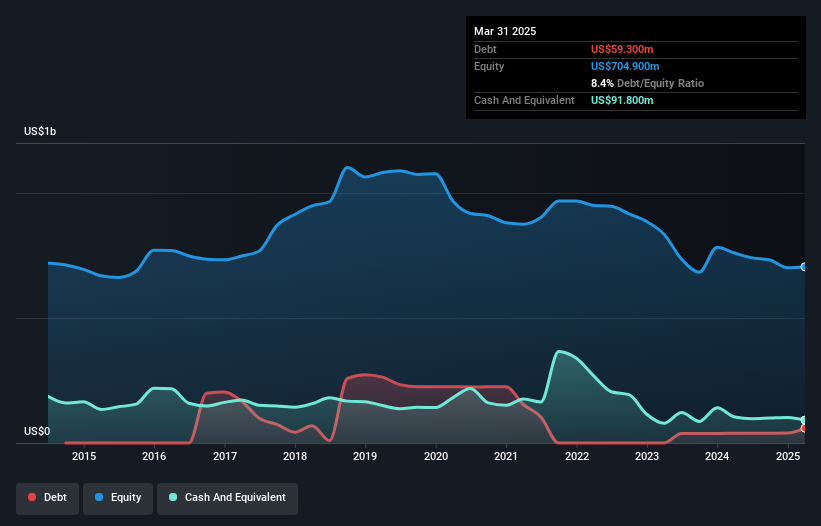

Myriad Genetics, with a market cap of approximately US$408.35 million, is currently trading significantly below its estimated fair value but remains unprofitable with increased losses over the past five years. Despite this, it has improved its financial position by reducing its debt-to-equity ratio and maintaining more cash than total debt. Recent strategic collaborations and product innovations in precision medicine have been announced, including AI-powered cancer diagnostics and enhancements to their breast cancer risk assessment tool. However, the company recently lowered revenue guidance for 2025 due to challenges in specific business segments.

- Navigate through the intricacies of Myriad Genetics with our comprehensive balance sheet health report here.

- Assess Myriad Genetics' future earnings estimates with our detailed growth reports.

Ventyx Biosciences (NasdaqGS:VTYX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ventyx Biosciences, Inc. is a clinical-stage biopharmaceutical company focused on developing oral therapies for autoimmune, inflammatory, and neurodegenerative diseases, with a market cap of approximately $103.18 million.

Operations: Currently, Ventyx Biosciences does not report any revenue segments.

Market Cap: $103.18M

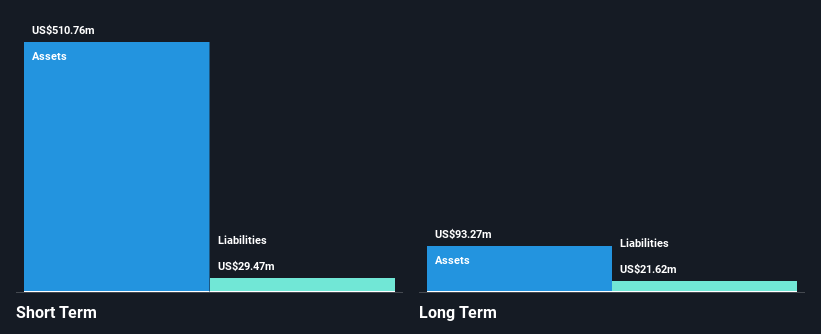

Ventyx Biosciences, with a market cap of US$103.18 million, is pre-revenue and currently unprofitable, reporting a net loss of US$27.44 million for Q1 2025. Despite the absence of revenue, the company maintains a strong financial position with short-term assets totaling US$242.6 million exceeding both its short- and long-term liabilities. The recent appointment of seven renowned scientists to its Scientific Advisory Board underscores Ventyx's commitment to advancing research in autoimmune and neurodegenerative diseases. While it has no debt and an adequate cash runway for over a year, its share price remains highly volatile.

- Get an in-depth perspective on Ventyx Biosciences' performance by reading our balance sheet health report here.

- Understand Ventyx Biosciences' earnings outlook by examining our growth report.

Seize The Opportunity

- Investigate our full lineup of 719 US Penny Stocks right here.

- Searching for a Fresh Perspective? Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VTYX

Ventyx Biosciences

A clinical-stage biopharmaceutical company, develops oral therapies for patients with autoimmune, inflammatory, and neurodegenerative diseases.

Flawless balance sheet low.

Market Insights

Community Narratives