- United States

- /

- Biotech

- /

- NasdaqCM:TGTX

Upgrade: Analysts Just Made A Stunning Increase To Their TG Therapeutics, Inc. (NASDAQ:TGTX) Forecasts

TG Therapeutics, Inc. (NASDAQ:TGTX) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. The consensus statutory numbers for both revenue and earnings per share (EPS) increased, with their view clearly much more bullish on the company's business prospects.

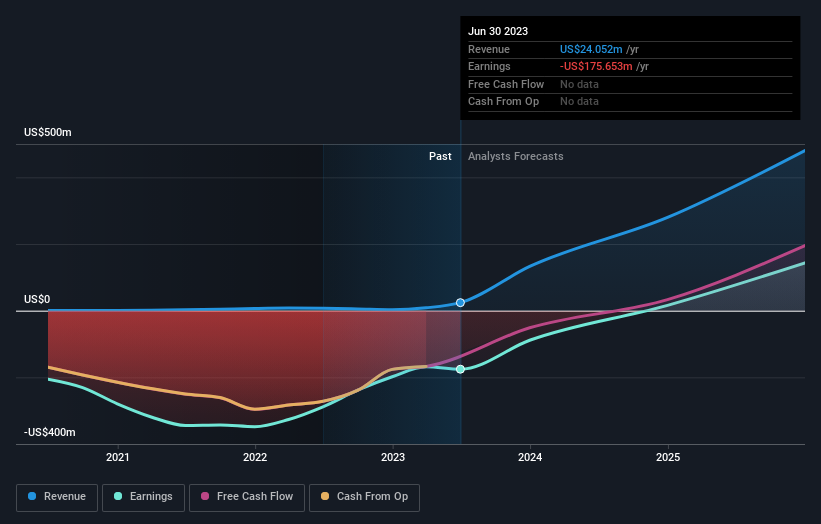

After this upgrade, TG Therapeutics' eight analysts are now forecasting revenues of US$126m in 2023. This would be a substantial 425% improvement in sales compared to the last 12 months. The loss per share is anticipated to greatly reduce in the near future, narrowing 48% to US$0.65. Yet prior to the latest estimates, the analysts had been forecasting revenues of US$91m and losses of US$0.89 per share in 2023. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a sizeable increase to their revenue forecasts while also reducing the estimated loss as the business grows towards breakeven.

Check out our latest analysis for TG Therapeutics

Yet despite these upgrades, the analysts cut their price target 8.4% to US$29.06, implicitly signalling that the ongoing losses are likely to weigh negatively on TG Therapeutics' valuation. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. There are some variant perceptions on TG Therapeutics, with the most bullish analyst valuing it at US$41.00 and the most bearish at US$6.00 per share. As you can see the range of estimates is wide, with the lowest valuation coming in at less than half the most bullish estimate, suggesting there are some strongly diverging views on how think this business will perform. As a result it might not be possible to derive much meaning from the consensus price target, which is after all just an average of this wide range of estimates.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. The analysts are definitely expecting TG Therapeutics' growth to accelerate, with the forecast 25x annualised growth to the end of 2023 ranking favourably alongside historical growth of 75% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 16% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that TG Therapeutics is expected to grow much faster than its industry.

The Bottom Line

The highlight for us was that the consensus reduced its estimated losses this year, perhaps suggesting TG Therapeutics is moving incrementally towards profitability. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. A lower price target is not intuitively what we would expect from a company whose business prospects are improving - at least judging by these forecasts - but if the underlying fundamentals are strong, TG Therapeutics could be one for the watch list.

These earnings upgrades look like a sterling endorsement, but before diving in - you should know that we've spotted 4 potential concerns with TG Therapeutics, including recent substantial insider selling. You can learn more, and discover the 3 other concerns we've identified, for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if TG Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:TGTX

TG Therapeutics

A commercial stage biopharmaceutical company, focuses on the acquisition, development, and commercialization of novel treatments for B-cell mediated diseases in the United States and internationally.

Exceptional growth potential with excellent balance sheet.