Stock Analysis

- United States

- /

- Pharma

- /

- NasdaqGM:VRCA

3 High Insider Ownership US Stocks With Up To 52% Revenue Growth

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations with major indices showing minimal changes and investors anticipating rate cuts, it's a critical time to consider the stability and potential growth of companies. High insider ownership can be a strong signal of confidence in a company's future, particularly in such uncertain market conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.9% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 25.2% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.6% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 32.3% |

| Bridge Investment Group Holdings (NYSE:BRDG) | 11.3% | 98.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 39% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 94.7% |

We're going to check out a few of the best picks from our screener tool.

Verrica Pharmaceuticals (NasdaqGM:VRCA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Verrica Pharmaceuticals Inc. is a clinical-stage dermatology therapeutics company focused on developing medications for skin diseases in the United States, with a market capitalization of approximately $307.12 million.

Operations: The company generates revenue primarily from its pharmaceuticals segment, totaling $8.91 million.

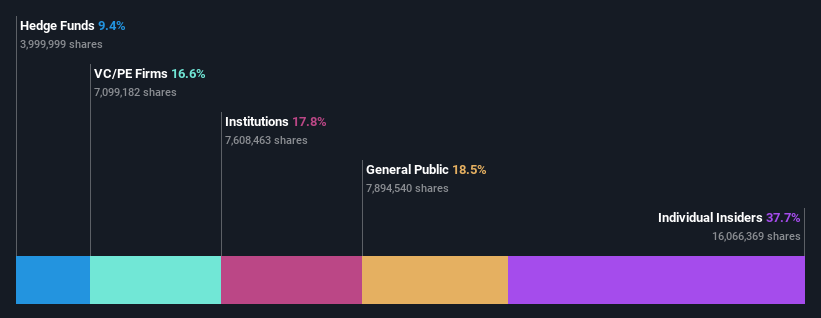

Insider Ownership: 38.2%

Revenue Growth Forecast: 49.8% p.a.

Verrica Pharmaceuticals, despite a volatile share price, shows promise with expected significant revenue growth (49.8% per year) and a path to profitability within three years. Recent strategic alliances and litigation settlements enhance its market position, although challenges include high insider selling and limited cash runway. The company's focus on expanding the treatment for common warts could tap into a substantial unmet medical need, potentially driving future growth if clinical outcomes are favorable.

- Get an in-depth perspective on Verrica Pharmaceuticals' performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Verrica Pharmaceuticals is priced higher than what may be justified by its financials.

Coastal Financial (NasdaqGS:CCB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Coastal Financial Corporation, serving as the bank holding company for Coastal Community Bank, offers banking products and services to small and medium-sized businesses, professionals, and individuals in Washington's Puget Sound region, with a market cap of approximately $710.29 million.

Operations: The bank's revenue is primarily generated through its CCBX and Community Bank segments, which respectively contribute $170.08 million and $166.08 million, alongside a smaller contribution of $9.31 million from its Treasury & Administration segment.

Insider Ownership: 18.8%

Revenue Growth Forecast: 53% p.a.

Coastal Financial's recent inclusion in multiple Russell indexes underscores its market recognition, aligning with a substantial $200 million shelf registration aimed at future growth. Although recent earnings show a dip in net income and EPS, the company is trading significantly below estimated fair value and forecasts suggest a robust annual revenue growth of 53% per year. Insider activity indicates more buying than selling, highlighting confidence from those closest to the company.

- Click to explore a detailed breakdown of our findings in Coastal Financial's earnings growth report.

- Our expertly prepared valuation report Coastal Financial implies its share price may be lower than expected.

