- United States

- /

- Pharma

- /

- NasdaqGS:TLRY

Can Tilray’s 57% Rally Signal a New Trend or Another Bubble in 2025?

Reviewed by Bailey Pemberton

If you have ever found yourself agonizing over whether to hold, buy, or move on from Tilray Brands, you are definitely not alone. The stock has been on quite a rollercoaster, grabbing attention from traders and long-term investors alike. In just the past month, Tilray Brands saw its price shoot up by an impressive 57.8%. Even over the last week, the stock has tacked on another 6.2%, suggesting genuine momentum. That being said, anyone who has followed Tilray for more than a few years knows this company has seen long-term declines, with a 3-year return of -45.2%. Still, the year-to-date number sits at 17.8% and the 1-year return at 5.5%, hinting that shifts in market regulation and renewed interest in cannabis may be lifting sentiment, or at least changing perceptions of risk.

With Tilray Brands closing at $1.72 most recently, the big question is whether this is a company being rediscovered by the market or just another swing in a notoriously volatile sector. To figure that out, it helps to look at the numbers. Out of six major valuation checks, Tilray scores a 3, meaning it might be undervalued in half of the most important ways experienced investors use to assess a stock. But is that enough to call it a bargain, or is there more to the story?

In the next section, we will break down the different valuation methods used to analyze companies like Tilray and why a single score only scratches the surface. Stick around for a final look at the smarter way to size up a company’s real worth.

Approach 1: Tilray Brands Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model works by estimating the future cash flows a business is expected to generate and then discounting them back to today's value. This allows investors to estimate how much a company is intrinsically worth, based on its ability to generate cash going forward.

For Tilray Brands, the most recent Free Cash Flow stands at negative $93.4 million, meaning the company is currently operating with negative cash flow. According to analyst projections, Tilray's Free Cash Flow could turn positive and reach $43 million in 2030, with incremental increases each year. The first five years of projections are based on analyst estimates, while further figures come from extended extrapolations.

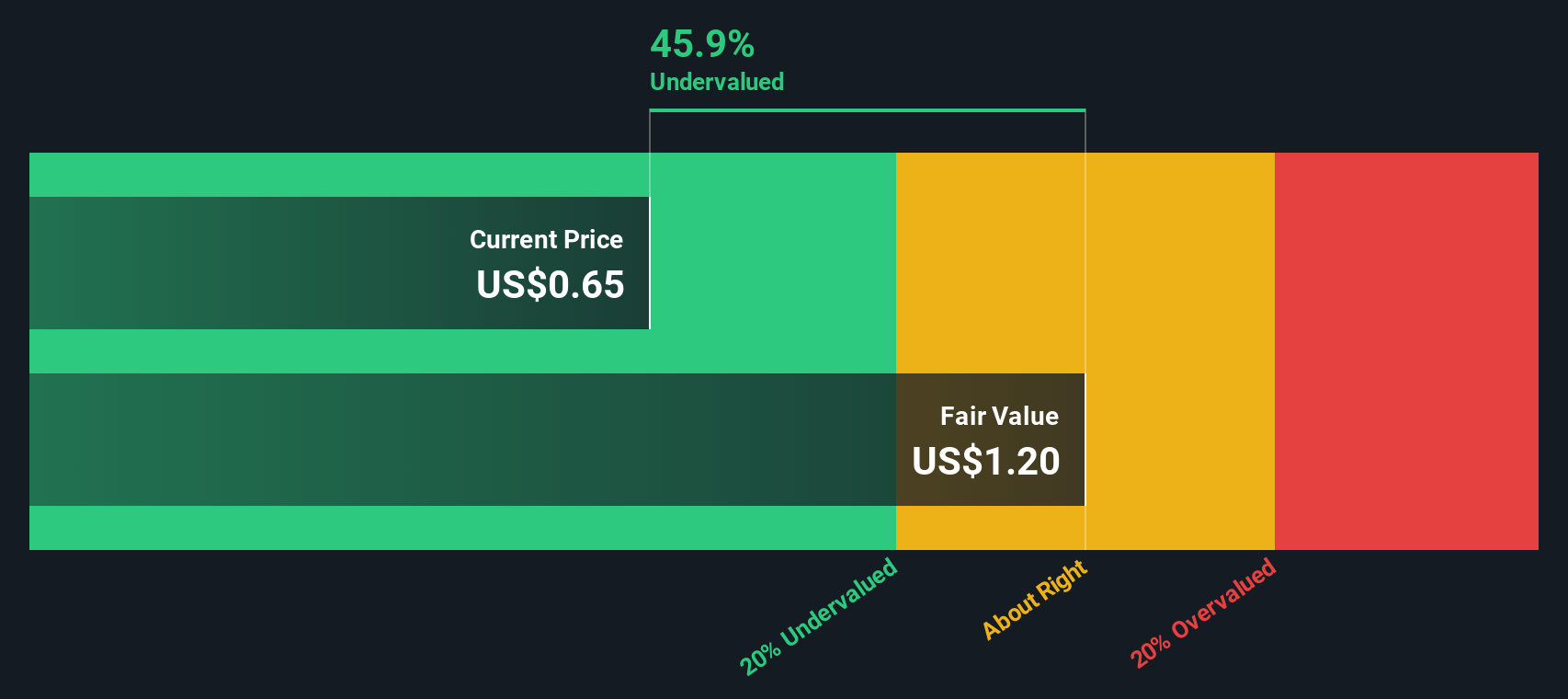

Using these projected numbers and discounting them back to the present, the DCF model calculates an estimated intrinsic value for Tilray Brands of $1.14 per share. In comparison to its latest closing share price of $1.72, this means the stock is approximately 50.3 percent overvalued.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Tilray Brands may be overvalued by 50.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Tilray Brands Price vs Sales

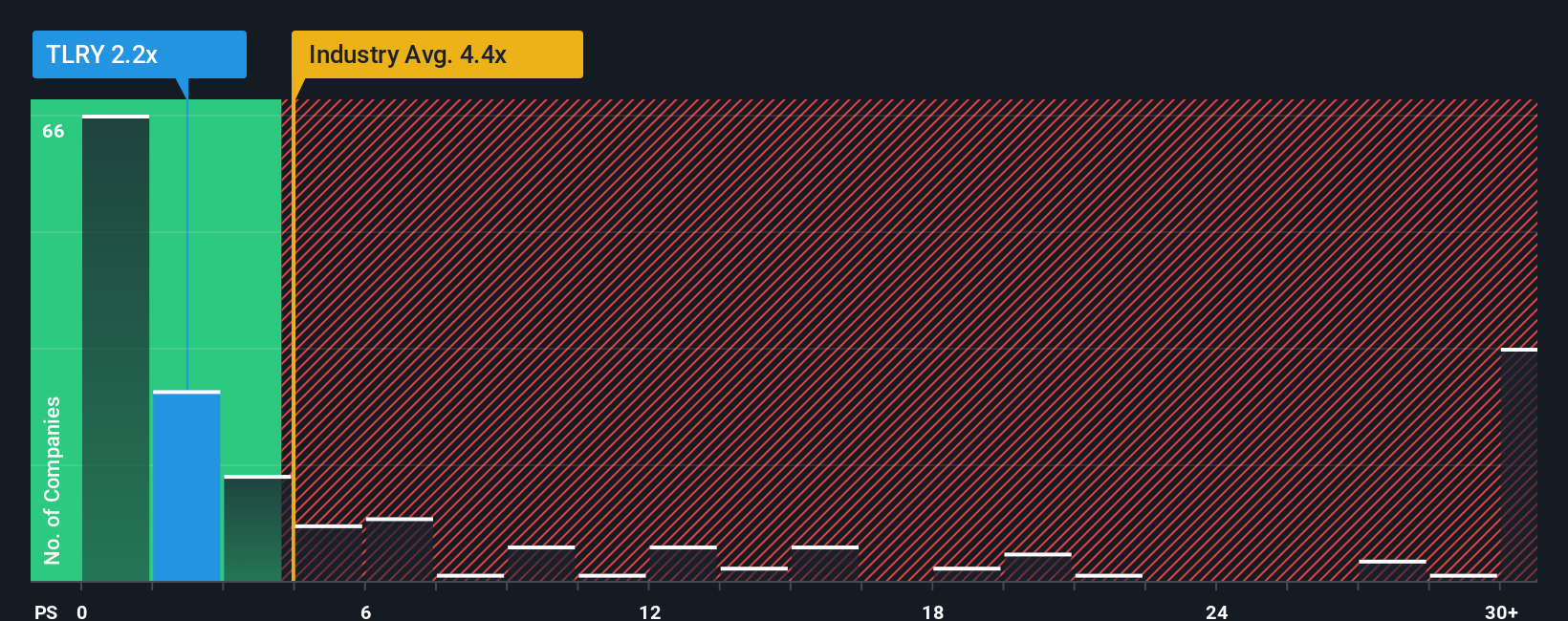

The price-to-sales (P/S) ratio is a favored valuation metric for companies like Tilray Brands, especially when profits are inconsistent or negative, as it focuses on the company’s revenues rather than earnings. For businesses still establishing profitability, sales-based multiples help investors compare growth-stage companies with their peers and industry benchmarks in a more meaningful way.

Growth expectations and risk play a key role in determining a "fair" P/S ratio. Higher growth and lower risk tend to justify higher multiples, while slower growth or elevated risks usually call for a discount. Comparing Tilray’s current P/S ratio of 2.3x with the pharmaceuticals industry average of 4.6x and the peer group average of 11.9x suggests that the stock is trading at a significant discount relative to both its industry and direct competitors.

