- United States

- /

- Biotech

- /

- NasdaqGM:VCYT

Should Early Validation of Decipher GRID for Prostate Cancer Personalization Prompt Action From Veracyte (VCYT) Investors?

Reviewed by Sasha Jovanovic

- Veracyte, Inc. recently announced that the first prospective validation data for a molecular signature to predict hormone therapy benefit in men with recurrent prostate cancer were presented at ASTRO 2025, using its Decipher GRID research tool.

- This development underscores Veracyte’s emphasis on clinically validated genomic innovations that could influence the personalization of prostate cancer treatment and research collaborations.

- We'll examine how these first-of-their-kind validation results from the Decipher GRID tool could shape Veracyte’s broader growth narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Veracyte Investment Narrative Recap

To be a shareholder in Veracyte, you need to believe in the growing relevance of genomics and precision medicine, especially in cancer diagnostics, and the company’s ability to sustain leadership through clinically validated tools like Decipher. The recent validation data presented at ASTRO 2025 reinforce Veracyte’s innovation focus but do not materially shift the near-term catalysts or mitigate the significant revenue concentration risk tied to its core products, which remains a key consideration for investors.

Among recent events, the August 27 publication highlighting the Decipher Prostate Genomic Classifier’s role in predicting chemotherapy benefit stands out. This aligns closely with the latest ASTRO data, providing complementary clinical validation that supports Veracyte’s pipeline-driven catalysts and helps strengthen the case for broader adoption and guideline inclusion.

Yet, in contrast to recent clinical momentum, investors should be aware that much of Veracyte’s revenue still depends on...

Read the full narrative on Veracyte (it's free!)

Veracyte's outlook anticipates $629.2 million in revenue and $121.9 million in earnings by 2028. This reflects a 9.5% annual revenue growth rate and an earnings increase of $95.6 million from the current $26.3 million.

Uncover how Veracyte's forecasts yield a $39.75 fair value, a 19% upside to its current price.

Exploring Other Perspectives

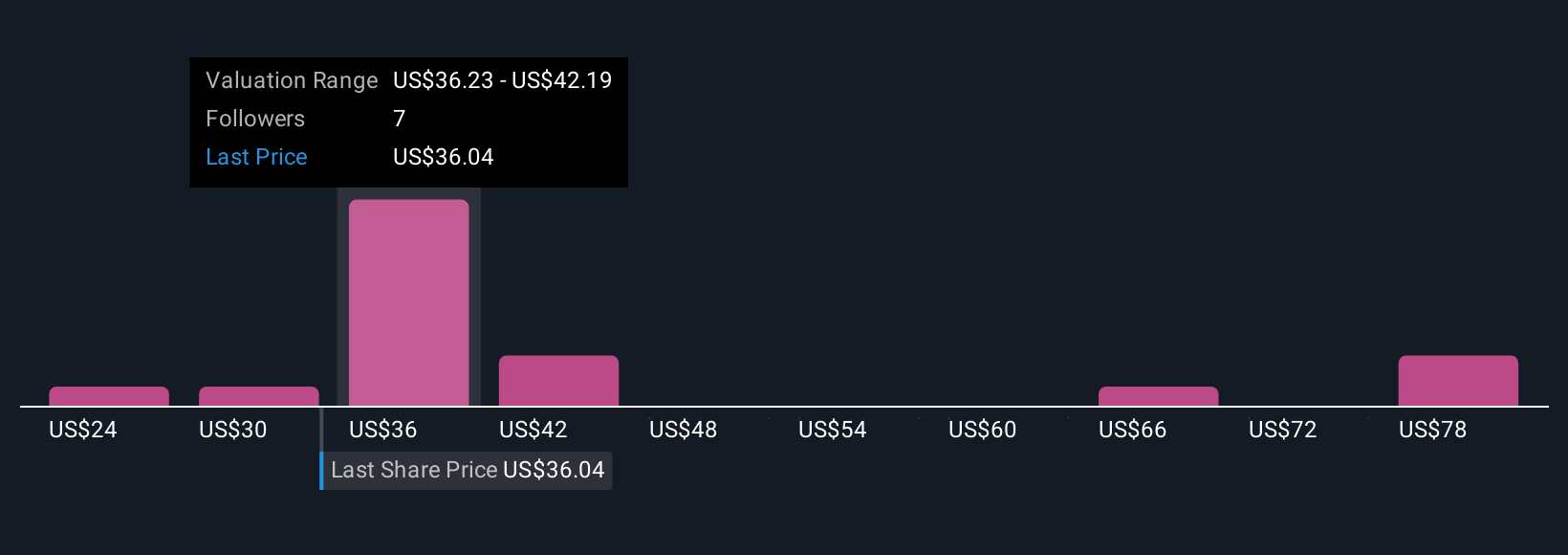

Fair value opinions from the Simply Wall St Community span US$24.31 to US$84.40 across 6 analyses. While optimism around the company’s genomic platforms is clear, concentration risk remains a crucial point to explore in forecasting Veracyte’s performance.

Explore 6 other fair value estimates on Veracyte - why the stock might be worth over 2x more than the current price!

Build Your Own Veracyte Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Veracyte research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Veracyte research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Veracyte's overall financial health at a glance.

No Opportunity In Veracyte?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VCYT

Veracyte

Operates as a diagnostics company in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A buy recommendation

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026