- United States

- /

- Biotech

- /

- NasdaqGS:TWST

Twist Bioscience (TWST) Is Up 18.0% After Exclusive Rapid Sequencing Integration With Element – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- On October 6, 2025, Twist Bioscience Corporation and Element Biosciences, Inc. announced the launch of the Trinity Freestyle Fast Hybridization workflow for Element’s AVITI sequencing platforms, offering a high-speed, scalable, end-to-end solution that enables researchers to process samples in as little as five hours.

- This collaboration grants Twist exclusive access to integrate the new workflow with its full range of library prep kits, enhancing both compatibility and performance across diverse genomic sequencing applications.

- We'll examine how Twist’s exclusive integration of a rapid workflow with Element’s AVITI platforms could impact the company’s growth outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Twist Bioscience Investment Narrative Recap

To be a Twist Bioscience shareholder, you need to believe in the company's ability to expand its reach in the growing genomics and synthetic biology markets through continual innovation, despite ongoing profitability challenges. The launch of the Trinity Freestyle Fast Hybridization workflow on Element’s AVITI platforms could help Twist reinforce its product integration advantage, supporting market adoption and customer retention, though the most immediate risk remains persistent losses and the potential for future capital raises, which could pressure shareholder value in the near term.

Of Twist’s recent announcements, the September 2025 collaboration with Synthetic Design Lab stands out in relation to the Trinity Freestyle partnership, as both efforts reflect the company’s focus on broadening its technology portfolio in fast-evolving research and therapeutic markets. By building out end-to-end solutions and strengthening partnerships, Twist aims to accelerate the adoption of its advanced DNA tools, which is central to its growth catalyst.

Yet, even as Twist moves quickly to commercialize new technology, investors should not overlook the risks around recurring revenue concentration with a handful of large NGS customers...

Read the full narrative on Twist Bioscience (it's free!)

Twist Bioscience's narrative projects $575.2 million in revenue and $92.4 million in earnings by 2028. This requires 16.7% yearly revenue growth and a $177.6 million increase in earnings from current earnings of $-85.2 million.

Uncover how Twist Bioscience's forecasts yield a $40.00 fair value, a 26% upside to its current price.

Exploring Other Perspectives

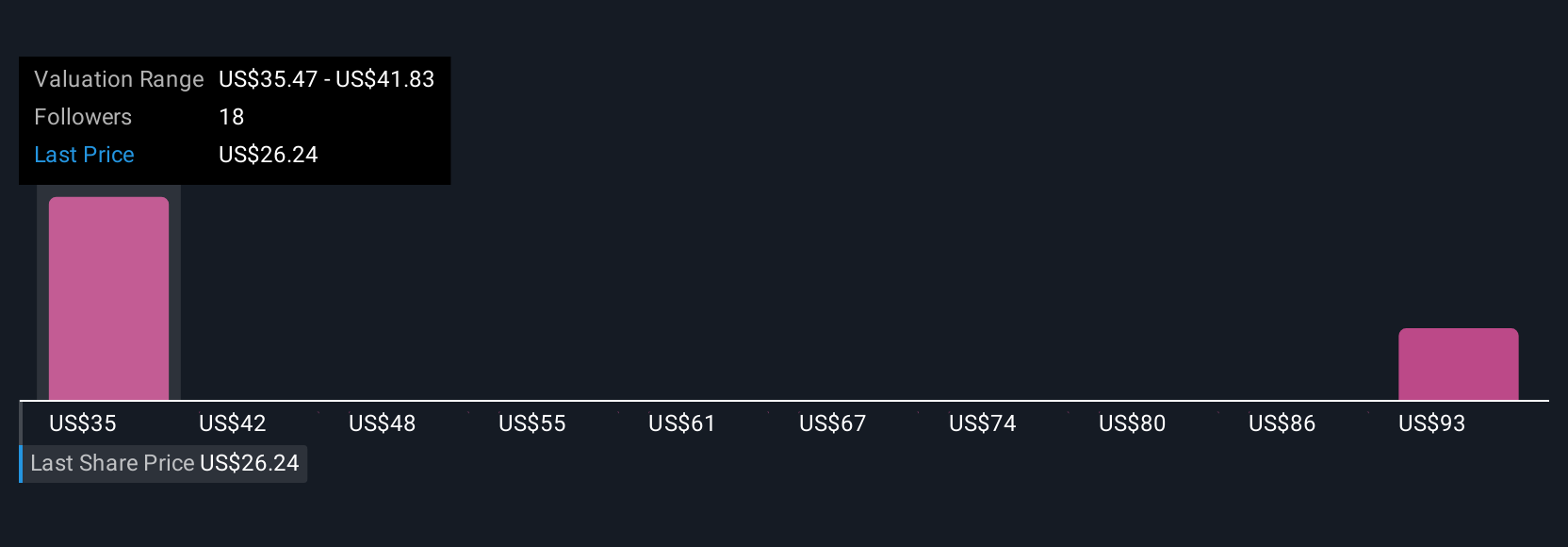

Three fair value estimates from the Simply Wall St Community range widely from US$35.47 up to US$98.86, showing sharply divided investor outlooks. While many see opportunity, persistent unprofitability and potential for additional capital raises remain factors that could shape Twist’s future direction, explore these alternative viewpoints to see where you stand.

Explore 3 other fair value estimates on Twist Bioscience - why the stock might be worth over 3x more than the current price!

Build Your Own Twist Bioscience Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Twist Bioscience research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Twist Bioscience research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Twist Bioscience's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Twist Bioscience might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TWST

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives