- United States

- /

- Pharma

- /

- NasdaqGS:TLRY

Tilray (NasdaqGS:TLRY) Valuation in Focus After 42% Monthly Share Price Surge

Reviewed by Kshitija Bhandaru

Tilray Brands (NasdaqGS:TLRY) shares have experienced a wide range of moves this year as the market weighs the company’s prospects. The stock has climbed 42% over the past month, drawing investor attention.

See our latest analysis for Tilray Brands.

After a lengthy slump, Tilray's 42% share price return for the month is the latest in a string of sharp moves, following a 5% gain in the last day alone. While that has sparked some renewed optimism, total shareholder return across one year remains modest at 6%, and the long-term picture is still recovering from a steep decline.

If momentum shifts like this have you on the lookout for growth stories, it is a good opportunity to discover fast growing stocks with high insider ownership.

The recent surge in Tilray’s share price raises a critical question for investors: Is the current rally a sign of underlying value, or is future growth already reflected in the stock’s price?

Most Popular Narrative: 51% Overvalued

Tilray Brands’ most widely followed narrative points to a fair value well below the current market price, with analysts anchored on the company’s evolving global strategy. Expectations of significant operational catalysts and international demand are at the heart of this calculation.

Tilray's international cannabis business is achieving rapid organic growth, with European cannabis revenue up 112% YoY (excluding Australia) and significant share gains in Germany due to regulatory tailwinds, broader medical adoption, and expanding legalization. These factors support a long runway for top-line revenue acceleration as global cannabis markets open.

Think global expansion means automatic upside? The consensus narrative is powered by assumptions of sustained revenue growth, expanding margins, and major industry breakthroughs. Want to see exactly how these pivotal forecasts drive the premium versus fair value? The next section unlocks the full rationale.

Result: Fair Value of $1.11 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent delays in U.S. legalization and ongoing price pressures in Canada could easily stall Tilray’s progress and limit growth, despite promising global trends.

Find out about the key risks to this Tilray Brands narrative.

Another View: Value Signals from Industry Comparisons

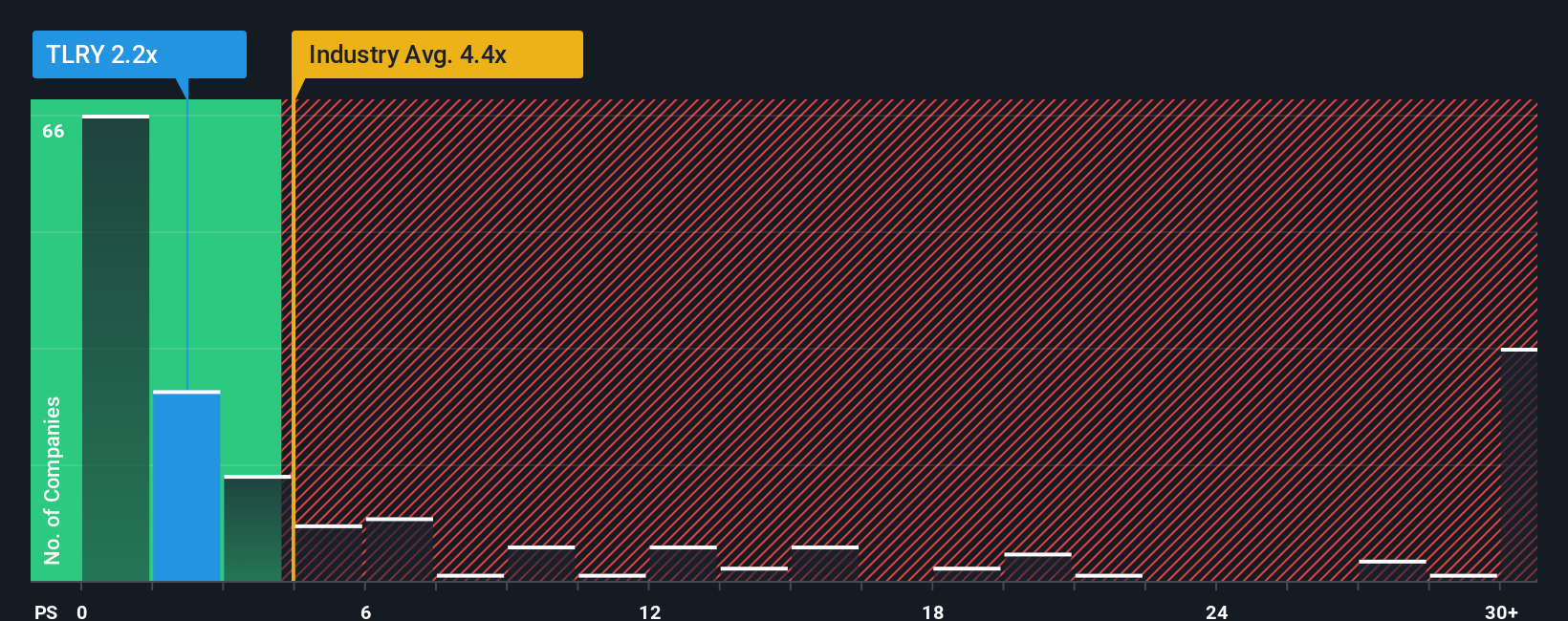

Looking past future profits, Tilray trades at a price-to-sales ratio of 2.3x, which is lower than both the US Pharmaceuticals industry average of 4.4x and the peer average of 12.2x. This suggests the market may be discounting risk, or could be overlooking potential upside if business conditions turn.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tilray Brands Narrative

If you want to dive into the numbers and shape your own view, you can easily build a narrative of your own in just a few minutes. Do it your way.

A great starting point for your Tilray Brands research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Turn the energy from Tilray’s moves into real opportunities. Step up your investing game before the market’s next shift leaves you catching up.

- Boost your search for rising income by checking out these 18 dividend stocks with yields > 3%, which offers strong yields above 3% and robust fundamentals to back them up.

- Scout promising tech players positioned at the crossroads of health and innovation by browsing these 33 healthcare AI stocks, now reshaping patient care with artificial intelligence.

- Seize the moment with these 874 undervalued stocks based on cash flows to spot shares trading below their true worth and give your portfolio a timely edge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tilray Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLRY

Tilray Brands

A lifestyle consumer products company, engages in the research, cultivation, processing, and distribution of medical cannabis products in Canada, the United States, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives