- United States

- /

- Biotech

- /

- NasdaqGS:VRTX

Vertex Pharmaceuticals (NasdaqGS:VRTX) Advances Diabetes Portfolio Despite 2% Decline in Share Price

Reviewed by Simply Wall St

Vertex Pharmaceuticals (NasdaqGS:VRTX) saw a notable 20.53% share price increase over the last quarter, which coincided with several key developments in its Type 1 Diabetes (T1D) initiatives. The company announced the completion of enrollment for the VX-264 and Zimislecel studies, though only Zimislecel remains on track for potential regulatory submissions following more promising outcomes. This progress, along with the recent approval of ALYFTREK in the UK for cystic fibrosis, might have supported the stock's strength despite broader market uncertainties and a 1.8% decline over the past week, primarily driven by tariff announcements affecting various sectors.

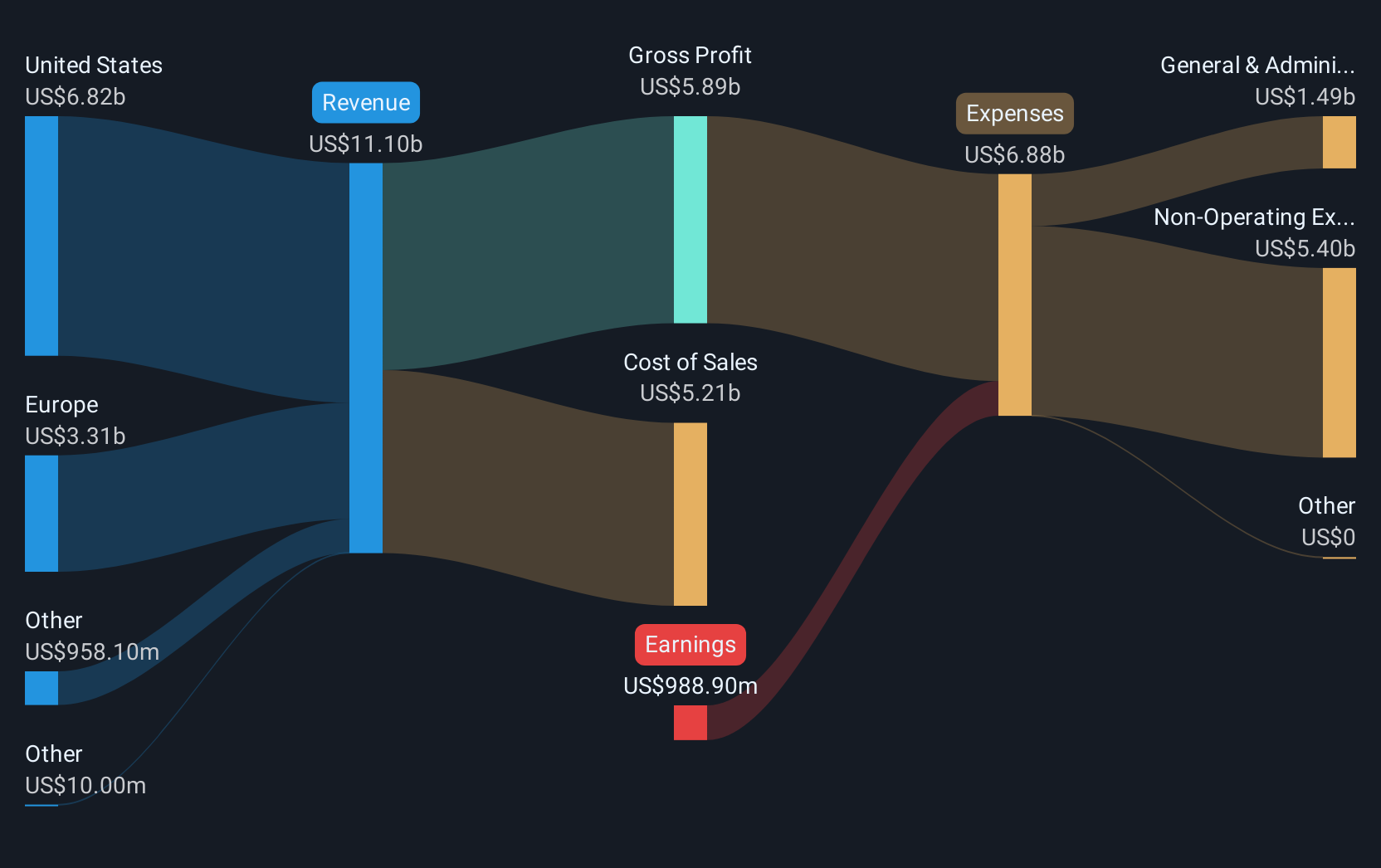

Vertex Pharmaceuticals has delivered strong returns over the past five years, achieving a total shareholder return of 106.74%. Recent developments have solidified the company’s innovative edge, including the FDA approval of JOURNAVX in January 2025, a major leap in non-opioid pain management treatments. The UK approval of ALYFTREK further boosted its presence in cystic fibrosis therapies, reinforcing Vertex's revenue potential in these key areas. Furthermore, the strategic collaboration with Zai Lab in early 2025 highlights Vertex's commitment to expanding its kidney disease solutions in Asia, a vital target market.

Corporate actions also played a role, with robust share buybacks amounting to approximately $1.6 billion since early 2023, indicating strong confidence in Vertex's financial health. Leadership changes, such as the appointment of Charles F. Wagner, Jr. as COO, suggest continuity and alignment with Vertex's growth objectives. While the company recorded a significant net loss for 2024, the long-term view and proactive R&D investments continue to outline a favorable outlook. Despite fluctuations, Vertex outperformed both the US Biotech industry and the broader US market over the past year, underlining its robust market position.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRTX

Vertex Pharmaceuticals

A biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF).

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives