- United States

- /

- Biotech

- /

- NasdaqCM:TGTX

Is TG Therapeutics Still Attractively Priced After Recent Multiple Sclerosis Expansion Progress?

Reviewed by Bailey Pemberton

- If you are wondering whether TG Therapeutics is still a smart bet at around $30 a share, you are not alone. This stock sits right in the crosshairs of growth hopes and valuation worries.

- Despite being down 8.3% over the last week, 9.1% over the past month, and 9.6% over the last year, the stock is still up 268.6% over three years, a pattern that often signals shifting risk perceptions rather than a simple boom-or-bust story.

- Recent headlines have focused on the company’s progress in expanding the market for its multiple sclerosis treatment and its strategic positioning in neurology, which has kept TG Therapeutics on the radar of both institutional and retail investors. At the same time, ongoing discussions around competition in MS therapies and regulatory scrutiny have added a layer of uncertainty that helps explain the choppy share price.

- On our valuation checks TG Therapeutics scores a 5/6, which suggests potential undervaluation. Next, we will unpack what that means under different valuation approaches, and later on we will look at an even more practical way to judge whether the current price really makes sense for long term investors.

Find out why TG Therapeutics's -9.6% return over the last year is lagging behind its peers.

Approach 1: TG Therapeutics Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today to account for risk and the time value of money.

For TG Therapeutics, the latest twelve months Free Cash Flow is around negative $70.2 Million. This means the business is still investing heavily rather than throwing off excess cash. Analysts expect this to change meaningfully, with Simply Wall St using a 2 stage Free Cash Flow to Equity model that builds on analyst forecasts to 2029 and then extrapolates growth further. Under this framework, free cash flow is projected to rise to roughly $1.11 Billion by 2035, with intermediate steps such as $316.2 Million in 2026 and $678.9 Million in 2029.

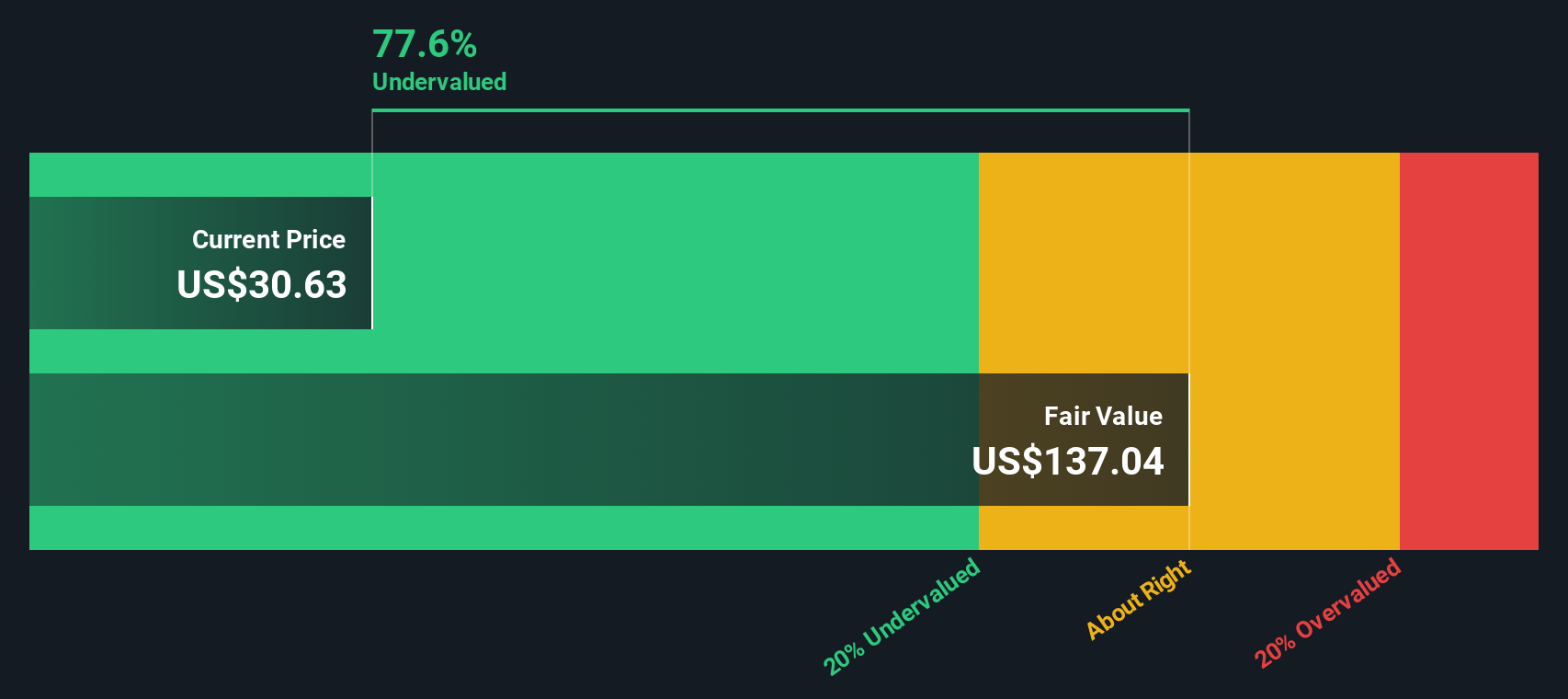

Discounting those projected cash flows back to today in dollar terms leads to an estimated intrinsic value of about $137.04 per share. Compared with a current share price near $30, the model suggests the stock is roughly 77.6% undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests TG Therapeutics is undervalued by 77.6%. Track this in your watchlist or portfolio, or discover 930 more undervalued stocks based on cash flows.

Approach 2: TG Therapeutics Price vs Earnings

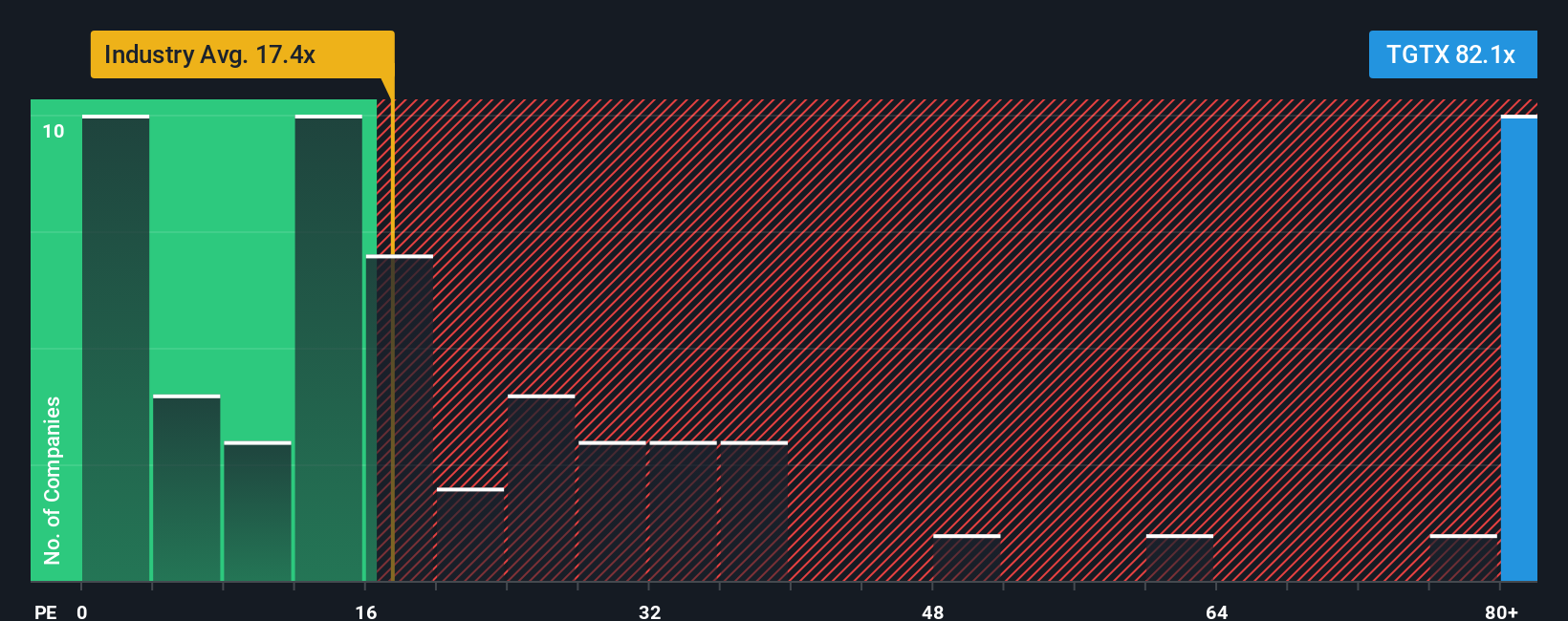

For profitable companies like TG Therapeutics, the price to earnings (PE) ratio is a practical way to gauge whether investors are paying a reasonable price for each dollar of earnings. A higher PE can be justified when markets expect strong, durable growth with manageable risk, while lower multiples usually reflect slower growth or greater uncertainty.

TG Therapeutics currently trades at about 10x earnings, which is well below the broader Biotechs industry average of roughly 19x and far under a peer group average of around 57x. On those simple comparisons alone, the stock looks inexpensive. However, peers and industry groups can differ meaningfully in growth outlook, profitability, risk and size, which makes headline comparisons a blunt tool.

That is where Simply Wall St’s proprietary Fair Ratio comes in. For TG Therapeutics, the Fair PE Ratio is estimated at 19.41x, based on factors such as expected earnings growth, profit margins, industry, market cap and company specific risks. Because this approach tailors the “normal” multiple to the company’s own profile, it is a more precise yardstick than raw peer or industry averages. Comparing the Fair Ratio of 19.41x with the current 10x suggests TG Therapeutics is trading at a meaningful discount to what its fundamentals would warrant.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

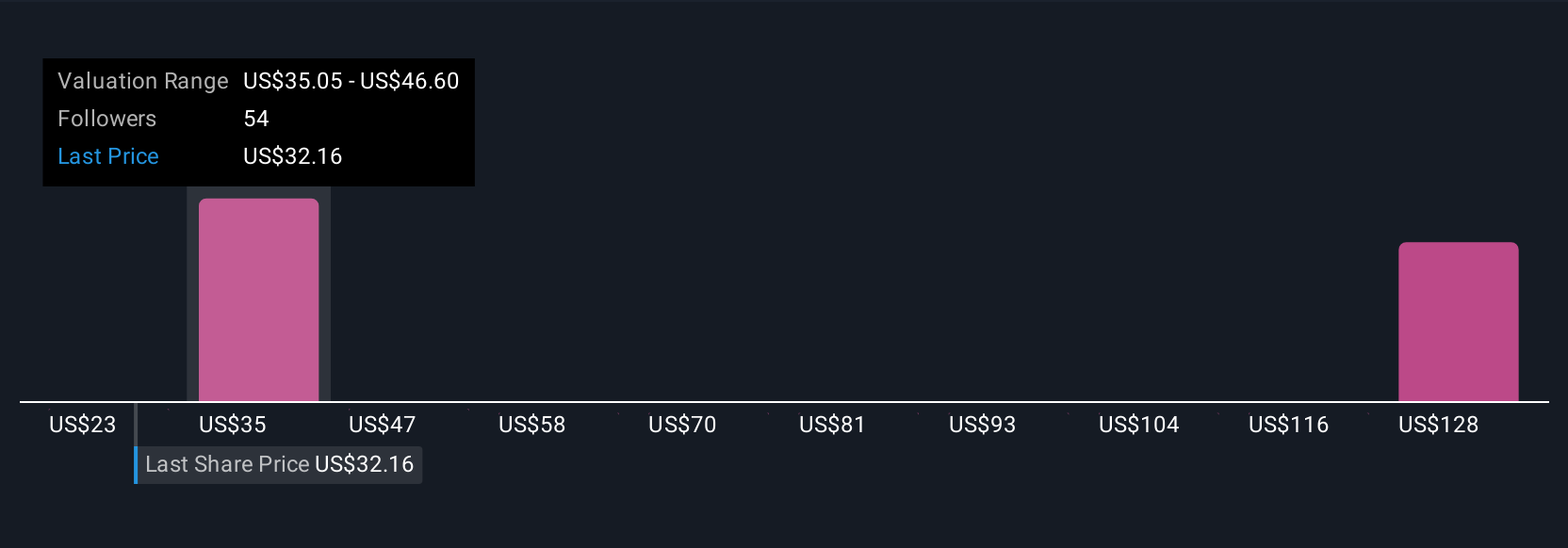

Upgrade Your Decision Making: Choose your TG Therapeutics Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach your story about TG Therapeutics to the numbers you think are realistic for its future revenue, earnings and margins. A Narrative on Simply Wall St links three things: the business story you believe, the financial forecast that story implies, and the fair value that falls out of those assumptions. On the Community page, used by millions of investors, you can browse and create Narratives that turn your view of catalysts, risks and competitive dynamics into a living valuation model that compares Fair Value to today’s Price, helping you frame a decision around whether to buy, hold or sell. These Narratives update dynamically as fresh information like earnings releases, trial results or guidance changes come in, so your view stays grounded in the latest data rather than a static snapshot. For TG Therapeutics, one investor might build a bullish Narrative around BRIUMVI and arrive at a fair value near $53, while a more cautious investor could focus on concentration risk and competition to arrive at a fair value closer to $11. The platform helps you see and test both perspectives quickly.

Do you think there's more to the story for TG Therapeutics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TG Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TGTX

TG Therapeutics

A commercial stage biopharmaceutical company, focuses on the acquisition, development, and commercialization of novel treatments for B-cell mediated diseases in the United States and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026