- United States

- /

- Biotech

- /

- NasdaqGS:VRTX

Assessing Vertex Pharmaceuticals (VRTX) Valuation After Recent 4% Share Price Gain

Reviewed by Kshitija Bhandaru

Vertex Pharmaceuticals (VRTX) has continued to attract investor attention. Recent movements in its share price prompt a closer look at the company’s fundamentals and growth outlook. Over the past month, VRTX shares have climbed 4%.

See our latest analysis for Vertex Pharmaceuticals.

VRTX's recent 4% share price climb has added a spark to a year marked by volatility, with momentum beginning to return after a difficult patch. Despite a modest year-to-date advance, the company’s one-year total shareholder return sits at -15%, highlighting the swings that can come with biotech investing. Its five-year total shareholder return of 92% puts longer-term gains in perspective.

If Vertex’s rebound has you watching biotech trends, now is an excellent moment to discover other innovators. Check out the opportunities in our healthcare stocks screener: See the full list for free.

With shares still trading below analyst targets and strong revenue growth continuing, the question for investors is clear: is Vertex now undervalued after last year’s dip, or is the market already pricing in its future gains?

Most Popular Narrative: 14.1% Undervalued

Compared to the last close of $412.22, the most widely followed narrative values Vertex Pharmaceuticals at a significantly higher fair value. This sets the stage for a deeper dive into what is driving such bullish sentiment from the consensus.

Vertex's pipeline diversification, including programs in pain, kidney, and type 1 diabetes, leverages global advances in genomic and gene-editing technologies. This positions the company to capture long-term growth from accelerating personalized and precision medicine adoption, supporting both revenue and long-term margin expansion.

Curious about what exactly makes the Street so confident? The foundation of this valuation rests on aggressive growth projections for pipeline innovation and expanding margins far beyond legacy therapies. Want to see the key forecasts that could turbocharge Vertex’s financial trajectory? Find out precisely what’s behind that high fair value estimate.

Result: Fair Value of $479.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Vertex’s continued reliance on cystic fibrosis therapies, along with the risk of setbacks in its newer pipeline, could dampen the bullish outlook.

Find out about the key risks to this Vertex Pharmaceuticals narrative.

Another View: Multiples Tell a Cautious Story

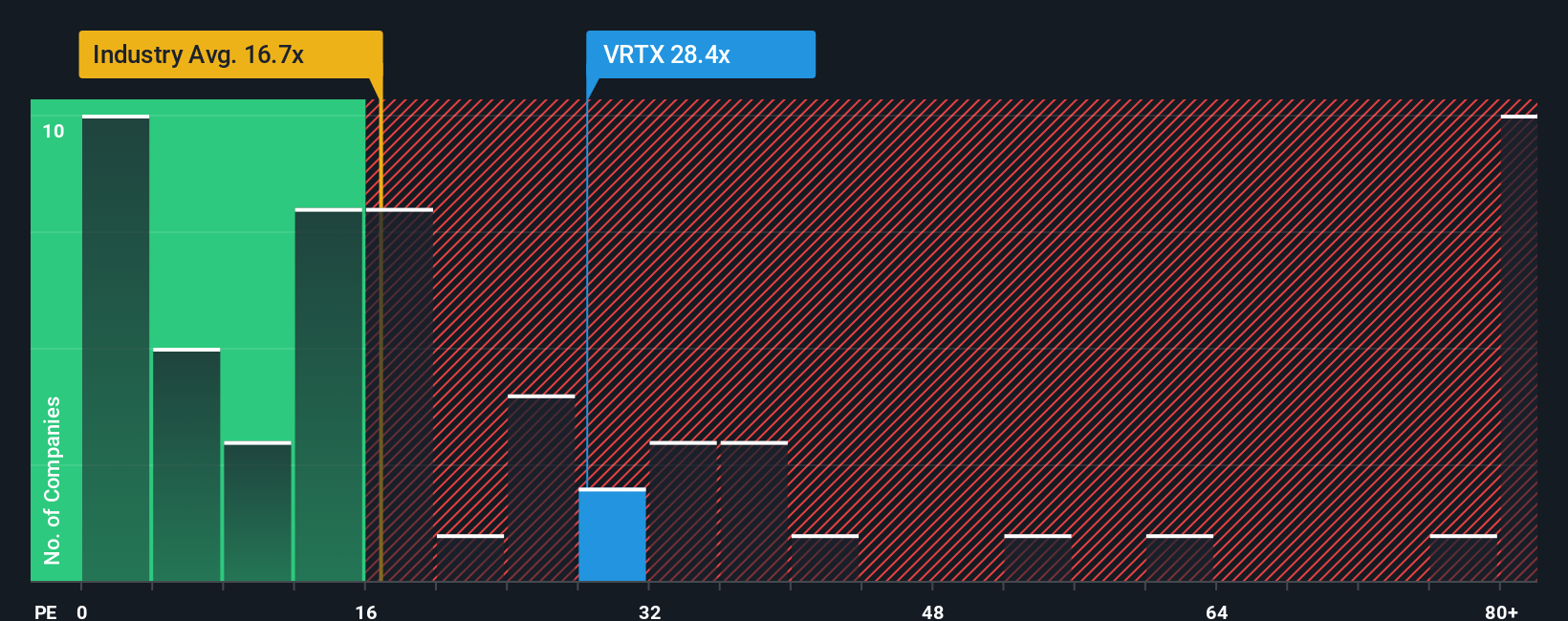

Looking at Vertex through the lens of its price-to-earnings ratio, the picture changes. The current PE of 29.1 times is not only above the US Biotech industry average of 17.1 times but also higher than the market’s fair ratio of 27 times. This implies investors are paying a noticeable premium, which could limit further upside if growth falls short of expectations. Could this premium price become a risk if forecasts disappoint?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vertex Pharmaceuticals Narrative

If you want to dig into the data and shape your own view, you can create a customized narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vertex Pharmaceuticals.

Looking for More Smart Investment Moves?

Don’t just watch from the sidelines. These are the investment opportunities everyone will be talking about tomorrow, and you can get ahead now:

- Tap into the potential of artificial intelligence by evaluating these 25 AI penny stocks that are disrupting traditional sectors and shaping the future of automation and data-driven decision making.

- Maximize income with steady cash flow and growth by reviewing these 18 dividend stocks with yields > 3% that offer yields above 3% and have proven track records for reliable payouts.

- Stay ahead of market trends by researching these 79 cryptocurrency and blockchain stocks which power innovations in blockchain, decentralization, and secure digital payments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRTX

Vertex Pharmaceuticals

A biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF).

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives