- United States

- /

- Biotech

- /

- NasdaqGS:TWST

How Investors Are Reacting To Twist Bioscience (TWST) Gaining Exclusive Access to Advanced Sequencing Workflow

Reviewed by Sasha Jovanovic

- On October 6, 2025, Element Biosciences and Twist Bioscience announced the launch of the new Trinity Freestyle Fast Hybridization workflow for Element’s AVITI sequencing platforms, providing a rapid, scalable, and user-friendly solution for genomic researchers.

- This expanded agreement gives Twist Bioscience exclusive access to the workflow with its entire lineup of library preparation kits, potentially enhancing compatibility and reinforcing the appeal of Twist’s synthetic DNA technology to a broader segment of sequencing users.

- We’ll explore how Twist’s exclusive access to the advanced sequencing workflow could influence its growth narrative and future market opportunities.

Find companies with promising cash flow potential yet trading below their fair value.

Twist Bioscience Investment Narrative Recap

Twist Bioscience’s growth story continues to rely on expanding its customer base, especially in next-generation sequencing (NGS), while managing both profitability and revenue concentration risks. The recent exclusive workflow agreement with Element Biosciences provides Twist with a differentiated platform, likely aiding the roll-out of innovative products and possibly enhancing short-term customer adoption, but does not materially reduce the company’s ongoing exposure to its top NGS customers or shift the near-term profitability outlook.

The August 2025 launch of the Twist Oncology DNA Comprehensive Genomic Profiling (CGP) Panel stands out as another move to broaden the addressable market, especially alongside the new workflow integration, which together aim to strengthen customer engagement and drive NGS revenue growth. These recent product introductions support Twist's catalyst of broadening market reach, a crucial factor for sustainable top-line momentum as competition intensifies.

By contrast, investors should consider the persistent risk tied to revenue concentration with just a handful of large NGS customers, as even a single lost relationship could...

Read the full narrative on Twist Bioscience (it's free!)

Twist Bioscience's narrative projects $575.2 million in revenue and $92.4 million in earnings by 2028. This requires 16.7% yearly revenue growth and a $177.6 million increase in earnings from the current -$85.2 million.

Uncover how Twist Bioscience's forecasts yield a $40.00 fair value, a 31% upside to its current price.

Exploring Other Perspectives

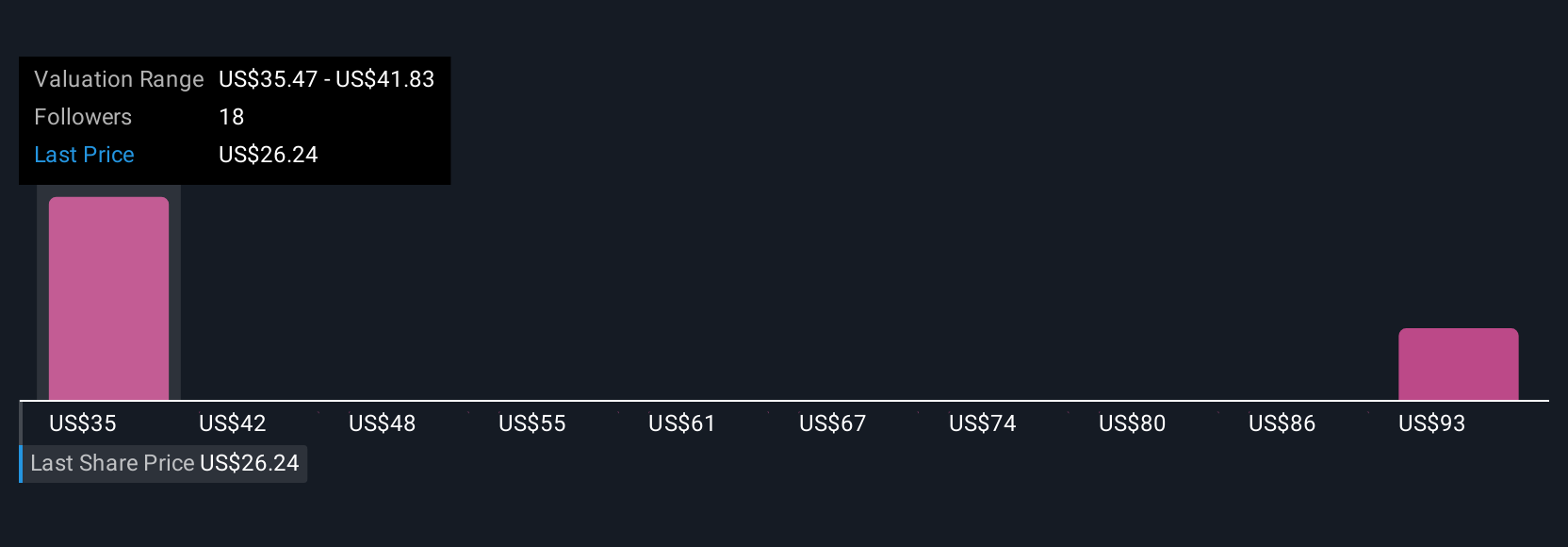

The Simply Wall St Community’s fair value opinions for Twist Bioscience span from US$35.47 to US$98.86, based on four separate estimates. While many see opportunity in recent product innovation, keep in mind that ongoing concentration of NGS revenue among a few customers could expose the company to abrupt changes in growth or earnings potential.

Explore 4 other fair value estimates on Twist Bioscience - why the stock might be worth just $35.47!

Build Your Own Twist Bioscience Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Twist Bioscience research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Twist Bioscience research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Twist Bioscience's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Twist Bioscience might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TWST

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives