- United States

- /

- Biotech

- /

- NasdaqCM:VTGN

VistaGen Therapeutics (NASDAQ:VTGN shareholders incur further losses as stock declines 15% this week, taking five-year losses to 47%

The main aim of stock picking is to find the market-beating stocks. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term VistaGen Therapeutics, Inc. (NASDAQ:VTGN) shareholders for doubting their decision to hold, with the stock down 47% over a half decade. And it's not just long term holders hurting, because the stock is down 45% in the last year. Furthermore, it's down 36% in about a quarter. That's not much fun for holders. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

Since VistaGen Therapeutics has shed US$50m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for VistaGen Therapeutics

We don't think VistaGen Therapeutics' revenue of US$1,511,900 is enough to establish significant demand. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, they may be hoping that VistaGen Therapeutics comes up with a great new product, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized).

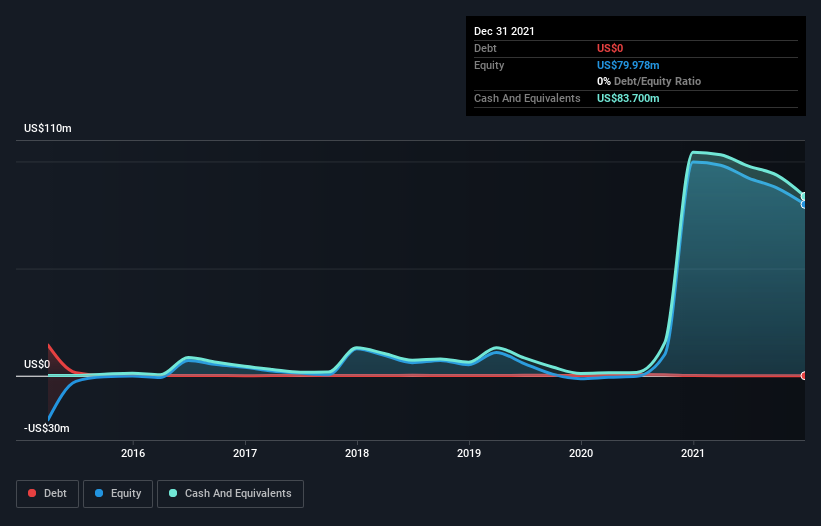

When it last reported its balance sheet in December 2021, VistaGen Therapeutics had cash in excess of all liabilities of US$73m. That's not too bad but management may have to think about raising capital or taking on debt, unless the company is close to breaking even. With the share price down 8% per year, over 5 years , it seems likely that the need for cash is weighing on investors' minds. The image below shows how VistaGen Therapeutics' balance sheet has changed over time; if you want to see the precise values, simply click on the image.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. What if insiders are ditching the stock hand over fist? I would feel more nervous about the company if that were so. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

A Different Perspective

Investors in VistaGen Therapeutics had a tough year, with a total loss of 45%, against a market gain of about 2.0%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand VistaGen Therapeutics better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 4 warning signs for VistaGen Therapeutics you should know about.

Of course VistaGen Therapeutics may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:VTGN

Vistagen Therapeutics

A biopharmaceutical company, engages in the development and commercialization of therapies for psychiatric and neurological disorders.

Flawless balance sheet low.

Market Insights

Community Narratives