- United States

- /

- Pharma

- /

- NasdaqCM:TVRD

Can Early REVERT Data Shape Tvardi Therapeutics' (TVRD) Path in the Pulmonary Fibrosis Market?

Reviewed by Sasha Jovanovic

- On October 13, 2025, Tvardi Therapeutics held a special call to provide an update on preliminary results from its Phase 2 REVERT trial evaluating a therapy for idiopathic pulmonary fibrosis.

- This update offers critical insight into the company’s research progress on a disease with limited treatment options and high unmet need.

- We’ll look at how the release of new clinical trial data frames Tvardi Therapeutics’ investment narrative and clinical development outlook.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

What Is Tvardi Therapeutics' Investment Narrative?

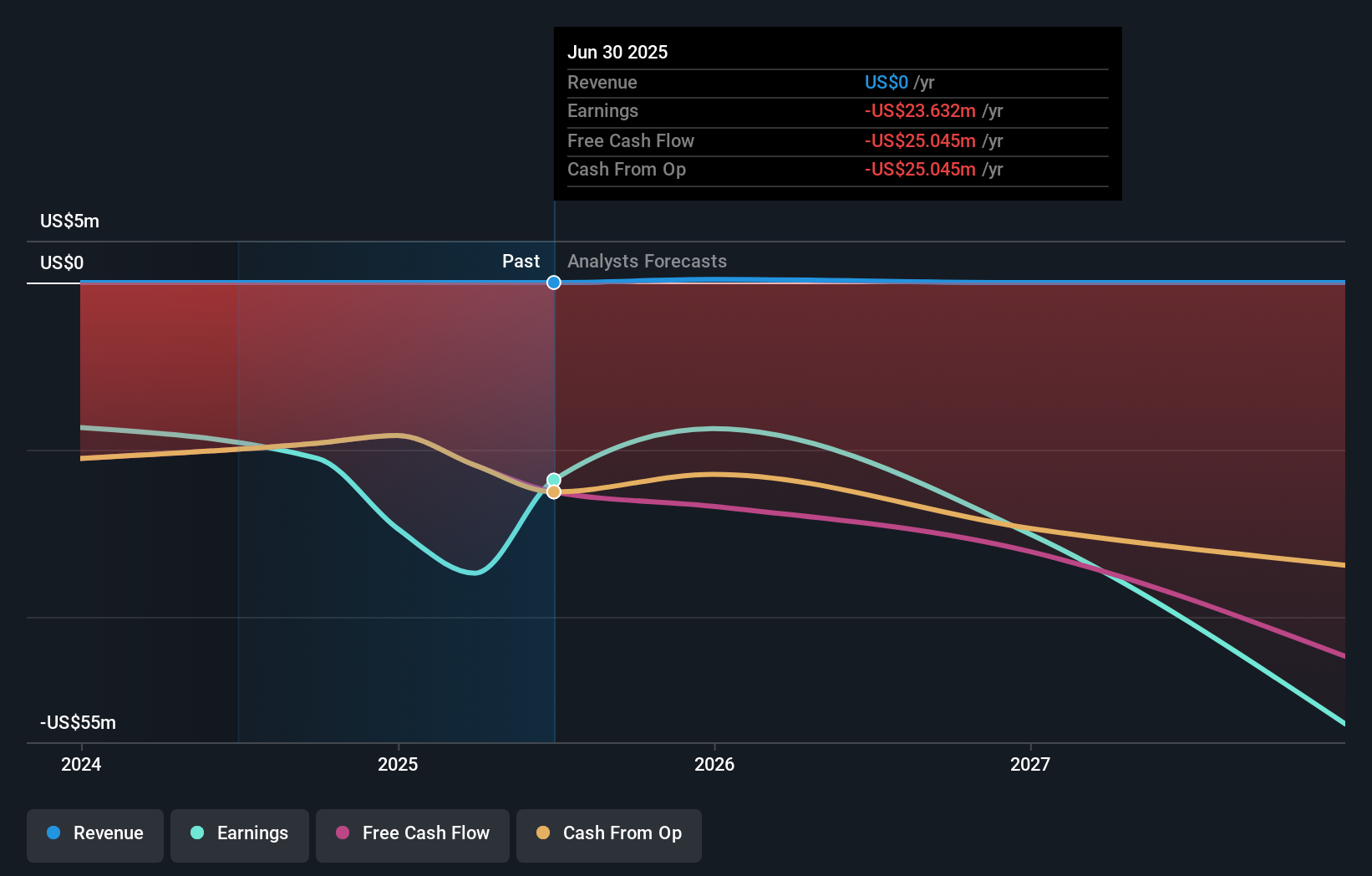

To be a shareholder in Tvardi Therapeutics, you need confidence in the company's innovative pipeline and potential to address severe unmet medical needs like idiopathic pulmonary fibrosis. The special call and fresh preliminary data from the Phase 2 REVERT trial provide a first look at Tvardi’s lead candidate, which is a key short-term catalyst and could signal a step forward for the business. However, the vast share price decline following the event implies that the news may not have delivered the strength or clarity the market was hoping for, at least in the short term. This shifts focus toward ongoing trial updates, regulatory feedback, and the company’s ability to stabilize finances, especially with auditor “going concern” remarks still unresolved. The release may not be the breakthrough needed to counter the biggest risks: persistent losses, limited cash runway, and market volatility amid patchy clinical progress.

In contrast, questions around liquidity and long-term funding remain crucial for investors to understand.

Exploring Other Perspectives

Build Your Own Tvardi Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tvardi Therapeutics research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Tvardi Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tvardi Therapeutics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Tvardi Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TVRD

Tvardi Therapeutics

A clinical-stage biopharmaceutical company, engages in the development of novel, oral, and small molecule therapies targeting STAT3 to treat fibrosis-driven diseases with significant unmet need in the United States.

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion