- United States

- /

- Biotech

- /

- NasdaqGS:UPB

Will Upstream Bio’s (UPB) Search for New Funding Reshape Its Long-Term Competitive Position?

Reviewed by Sasha Jovanovic

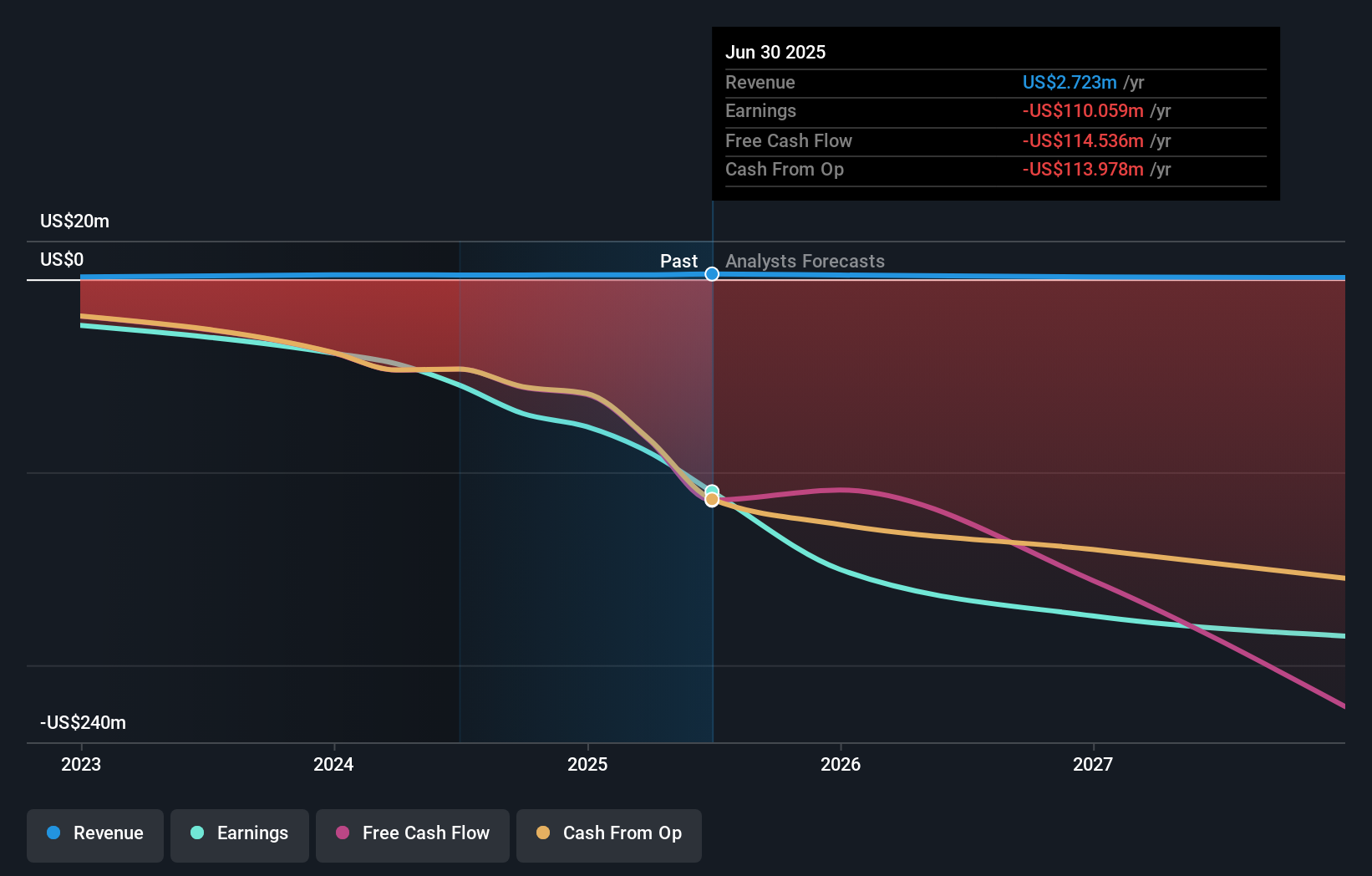

- Upstream Bio recently announced third quarter 2025 earnings, reporting sales of US$683,000 and a net loss of US$33.75 million, alongside the filing of a universal shelf registration for potential future offerings.

- The combination of widening net losses and the shelf registration filing highlights management's pursuit of new funding options as the company scales operations.

- We'll examine how the shelf registration filing and rising net losses shape Upstream Bio's evolving investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Upstream Bio's Investment Narrative?

For anyone considering Upstream Bio, the investment thesis leans on belief in verekitug’s commercial and clinical potential, coupled with rapidly scaling revenue. However, the latest quarterly numbers present new considerations. While revenue edged higher, net losses nearly doubled year-over-year, highlighting the significant cash burn as research and trials ramp up. The newly filed universal shelf registration signals that management is actively seeking flexibility to raise fresh capital, which may weigh on dilution risk in the near term. Short-term catalysts still center on clinical trial readouts for verekitug across multiple indications and the company’s inclusion in major biotech indexes. Yet, with losses accelerating and a capital raise likely on the table, near-term risks now tilt more toward balance sheet strength and the market’s appetite for more equity or debt funding. The announcement shifts the conversation from just product milestones to the risk of funding and its impact on shareholder value.

But beyond clinical milestones, the need for more funding has become harder for investors to ignore. According our valuation report, there's an indication that Upstream Bio's share price might be on the expensive side.Exploring Other Perspectives

Explore 2 other fair value estimates on Upstream Bio - why the stock might be worth over 3x more than the current price!

Build Your Own Upstream Bio Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Upstream Bio research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Upstream Bio research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Upstream Bio's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UPB

Upstream Bio

A clinical-stage biotechnology company, develops treatments for inflammatory diseases focusing on severe respiratory disorders.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.