- United States

- /

- Pharma

- /

- NasdaqGS:TLRY

Tilray Brands (NasdaqGS:TLRY) Faces Nasdaq Compliance Challenge Amid 11% Decline Last Month

Reviewed by Simply Wall St

Tilray Brands (NasdaqGS:TLRY) is facing compliance challenges as it received a notice from Nasdaq for not meeting the $1.00 minimum bid price requirement. This notice comes amid the company's efforts to reintroduce Hi*Ball Energy beverages through Whole Foods Market and expand its Runner's High Brewing distribution. The stock's 11% decline over the past month could be partly influenced by these developments, alongside broader market pressures, including a sharp 5% decline in the Nasdaq amid fears of a trade war and economic recession, emphasizing the challenging landscape for Tilray Brands as it navigates these turbulent times.

Buy, Hold or Sell Tilray Brands? View our complete analysis and fair value estimate and you decide.

Find companies with promising cash flow potential yet trading below their fair value.

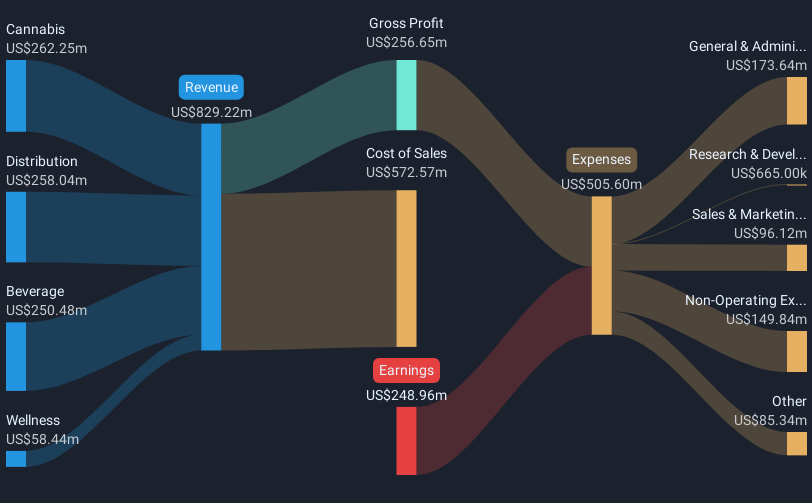

In the past year, Tilray Brands experienced a substantial total shareholder return decline of 76.94%. The company's performance notably lagged behind both the US market and the US Pharmaceuticals industry, which saw returns of 3.3% and a decline of 4.3%, respectively, over the same period. Several key factors contributed to this underperformance. The Q2 2025 earnings report highlighted a widening net loss of US$85.34 million, compared to US$46.18 million in the previous year, despite increased sales. Challenges also arose with compliance issues when a Nasdaq notice was issued for not meeting the minimum bid price requirement.

Tilray made efforts to expand its product lineup and market reach, which included launching new cannabis beverages and expanding Runners High Brewing's distribution. However, these moves were partially overshadowed by legal hurdles, such as a CAD 30 million settlement related to the Aphria Canadian Class Action, impacting investor confidence. Despite these efforts, the challenges faced reflected in the overall shareholder returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tilray Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLRY

Tilray Brands

A lifestyle consumer products company, engages in the research, cultivation, processing, and distribution of medical cannabis products in Canada, the United States, Europe, Australia, New Zealand, Latin America, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives