- United States

- /

- Hospitality

- /

- NasdaqCM:YTRA

October 2025's Noteworthy Penny Stocks

Reviewed by Simply Wall St

As the U.S. stock market rebounds with major indexes like the S&P 500 hitting new all-time highs, investors are keenly observing the Federal Reserve's recent interest rate cut amidst ongoing economic uncertainties. For those willing to explore beyond established giants, penny stocks—often representing smaller or newer companies—offer intriguing possibilities despite their somewhat antiquated label. In this article, we explore three penny stocks that showcase robust financial health and potential for significant growth, providing a chance to uncover hidden value in promising enterprises.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.96 | $437.18M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.93 | $712.48M | ✅ 4 ⚠️ 0 View Analysis > |

| Global Self Storage (SELF) | $4.993 | $57.14M | ✅ 5 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $1.89 | $23.62M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.58 | $654.03M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.96 | $7.05M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.82 | $86.32M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.40 | $11.54M | ✅ 2 ⚠️ 3 View Analysis > |

| Resources Connection (RGP) | $4.85 | $164.18M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 365 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Veru (VERU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Veru Inc. is a late clinical stage biopharmaceutical company that develops medicines for metabolic diseases, oncology, and viral-induced acute respiratory distress syndrome (ARDS), with a market cap of $58.75 million.

Operations: No specific revenue segments are reported for Veru Inc.

Market Cap: $58.75M

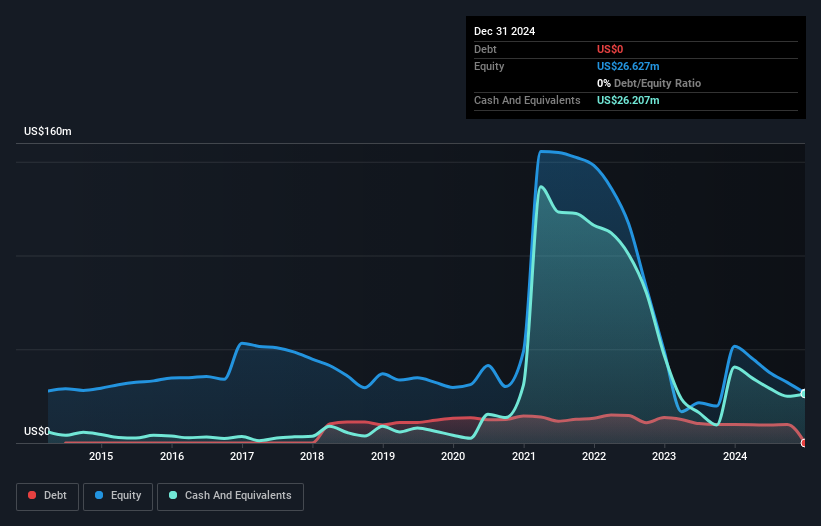

Veru Inc., a pre-revenue biopharmaceutical company, has recently gained FDA regulatory clarity for its enobosarm product candidate, offering potential in the obesity treatment market. Despite this progress, Veru faces financial challenges with less than a year of cash runway and persistent unprofitability. The company's stock is highly volatile and was recently dropped from the S&P Global BMI Index. However, Veru's debt-free status and favorable short-term asset position provide some financial stability amidst these uncertainties. Recent clinical successes may enhance its prospects if further supported by strategic developments and funding solutions.

- Get an in-depth perspective on Veru's performance by reading our balance sheet health report here.

- Gain insights into Veru's outlook and expected performance with our report on the company's earnings estimates.

Yatra Online (YTRA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Yatra Online, Inc. is an online travel company operating in India and internationally, with a market cap of $85.16 million.

Operations: The company's revenue is derived from three main segments: Air Ticketing, which generated ₹2.12 billion; Hotels and Packages, contributing ₹6.01 billion; and Other Services, accounting for ₹319.79 million.

Market Cap: $85.16M

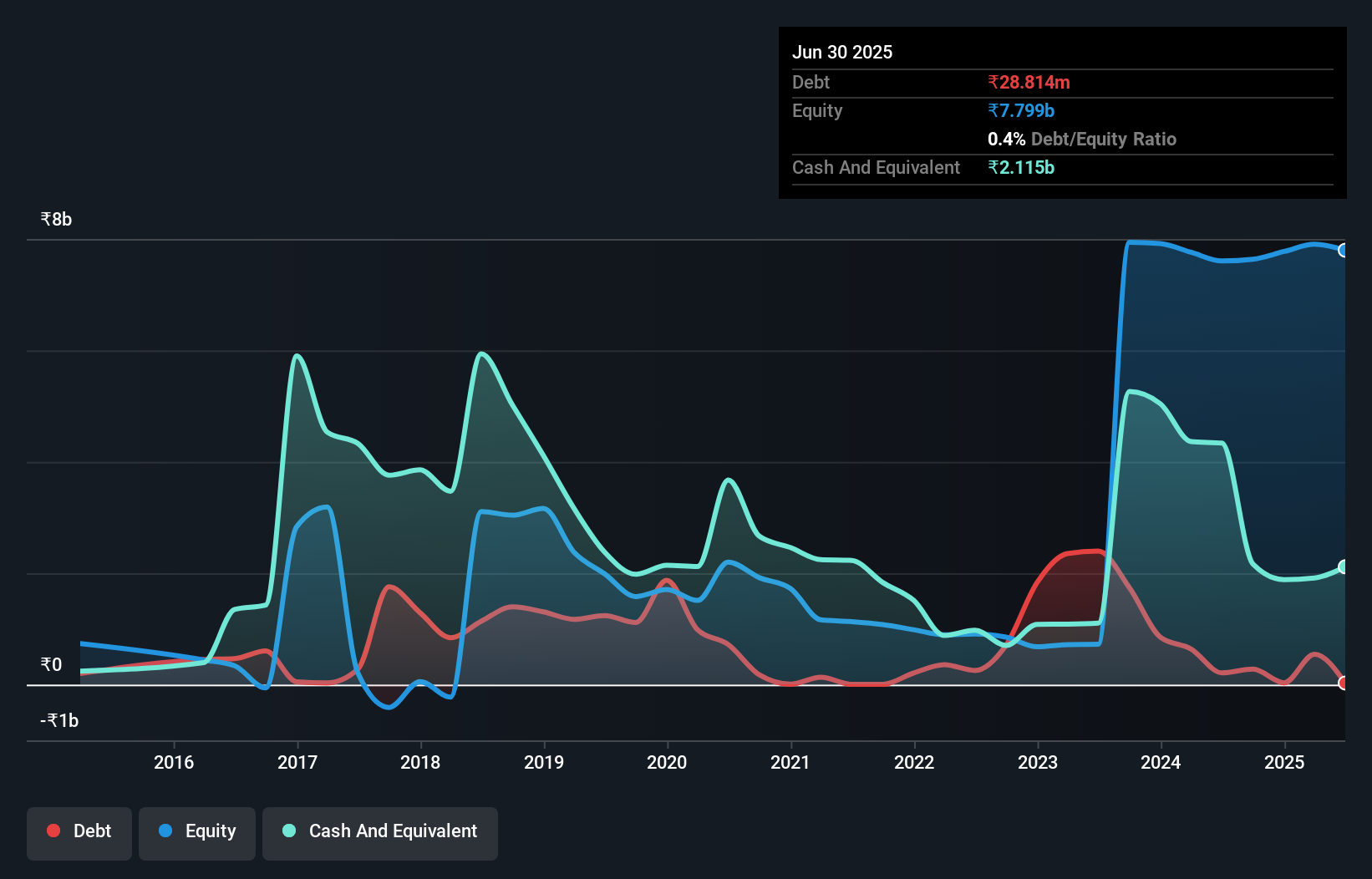

Yatra Online, Inc. has shown promising financial improvements despite being unprofitable, with a reduction in debt to equity ratio from 32.7% to 0.4% over five years and having more cash than total debt. Its short-term assets of ₹10.2 billion exceed both its short and long-term liabilities, providing a solid financial cushion. Recent earnings reports indicate revenue growth from ₹1,050.72 million to ₹2,098.14 million year-over-year with net income reaching INR 52.9 million compared to a prior net loss, reflecting operational progress amidst stable weekly volatility and no significant shareholder dilution recently noted.

- Click here and access our complete financial health analysis report to understand the dynamics of Yatra Online.

- Gain insights into Yatra Online's past trends and performance with our report on the company's historical track record.

ZJK Industrial (ZJK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ZJK Industrial Co., Ltd. operates through its subsidiaries to manufacture and sell precision fasteners, structural parts, and other precision metal products across China, Taiwan, Singapore, the United States, and internationally with a market cap of $195.19 million.

Operations: The company generates revenue from its Metal Products - Fasteners segment, amounting to $46.28 million.

Market Cap: $195.19M

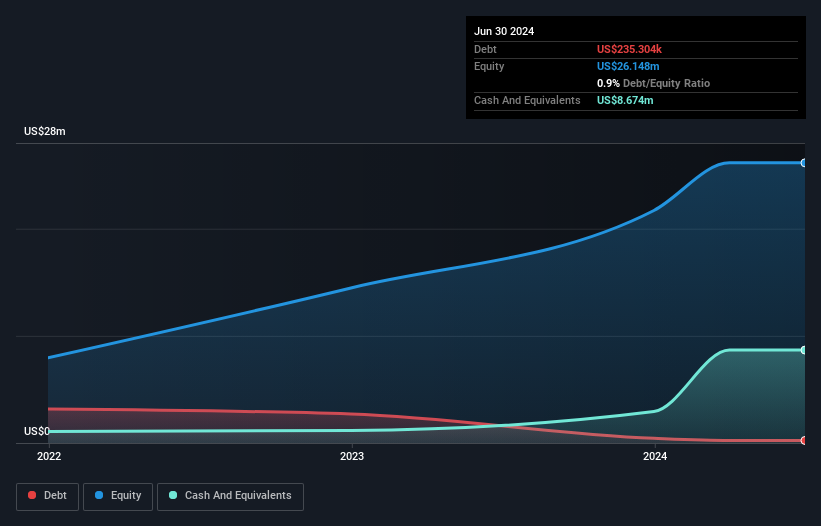

ZJK Industrial Co., Ltd. has recently enhanced its production capabilities with advanced technologies, including a six-flap eccentric chuck and semi-automatic punching equipment, which improve efficiency and reduce costs in producing complex components. Despite these operational advancements, the company faces challenges such as a volatile share price and negative earnings growth over the past year. Financially, ZJK maintains more cash than total debt and covers short-term liabilities with assets of US$51.1 million. However, it struggles with low return on equity at 11% and non-cash earnings impacting profit quality amidst an inexperienced board of directors.

- Take a closer look at ZJK Industrial's potential here in our financial health report.

- Examine ZJK Industrial's past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Navigate through the entire inventory of 365 US Penny Stocks here.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:YTRA

Yatra Online

Operates as an online travel company in India and internationally.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives