- United States

- /

- Pharma

- /

- NasdaqGS:TERN

Investors one-year losses grow to 87% as the stock sheds US$7.1m this past week

As every investor would know, you don't hit a homerun every time you swing. But it would be foolish to simply accept every extremely large loss as an inevitable part of the game. So we hope that those who held Terns Pharmaceuticals, Inc. (NASDAQ:TERN) during the last year don't lose the lesson, in addition to the 87% hit to the value of their shares. A loss like this is a stark reminder that portfolio diversification is important. We wouldn't rush to judgement on Terns Pharmaceuticals because we don't have a long term history to look at. The falls have accelerated recently, with the share price down 60% in the last three months. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for Terns Pharmaceuticals

Terns Pharmaceuticals recorded just US$1,000,000 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. Investors will be hoping that Terns Pharmaceuticals can make progress and gain better traction for the business, before it runs low on cash.

We think companies that have neither significant revenues nor profits are pretty high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Some Terns Pharmaceuticals investors have already had a taste of the bitterness stocks like this can leave in the mouth.

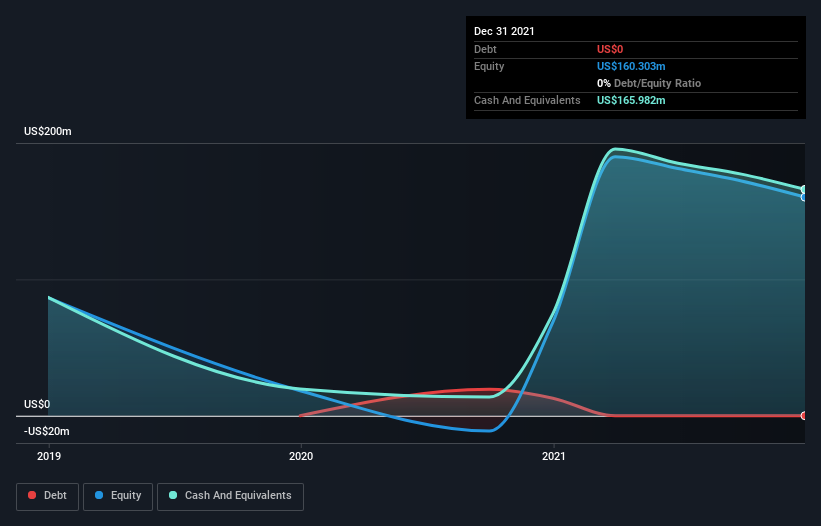

Terns Pharmaceuticals has plenty of cash in the bank, with cash in excess of all liabilities sitting at US$158m, when it last reported (December 2021). That allows management to focus on growing the business, and not worry too much about raising capital. But with the share price diving 87% in the last year , it could be that the price was previously too hyped up. You can click on the image below to see (in greater detail) how Terns Pharmaceuticals' cash levels have changed over time.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. What if insiders are ditching the stock hand over fist? It would bother me, that's for sure. You can click here to see if there are insiders selling.

A Different Perspective

While Terns Pharmaceuticals shareholders are down 87% for the year, the market itself is up 0.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 60%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Terns Pharmaceuticals (of which 1 is potentially serious!) you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you're looking to trade Terns Pharmaceuticals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Terns Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TERN

Terns Pharmaceuticals

A clinical-stage biopharmaceutical company, develops small-molecule product candidates for the treatment of oncology and obesity.

Flawless balance sheet slight.

Market Insights

Community Narratives