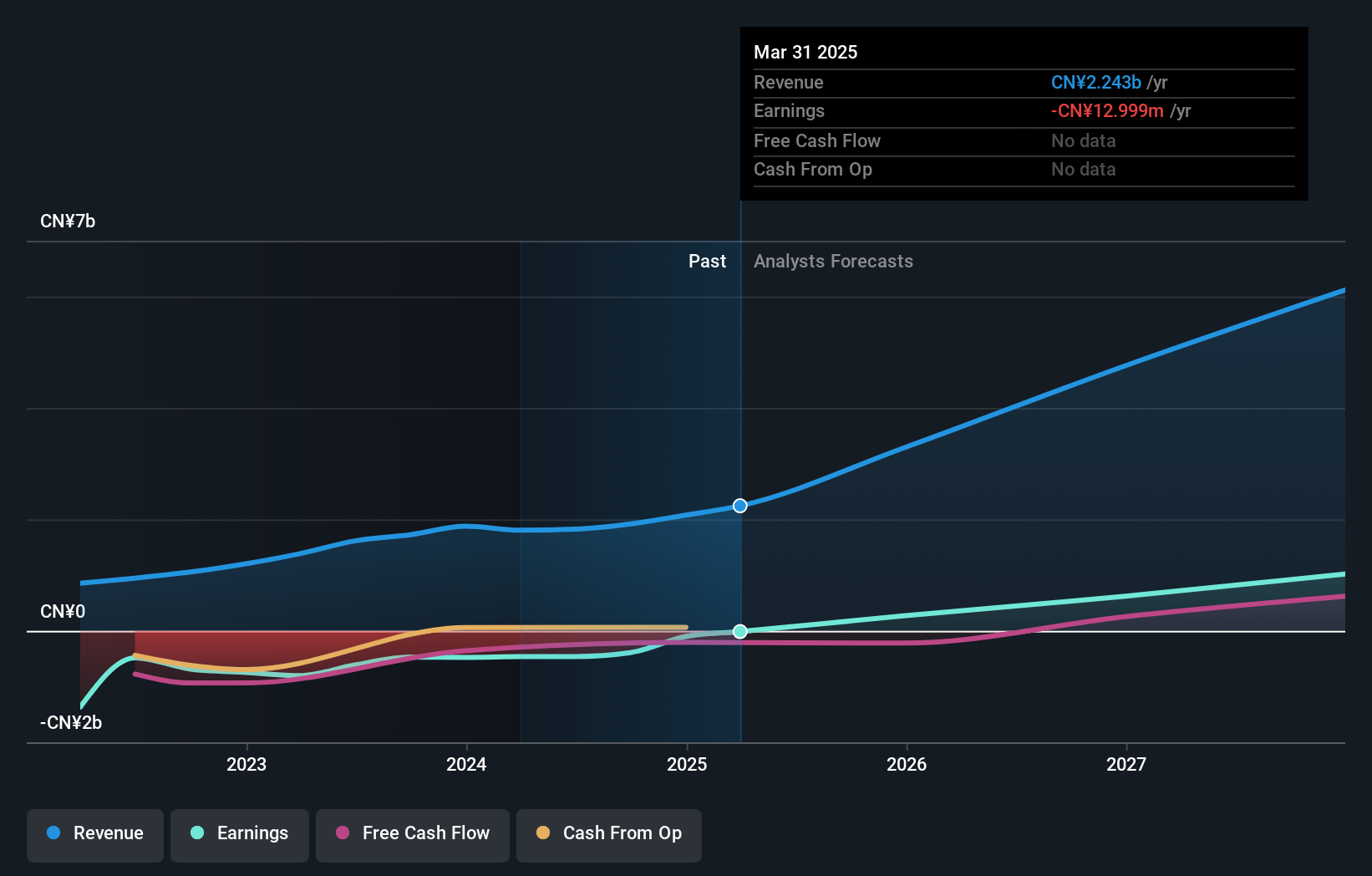

Hesai Group (NasdaqGS:HSAI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hesai Group operates globally, focusing on the development, manufacture, and sale of three-dimensional LiDAR solutions, with a market capitalization of approximately $583.85 million.

Operations: The company generates its revenue from the development, manufacture, and sale of 3D LiDAR solutions across Mainland China, Europe, and North America.

Insider Ownership: 24.4%

Revenue Growth Forecast: 26.5% p.a.

Hesai Group, a leader in lidar technology, is poised for significant growth with its exclusive deal to supply Baidu's robotaxi platform, potentially boosting revenues by US$200-300 million. Despite a recent net loss and executive turnover, Hesai's strong market presence—dominating 74% of the global robotaxi lidar market—and expected revenue growth of 26.5% per year outpace the broader US market significantly. However, its forecasted Return on Equity remains low at 11%.

- Take a closer look at Hesai Group's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Hesai Group is trading beyond its estimated value.

Taking Advantage

- Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 184 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VRCA

Verrica Pharmaceuticals

A clinical-stage dermatology therapeutics company, develops medications for the treatment of skin diseases in the United States.

High growth potential with mediocre balance sheet.