However, Simply Wall St’s proprietary Fair Ratio reveals a more tailored perspective. This metric considers not just the company’s growth prospects, but also its risks, profit margins, industry characteristics, and market capitalization to set a context-specific benchmark. In this case, the benchmark for Tilray is 2.5x. This approach gives a much clearer and more nuanced understanding of true value than simply comparing cohort averages or industry norms.

With Tilray's actual P/S ratio at 2.3x and the Fair Ratio at 2.5x, the two figures are in close alignment. This indicates that, based on the price-to-sales approach, the stock is valued about right for its current situation and outlook.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tilray Brands Narrative

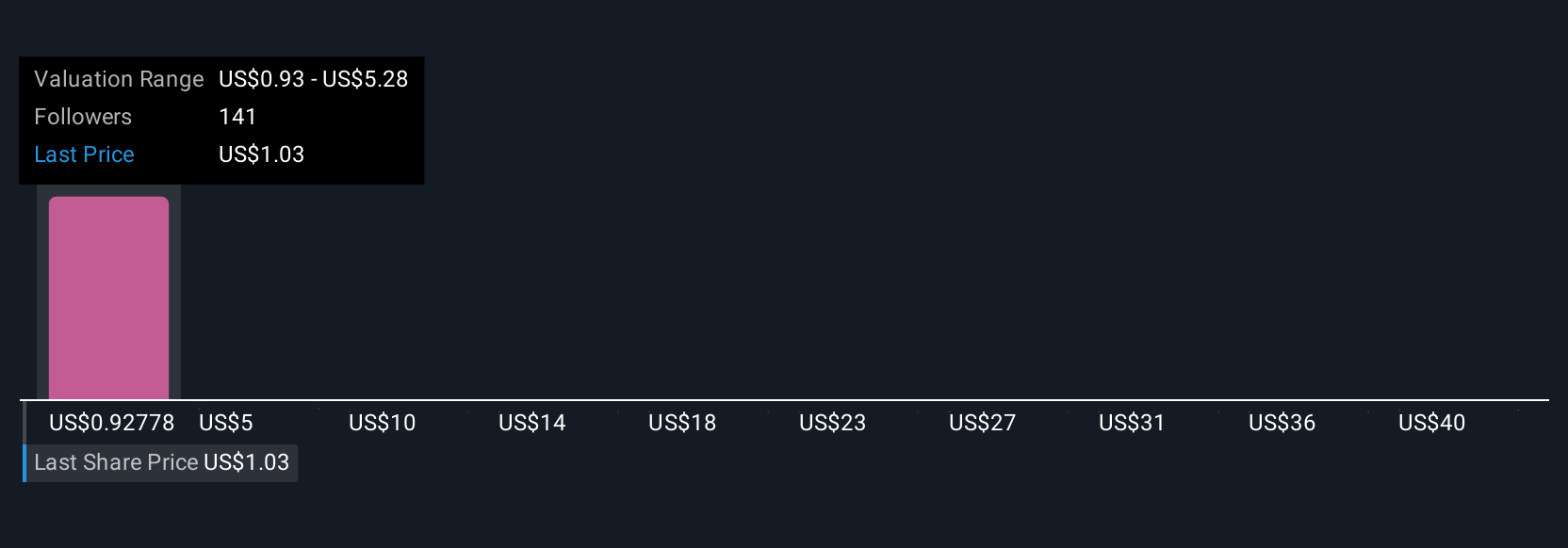

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is the story you tell about a company, your personal perspective that connects the company’s journey, its prospects, and your own future estimates into one easy-to-understand vision.

With Narratives, you take what you believe about Tilray Brands, such as how markets will evolve, what growth or margins are realistic, or which risks are worth worrying about, and link these views directly to your own financial forecasts and a fair value calculation. Instead of just crunching numbers, you see how your outlook lines up with what’s happening in the real world.

This tool is designed to be accessible and is available right now on Simply Wall St’s Community page, trusted by millions of investors. Narratives help you decide whether to buy or sell by showing how your fair value compares with the current price in real time. Even better, Narratives update automatically as new news, earnings releases, or regulatory changes come in so your viewpoint and estimates always stay up to date.

For example, with Tilray Brands, one investor may use a bullish Narrative based on fast European growth and price regulatory tailwinds to set a fair value as high as $1.50, while another may highlight persistent losses and slow U.S. reforms and see fair value closer to $0.60. Narratives empower you to invest with clarity, confidence, and your own story behind every number.

Do you think there's more to the story for Tilray Brands? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tilray Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLRY

Tilray Brands

A lifestyle consumer products company, engages in the research, cultivation, processing, and distribution of medical cannabis products in Canada, the United States, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives