- United States

- /

- Biotech

- /

- NasdaqGS:VRTX

Vertex Pharmaceuticals (VRTX): Revisiting Valuation After Upbeat Earnings Revisions and Growth Forecasts

Reviewed by Simply Wall St

Vertex Pharmaceuticals (VRTX) is back in the spotlight as investors look ahead to management’s appearance at Citi’s Global Healthcare Conference, combining that visibility with upbeat earnings revisions and growth projections that have kept the stock trending.

See our latest analysis for Vertex Pharmaceuticals.

The upcoming Citi conference appearance lands after a steady run, with a roughly 9 percent 3 month share price return and a powerful 5 year total shareholder return of about 93 percent. This signals momentum that is still broadly intact.

If Vertex’s trajectory has your attention, this is a good moment to explore other innovative healthcare names and see what stands out in healthcare stocks.

With shares trading roughly 11 percent below the average analyst target yet carrying a premium growth profile, investors now face a pivotal question: Is there still upside left, or has the market already priced in Vertex’s next chapter?

Most Popular Narrative: 9.7% Undervalued

Vertex Pharmaceuticals last closed at $433.15, while the most followed narrative pegs fair value noticeably higher and frames the stock as modestly mispriced ahead of key catalysts.

Strong cash flows and a robust balance sheet, bolstered by meaningful share repurchases and prudent reinvestment in R&D and commercial infrastructure, support future earnings power and the ability to capitalize on long term industry trends such as faster drug development via AI and high throughput screening. These factors help replenish the pipeline and widen growth opportunities.

Want to see how steady double digit growth, rising margins, and a premium future earnings multiple all come together in one valuation playbook? The full narrative spells it out.

Result: Fair Value of $479.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on the CF franchise and heightened pricing pressure from global payers could still challenge the upbeat valuation narrative ahead.

Find out about the key risks to this Vertex Pharmaceuticals narrative.

Another Lens on Value

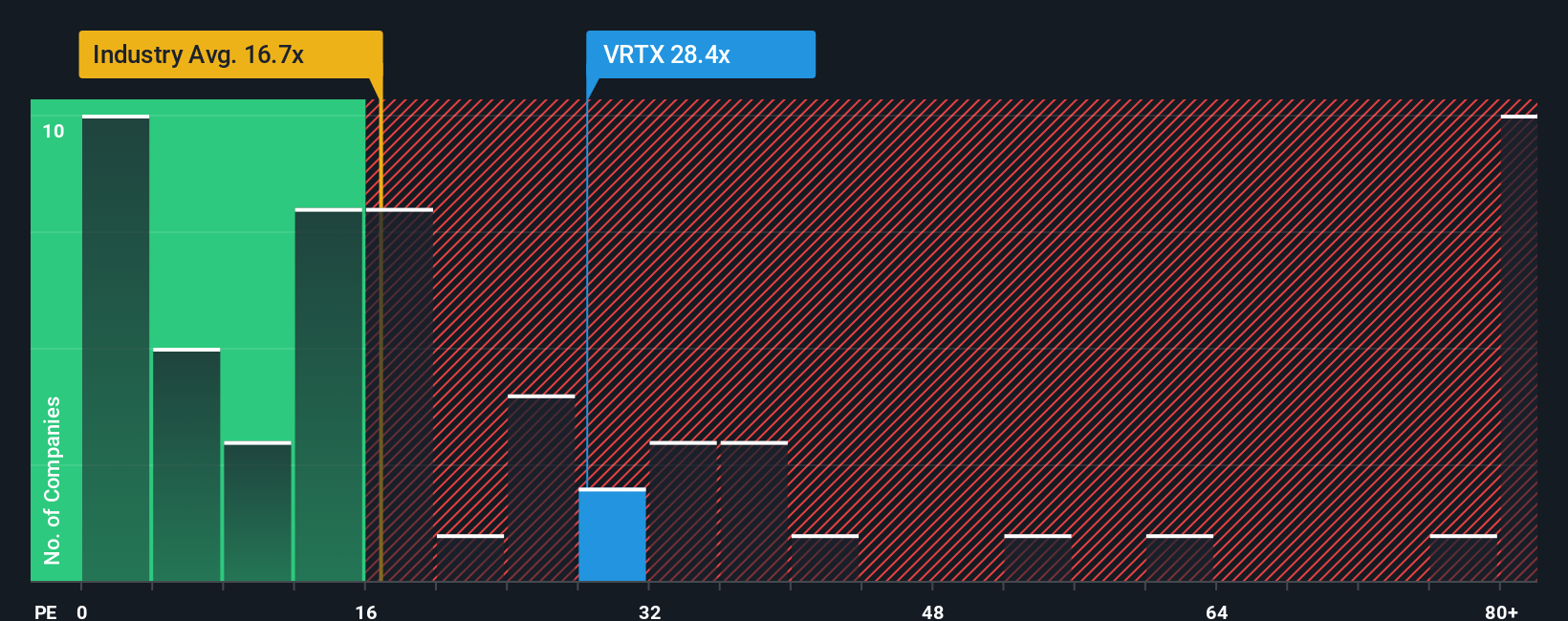

On earnings, Vertex looks less like a clear bargain. Its price to earnings ratio sits at about 29.9 times, slightly above a 29.7 times fair ratio and well above the US biotech average of 19.2 times, suggesting investors already pay up for its quality and pipeline promise.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vertex Pharmaceuticals Narrative

If you see the story differently or would rather dig into the numbers yourself, you can build a fresh view in under three minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vertex Pharmaceuticals.

Ready for your next investing move?

Before you move on, lock in your momentum by scanning fresh ideas on Simply Wall Street’s Screener so you are not leaving opportunities on the table.

- Capture potential mispricings by targeting companies trading below intrinsic value through these 927 undervalued stocks based on cash flows, and position yourself ahead of a possible repricing.

- Ride structural growth in automation and machine learning by filtering for innovative businesses using these 24 AI penny stocks that could redefine entire industries.

- Boost your portfolio’s income engine by focusing on dependable payers via these 14 dividend stocks with yields > 3%, keeping cash flow working for you through changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRTX

Vertex Pharmaceuticals

A biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF).

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026