- United States

- /

- Biotech

- /

- NasdaqCM:TYME

Tyme Technologies, Inc.'s (NASDAQ:TYME)) market cap declines to US$45m but insiders who sold US$871k stock were able to hedge their losses

Insiders at Tyme Technologies, Inc. (NASDAQ:TYME) sold US$871k worth of stock at an average price of US$0.78 a share over the past year, making the most of their investment. The company's market valuation decreased by US$11m after the stock price dropped 20% over the past week, but insiders were spared from painful losses.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we do think it is perfectly logical to keep tabs on what insiders are doing.

Check out our latest analysis for Tyme Technologies

The Last 12 Months Of Insider Transactions At Tyme Technologies

In the last twelve months, the biggest single purchase by an insider was when Independent Director David Carberry bought US$52k worth of shares at a price of US$1.03 per share. That means that an insider was happy to buy shares at above the current price of US$0.26. It's very possible they regret the purchase, but it's more likely they are bullish about the company. We always take careful note of the price insiders pay when purchasing shares. As a general rule, we feel more positive about a stock if insiders have bought shares at above current prices, because that suggests they viewed the stock as good value, even at a higher price.

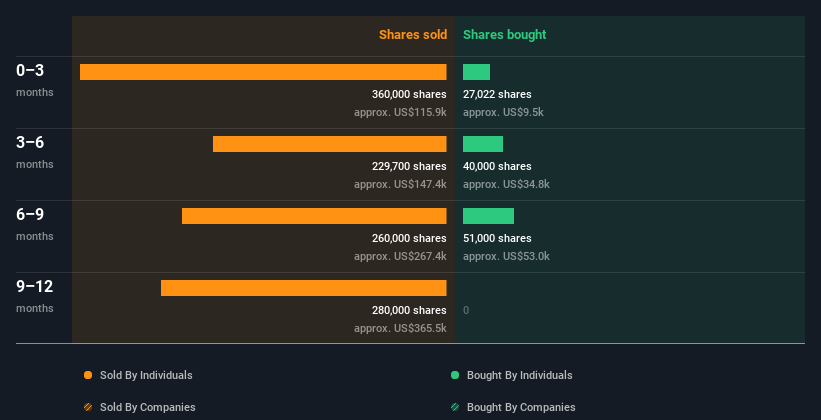

Over the last year, we can see that insiders have bought 118.02k shares worth US$97k. But they sold 1.11m shares for US$871k. Michael Demurjian ditched 1.11m shares over the year. The average price per share was US$0.78. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Tyme Technologies Insiders Are Selling The Stock

There was substantially more insider selling, than buying, of Tyme Technologies shares over the last three months. In total, insider Michael Demurjian sold US$116k worth of shares in that time. On the flip side, insiders spent US$9.3k on purchasing shares. We don't view these transactions as a positive sign.

Insider Ownership of Tyme Technologies

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. We usually like to see fairly high levels of insider ownership. Insiders own 26% of Tyme Technologies shares, worth about US$12m. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Does This Data Suggest About Tyme Technologies Insiders?

The insider sales have outweighed the insider buying, at Tyme Technologies, in the last three months. Zooming out, the longer term picture doesn't give us much comfort. Insider ownership isn't particularly high, so this analysis makes us cautious about the company. We're in no rush to buy! While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. To help with this, we've discovered 5 warning signs (2 are a bit concerning!) that you ought to be aware of before buying any shares in Tyme Technologies.

But note: Tyme Technologies may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Valuation is complex, but we're here to simplify it.

Discover if Tyme Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:TYME

Tyme Technologies

Tyme Technologies, Inc., a biotechnology company, develops cancer metabolism-based therapies (CMBTs) in the United States.

Flawless balance sheet and overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026